As we look towards the US CPI print in the session ahead, and a more formal start to Q3 US earnings tomorrow, we see US assets attracting and absorbing an increased share of global flows. New all-time highs have been seen in the S&P500 (cash and futures), with the Dow settling at a new all-time closing high, and NAS100 futures closing at the best levels since 17 July.

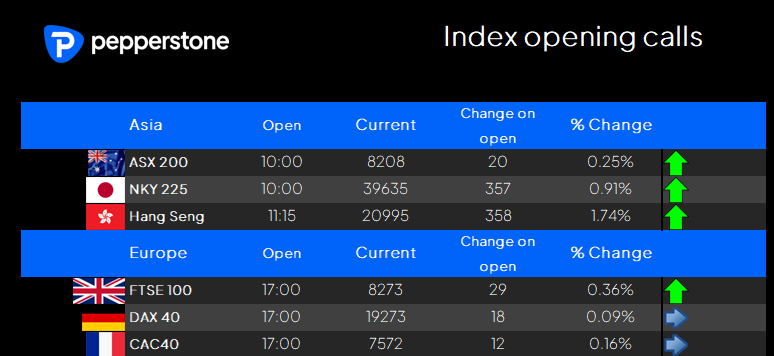

US equity aside, we also see good upside momentum building in the DAX40 and EUStoxx50, with the NKY225 also looking like it wants to kick higher and bull trend. We’re not too far off the ATHs in the ASX200 either, although the price action is a grind, and the buyers need to do more to push the sell side of the order book to thin out more to promote a more defined trend.

China/HK equity has stabilised, and we can see HK50 futures close to 2% higher from yesterday’s HK cash market close. One for the radar, as it would not surprise to see shorts in the HK50 cover, with brave organic buying also in the mix, as we roll into the weekend gapping risk, with the Ministry of Finance due to give a press conference on its fiscal plans on Saturday (10am local time).

It’s the US indices that get the lion's share of client flows though, and while some will be looking to fade the strength, for me, this is a trend which I would align to, as the bar for US companies to beat consensus expectations in this reporting quarter seems lower than has been the case in other quarters. We also see the US economy in a relatively solid position, while underpinning the positive flows remains the ‘Fed put’, although traders are questioning if we do indeed need/get another 25bp cut in the November FOMC meeting.

