- English

The Daily Fix: Volatility comes alive with the bull trend exhausted

However, the moves we saw in Asia yesterday built through Europe and into US trade, and despite an ugly session yesterday, we’re likely to see dark and sinister open for Asian equities today.

Here are some views, news and charts in this morning’s opening briefing.

Second wave concerns

Fears of a second wave, specifically in a number of the red states in the US were making waves around markets yesterday, and the fact that Steven Mnuchin has re-iterated calls that there will be no further shutdowns makes some feel a little vulnerable. There is increased focus on Arizona state which is going into high alert, but Florida and South Carolina are also getting attention and are worth watching for its case count.

Some have pointed to the Fed’s economic projections as a source of the reversal, which effectively took a V-shaped recovery off the table, and there is some merit to that given markets are priced so rich that they need new news that is going to knock it out of the park to push this risk juggernaut higher. But, at the helm and the reality of the situation is a market that been pushed to a limit, where the participation in the rally has become ever more concentrated and poor breadth is probably the key issue here. We’d seen sector rotation after rotation, all the signs of a healthy market, but with the clear benefit of hindsight, we’d got to a point where the elastic band had just been primed a little too far.

A huge move in equity vol

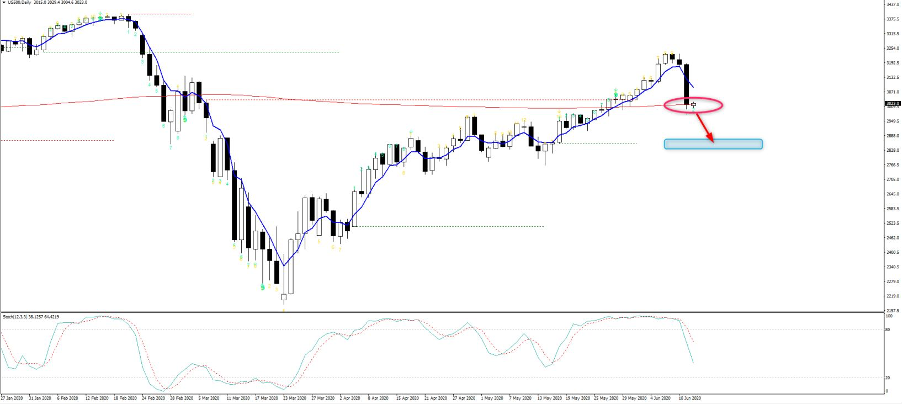

One factor that jumps out is that implied volatility has come alive, with options pricing implying ever-larger degrees of movement. The VIX index has lent on the 200-day and used it as a springboard to push to 40%, gaining 13 volatilities on the session – this implies a 2.5% daily move in the S&P 500 (higher or lower). There has been a massive shift across the VIX futures curve, with traders hedging downside risk and buying volatility in the next few months and it's not even that cheap.

Once bitten twice shy and this market is genuinely worried about the consequences of a second wave.

In terms of cash equities, the S&P 500 was taken downtown, with a 5.9% fall, the worst day since 16 March, to settle just above the 3000-handle. Turnover was 28% above the 30-day average and 99% of stocks were down on the day. Close to 3.5m S&P 500 futures contract traded hands, the most since the 12 march, with price settling back below the 200-day MA. The Russell 2000 has been smoked by -7.6%, while the NAS100 closed -5%.

(Will the US500 hold it 200-day MA?)

Obviously, the question on the floor is whether the second wave fears will be sustained, in which case we need to consider what exactly that looks like and how markets could be affected – or is this just another buying opportunity.

As goes the S&P 500 as goes risk FX

The moves in FX were also punchy, but as detailed yesterday, if the S&P 500 tracks lower than names like the MXN, CAD and AUD will be sold. I put EURCAD on the radar, and this is working well and feels like this could squeeze into 1.5530 near-term, especially with crude rolling over in such aggressive fashion. Not sure I really need to offer too much colour in FX other than where the S&P 500 goes, the path of risk FX will follow.

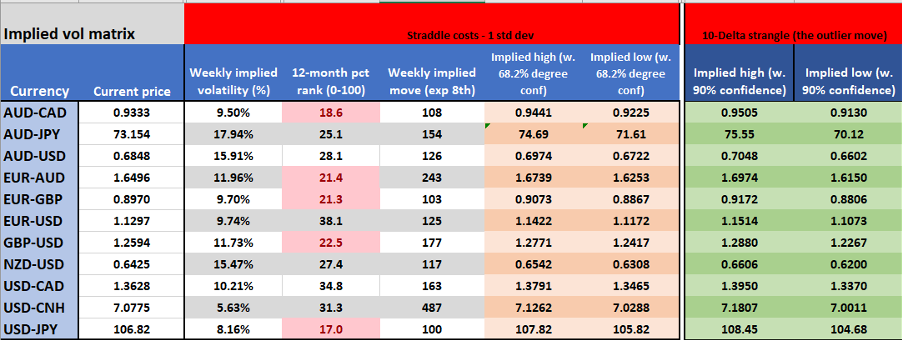

For those who find this useful - I have updated the week ahead Volmatrix.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.