- English (UK)

- Switching from tech to value areas of the equity market

- A sizeable reaction to earnings from Microsoft and AMD

- Asia equity opening calls – Focus falls on Aus CPI and the BoJ meeting

- EU CPI a risk to EUR positions

- The balance of risk seen in the FOMC meeting

As expected, the US economic data seen on the day was largely irrelevant for market pricing, with better-than-expected US JOLTS job openings (8.184m vs 8m eyed), and consumer confidence (100.3 vs 99.7). The clear theme though through the US cash session was angst in tech and worries that Microsoft may see a repeat of the takeaways seen in Alphabet's recent numbers, which again resulted in a tradeable switch from semis and AI names into value, with energy, financials and REITS feeling the love.

S&P500 sector performance

.jpg)

Nvidia saw big interest from market players with shares -7% in the cash session, with big moves also playing out in QCOM, ARM, and Super Micro Computers, with the SMH ETF (Semiconductor ETF) underperforming the SPY ETF (S&P500 ETF) by 3.2%. The NAS100 cash closed 1.4%, while the Dow closed +0.5%, and again it speaks to index composition and the make-up of stocks in the respective equity index – long Dow / short NAS100 as a pairs trade is working well, and I would remain biased for upside in this ratio.

The fact that energy equity rallied strongly in the face of a 1% decline in crude speaks to this being a pure switch through a ‘factor’ lens, amid prepositioning for Microsoft’s Q4 numbers. Hence, anyone who took this trade/position was initially rewarded with a punchy sell-off in Microsoft’s share price after hours, although the initial bloodbath was tempered by better numbers from AMD (shares +6.9% after hours), which lifted Nvidia 2% after hours.

Microsoft – good but not good enough

Microsoft (-5.9% afterhours) was central to the market's focus, and while Q4 Capex will please investors, what we saw out of Azure and Cloud has clearly underwhelmed and with such a crowded position, notably from the long-only funds, you simply must blow the lights out. AMD has clearly pleased the market, with better Q2 revenue (at $5.8b) and higher Capex at $154m, which has resulted in a solid pop in the after-hours trade, which in turn has lifted Nvidia and stabilized the post-cash session move in NAS100 futures.

Looking ahead, the earnings remain central with Boeing, and Mastercard out premarket, and then Meta, ARM and Qualcomm reporting in the post, so further risks to filter through the tech space – Meta, for example, is implied to see a -/+8.8% move on earnings, so it could get lively, with comments on AI and Capex potentially sending waves through related equity names.

