- English

ASX 200 earnings preview - could earnings be the catalyst to see the index convincingly break higher?

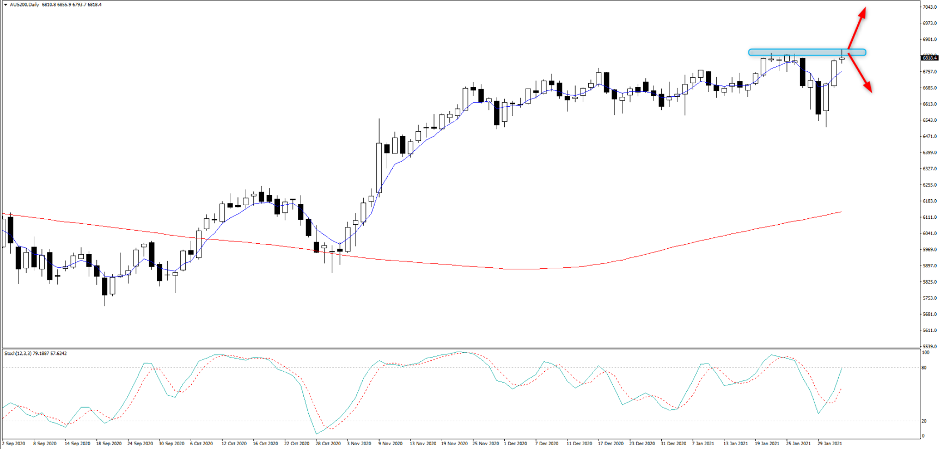

(AUS200 daily chart)

After a tough 2020 Aussie corporates are arguably seeing a brighter 2021, both for those sourcing revenues from Australia and or internationally. The question for many who assess the market from a fundamental standpoint is whether current expectations for 2021 Earnings-Per-Share (EPS) growth of 23% are too optimistic or perhaps even too pessimistic. Therefore, guidance and the outlooks from CEOs and CFO’s will be the key driver of volatility at a single stock basis and potential the AUS200 as well.

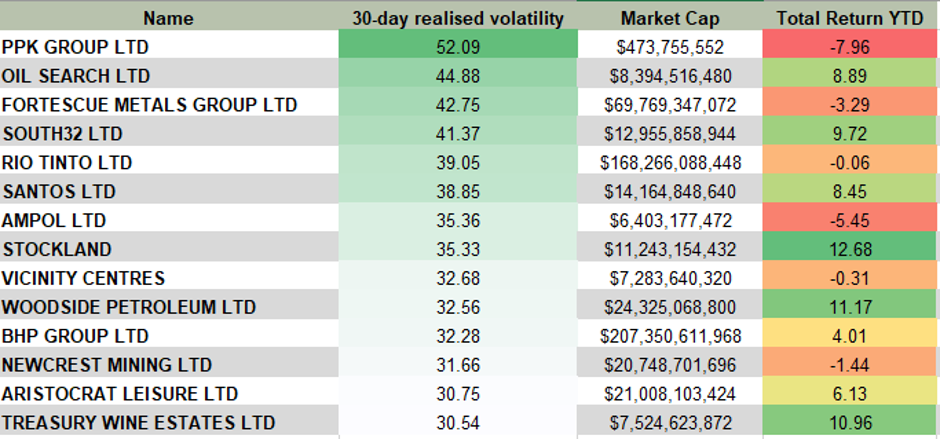

(Equity Scan – stocks in our universe with the highest 30-day volatility. For traders who like movement these have been the names to put on the radar).

Any revisions to earnings estimates will affect the forward price-to earnings (PE) multiple, which at 19x earnings (for the ASX 200) is still well above the long-term average and the level that market participants are prepared to pay for those future cash flows and earnings.

Looking forward, the macro-focused community expects economic growth to ramp up as we head into the 2H21 as the vaccine rollout takes effect globally, COVID-19 restrictions are relaxed and the pent-up demand hits the service sector – with central bank policy remaining incredibly accommodative, earnings are deemed to have troughed and we’re watching a cyclical recovery play out. Earnings upgrades will continue to normalise the forward PE ratio and bring it back to levels closer to a historical average.

