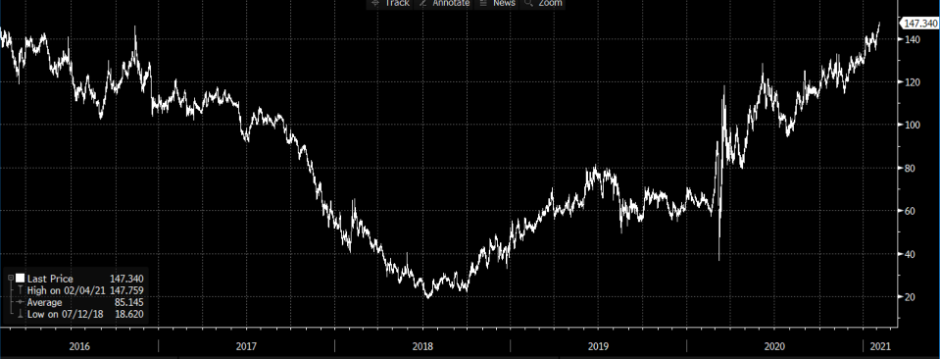

Small caps look good here, with the Russell 2000 moving to new highs and is the best-looking market on the day – the reflation vibe is playing out today with US financials the star sector helped by this continued shift higher in the US Treasury yield curve – see the US 5s vs 30s.

(Source: Bloomberg)

Happy to hold a long bias towards equity markets, with a keen eye on the AUS200 which is into the top of its range too and needs a heavy shove through 6840 – I wrote about Aussie earnings in this piece for anyone keen to explore this.

King USD, for now

A keen point debated heavily across the desks is that the USD is finding friends easy to come by in this market, with the USDX pushing into 91.50 and looking to test the 1 September low. The US is looking good on a relative basis, with rising inflation expectations, steeper yield curves, the US vaccination rate is rising, and savings rates are declining – the fact that in this quarterly reporting season 80% of companies have beaten expectations on EPS and 75% on sales is probably helping too, especially when we consider the average beat (on EPS) has been massive 18.4%.

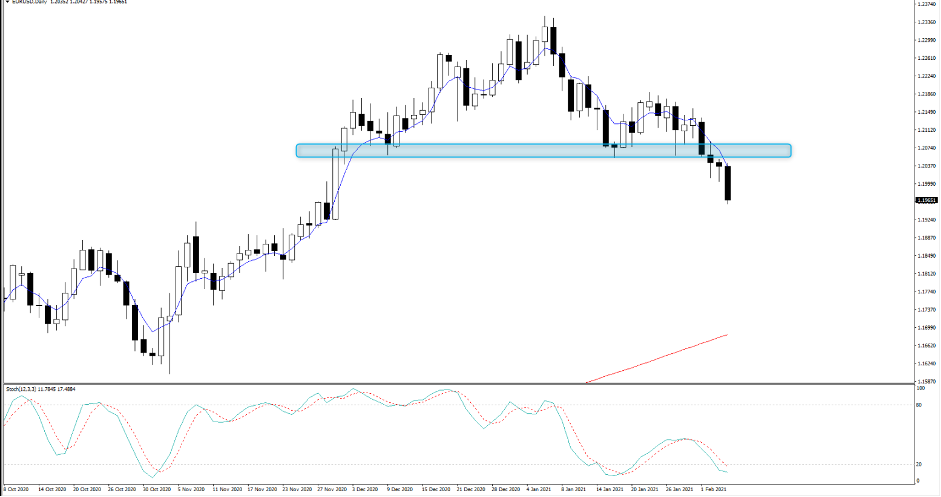

(EURUSD daily)

EURUSD has broken down hard through 1.2000 and has been well traded into the 100-day MA and the 61.8% fibo of the Nov to Jan rally at 1.1888 beckons. For the first time in a while, the pair looks like a higher conviction sell on rallies candidate and as long as price closes below the 5-day EMA then I shall stay with this trading view.