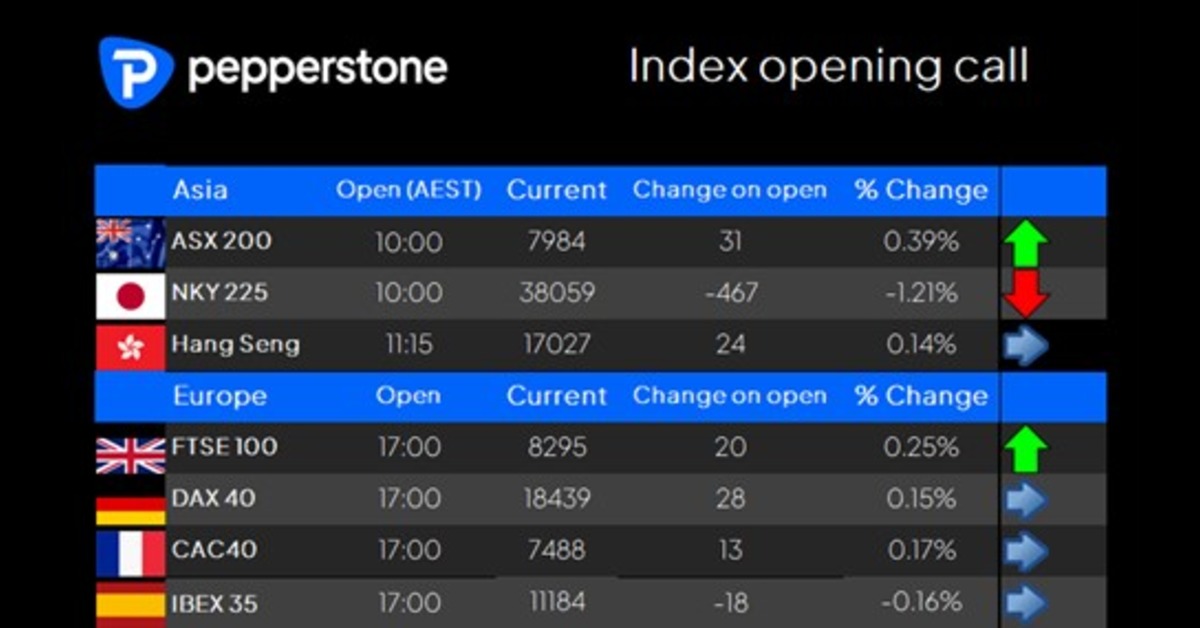

Asia opening calls

Our opening calls for Asia equity open look only too familiar – US tech down, and rotation into value areas of the equity market, backed by a strong JPY, and the result, as has been the case so frequently of late, is the NKY225 called lower on open. The ASX200, as a strong value-heavy index looks to be opening on the front foot. We have just seen Rio Tinto report 1H earnings, so that may also be a factor impacting the ASX200.

Both equity indices have huge challenges and risk events in the session ahead, as is the case with the AUD and JPY, with Aussie CPI due at 11:30 AEST and the BoJ meeting statement due in the latter stages of the session. There will also be some consideration to position ahead of the EU CPI print, and the FOMC meeting, with the previously mentioned US earnings also a factor..

Aus CPI expectations

Aus CPI is certainly going to get the full attention of the local market players, and for anyone globally running AUD positions. I would expect the algo’s to key directly off the trimmed mean print, and any initial spike higher/lower will come from this core inflation metric – where an outsized move in Aussie 3yr bond yields, and by extension AUD and interest rate sensitive equities, will come on a print above 4.1% y/y (vs 4% y/y expected), or below 3.8% y/y. Aussie rates market price a 25bp hike from the RBA next week at 30% implied, so any CPI read that deviates by 30bp+ from the RBA’s prior estimates of 3.8% y/y would certainly bring a hike firmly onto the table. Depending on the outcome of the data and how it flows into European trade, I would be a seller of rallies on the day into 0.6590 and would look to fade move into here.

Will the BoJ disappointed yet again?

The BoJ meeting is always a tough one for traders, partly because there is no definitive time for the announcement, but also because expectations for a 15bp hike have now been ratcheted higher, and we also know the BoJ never miss an opportunity to disappoint. Japan swaps price 8bp of hikes for today’s BoJ meeting, so should the BoJ stand pat and leave rates unchanged then we could see JPY weakness, but the probability of a 10 or 15bp hike is certainly there, and it will come concurrently with guidance on a cutback on monthly bond purchases.

One would also imagine the BoJ would be eager to help the MoF out and push for a stronger JPY, but they would also be keen to keep financial conditions in check and limit any excess volatility in the Japanese bond market - So I’m sure they will try to offset any hike with reassuringly dovish guidance that further hikes will be data dependent.

As the session rolls on, EU CPI gets a focus for EUR and EU equity heads, where the view is we may see a decline in the month headline inflation read, and a tick lower in core CPI year-on-year to 2.8%. EU swaps already have a 25bp cut from the ECB in September at 100%, and over two further 25bp priced by December – still, a weaker CPI print will only likely bring out increased EUR selling.

The balance of risk around the FOMC meeting

The FOMC meeting and Powell presser then take us home into the latter stages of US cash trade – the question then is where we see the balance of risk to US 2yr Treasuries, equity and the USD, and the extent of potential volatility. I am not going to take a position solely to trade the meeting, but the tone of the statement does need to justify what is already rich expectations for upcoming interest rate cuts, so on balance, I would argue there are small upside risks to the USD. Saying that, I think Powell will open the door to cuts, which will then be given additional legs at the Jackson Hole Symposium in August – but will it be enough?

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.