More companies upgrading earnings

Amid this backdrop and in the lead up to earnings season we’ve seen the ratio of companies reporting upgrades to guidance easily outpacing those offering downgrades, which of course is bullish and that's lead consensus earnings expectations higher. Commodity prices have been on a tear and in the past three months the analyst community have been ratcheting up earnings expectations in the resources sector by close to 15%. This has been outpaced by energy however, which has seen the biggest consensus earnings upgrades for the full year, driven by a strong move in the crude price which has pushed to the highest since January 2020.

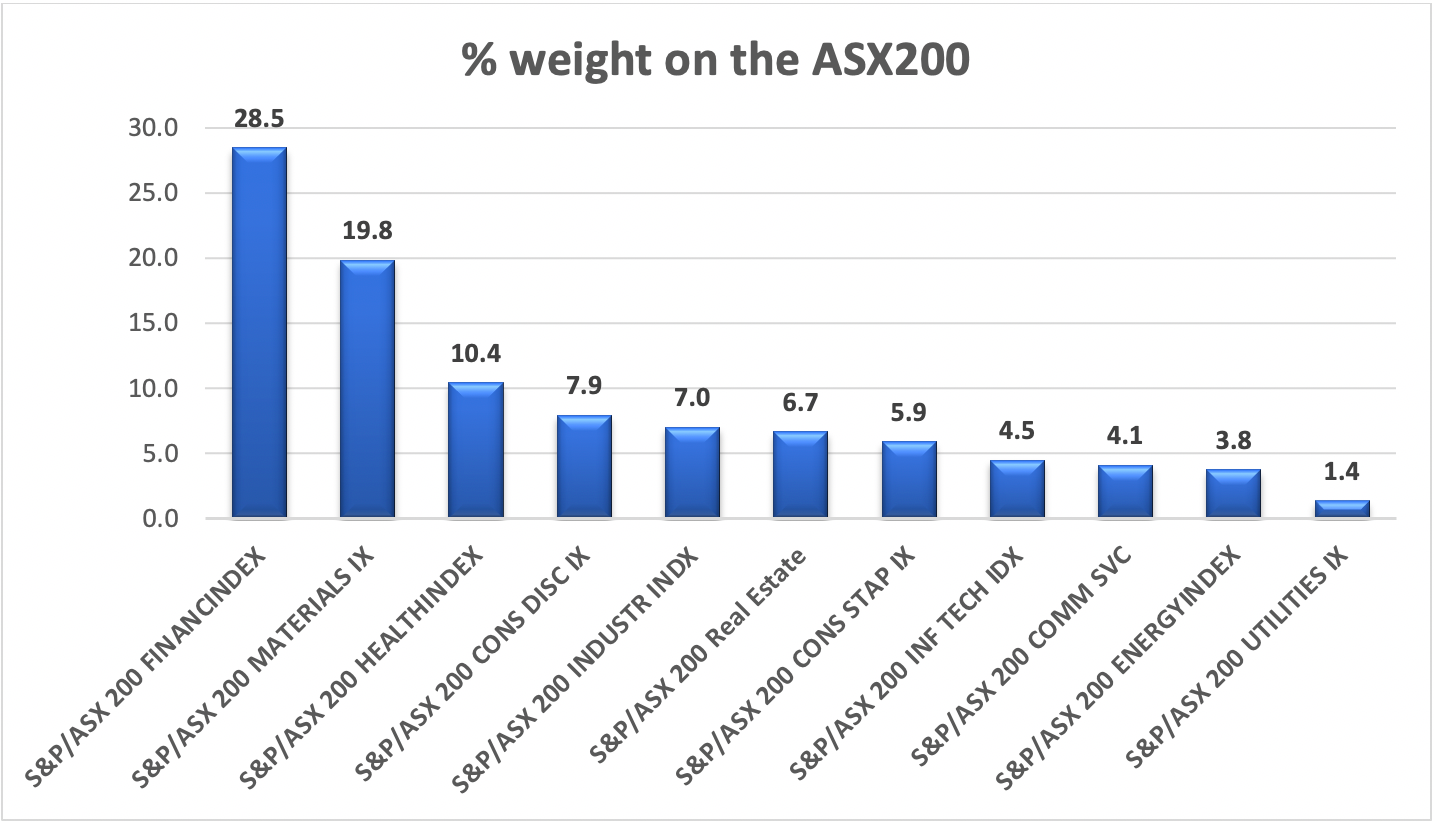

Financials will key give the sector commands a 28.5% weight on the ASX 200, so for AUS200 index traders, CBAs results on 10 February could be a catalyst for the broader market. Earning revisions for the financial sector have been modest at 5%, but for perspective this is the first time since 2015 we’ve seen consensus upgrades to this sector, so this is quite impressive. Consider then, that for the FY the consensus is that EPS for the banks will grow 30%, which should be the main catalyst for the earnings growth in the Aussie benchmark index.