EURGBP has collapsed through 0.88 and I question if this can stretch out into the April consolation zone around 0.8700. The BoE meeting proved to tilt towards the hawkish camp, a view my colleague Luke Suddards was portraying in his BoE preview – the idea that the bank still wants six months at a minimum before they’d be ready to implement negative rates suggests it’s off the cards, especially when they’ve already been discussing this for some time and their economic forecasts laid out are fairly bullish. GBP is the strongest G10 currency on the day and calls for 1.40 in cable are growing – with the USD looking strong, perhaps long GBP vs the crosses remain the better play.

We’ve seen a shift in UK rates pricing and UK gilts (Government liability in sterling) have sold off, with 1-yr gilts about to turn positive after pricing -13bp two days ago. Negative rates in the UK seems like a 2020 story.

Staying in the fixed income scene and there's been very little movement to talk about in US trade, with nominals, breakevens and real yields all largely unchanged. Initial jobless claims were better than feared at 779,000, while durable goods printed 0.5% vs 0.2% eyed, so this data failed to move the dial. We look to non-farm payrolls (00:30 AEDT) to see if there is a greater reaction in the bond market, as that could resonate into equities and the USD. Expectations are for 100,000 net jobs to be created (economists range sits at +400k to -250k) after last month’s 140,000 loss, with the unemployment rate remaining firm at 6.7% and hourly earnings pushing up 0.3% in January.

USDJPY is an interesting play ahead of NFPs, with price now pushing mid-105s and a test of the 200-day at 105.58 and 11 Nov high of 105.67. Hard to fade this pair given the flow and the preference is to buy pullbacks into 105.10, as per my vol model.

AUDUSD traded into 0.7588 and eyes a retest of the figure. While NFPs remain a risk, the RBA Statement on Monetary policy comes out at 11:30 AEDT and could give further colour. We’ve heard a lot from the RBA of late and while the SoMP will give economists new intel, I question if this impacts the AUD too intently. A risk event for exposures, but I am not expecting fireworks.

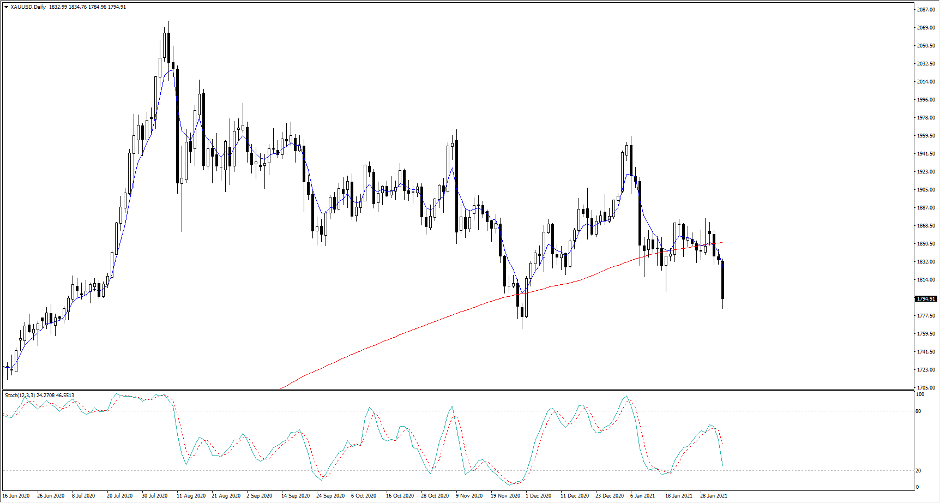

Gold into 1764?

Amid the USD strength and the recent moves higher in US Treasury yields, we’ve seen gold and silver challenged. XAUUSD has certainly caught client’s attention and price sits below 1800 and eyes a test of the 30 Nov low of 1764. The options market has 1-week put volatility trading at a small premium to calls, which is a solid reversal in the last few days. Moving the timeframe out a touch and 1-month risk reversals show call vol trading at 0.4 vol premium to puts and should this turn negative its usually a sign that the market has turned a touch bearish on gold and we’re ready to see a turning point.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.