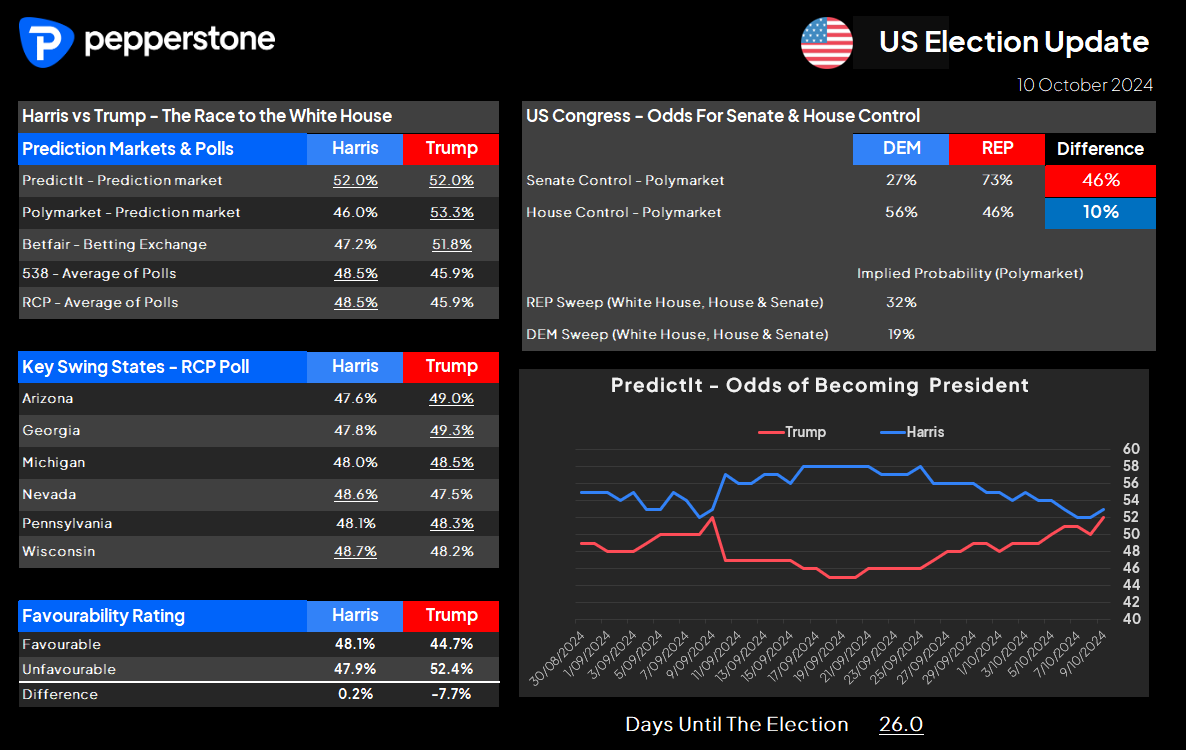

Another factor that is emerging is one of a political nature, with Trump starting to pull ahead in the betting markets implied probability. We can also see the average of the polls (source: RealClear Politics) showing Trump now ahead in 4 of the 6 key battleground states (Pennsylvania, Michigan, Georgia, and Arizona), with the weight of punters capital pushing Trump to a 9pp lead in PA (source: Polymarket).

This dynamic, while it could easily shift back in the days ahead, does bring in trades aligned to tariff risk, as Trump – if he indeed does get the White House – can push through increased tariffs, without the blessing of the House (I assume the REPs will get the Senate). That said, with Trump’s odds of becoming president increasing, in turn sees the probability of the REPs winning the House also increasing. So, while tariffs can be passed without the blessing of Congress, if the market starts to believe in a ‘Red Wave’, then it brings in tax cuts, increased fiscal spending, and deregulation into the mix, and these policies are undoubtedly positive for US equity and the USD.

We can see the risk of tariffs expressed in the options volatility space, with USDMXN 1-month implied volatility (vol) at 20.6%, and conveniently sitting at the highest since November 2020. EURUSD 1-month implied vol sits at 7.3% and is rising rapidly – this is also true of USDCNH with 1-month vols now at 8.03% and the highest since December 2022. Essentially, as Trump’s odds have increased the probability of tariff risk on China, Europe and other nations also increases, and this dynamic is a USD positive, and traders are betting on movement in broad USD pairs.

US election dynamics aside, we see relative interest rate expectations driving USD buying flows on the day. We saw the largely expected outsized 50bp cut from the RBNZ yesterday, but the market is now debating if the NZ central bank cut by 50bp or even 75bp in the next meeting on 27 November. The BoC meet on 23 October, and the CAD swaps markets price a 60% chance of a 50bp cut here, with the ECB firmly expected to ease 25bp next week.

Contrast this to the market pricing of implied Fed cuts, where the swaps market prices a 25bp cut in November at a 75% chance, with cuts being priced out in future months. A hot CPI print today – hypothetically, we see US core CPI prints above 0.3% m/m – and the market will throw increased doubt that we see a cut play out at all in November, although that call will be more heavily influenced by the October US nonfarm payrolls report (due 1 November).

NZDUSD has seen the big percentage change in G10 FX, with traders pushing this pair into 0.6050. AUDNZD also gets a good run, with volumes reported to have been some 8 times what the banks typically see, with the spot rate pushing into 1.1100. USDJPY has broken through 149 and tests the 15 August highs, where a break puts 150 in the mix. EURUSD prints new run lows, and we can look at tariff risk, but there are so many other fundamental factors that suggest the risk of this pair trading lower is elevated, and I see the probability of a run towards 1.0800 increasing. USDCAD has gained for 6 straight days, and again I like this higher in the short term.

In the commodity space, the moves in the USD and the rise in US Treasury yields has been a headwind for gold and we see price settling 0.5% lower. The technical’s and price action look heavy, and this will keep many of the would-be buyers out for now, with a test of $2600 and $2585 looking more probable. Crude settles modestly lower, as is the case with copper, while iron ore futures have lifted 0.9% in overnight futures trade. It all sets us up for some interesting trading, with equity seeing upside momentum building, the USD looking solid, with traders running short US treasury positions into CPI and the US election starting to creep more intently into traders' thinking.

Good luck to all

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.