Given the rebound in the Aussie economy and the strength in housing and improved demand for credit, there will be a broader macro focus in CBA’s results. With a rise in net interest margins and a normalising in bad debts driving a more inspiring performance.

A focus on the use of free cash – dividends and buybacks

One aspect that will be of keen focus is that of the potential for corporates to return cash to shareholders, and whether there's scope for higher payout ratios and capital management initiatives, such as buybacks. Banks will be key here, although absolute dividend growth is expected to come from resources names.

Given the AUS200 is considered a ‘value’ market, dividends are absolutely key. So any belief that companies are prepared to increased payout ratios should see capital flow to those names – watch for narrative about improved free cash flow (FCF) which naturally drives higher dividends. Companies expected to see FCF growth will outperform.

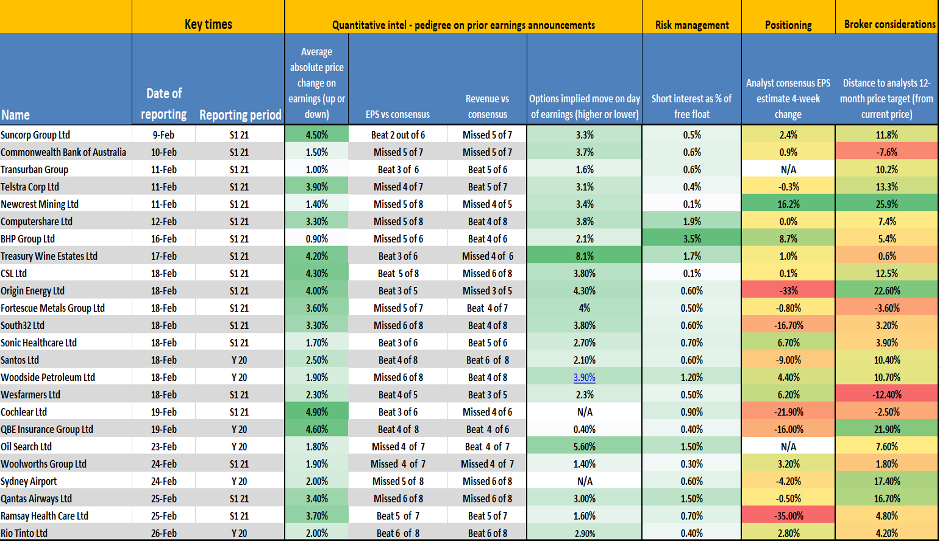

By way of a guide, here's a reporting calendar which we’ve selected a handful of stocks likely to be singled out by traders (from our universe) of blue-chip and liquid ASX 200-listed stocks. We’ve looked at the implied move on the day, which may help one’s risk management, as well as for those who are guided by movement in their trading. We’ve also looked at its pedigree in the reporting period vs historic trends.

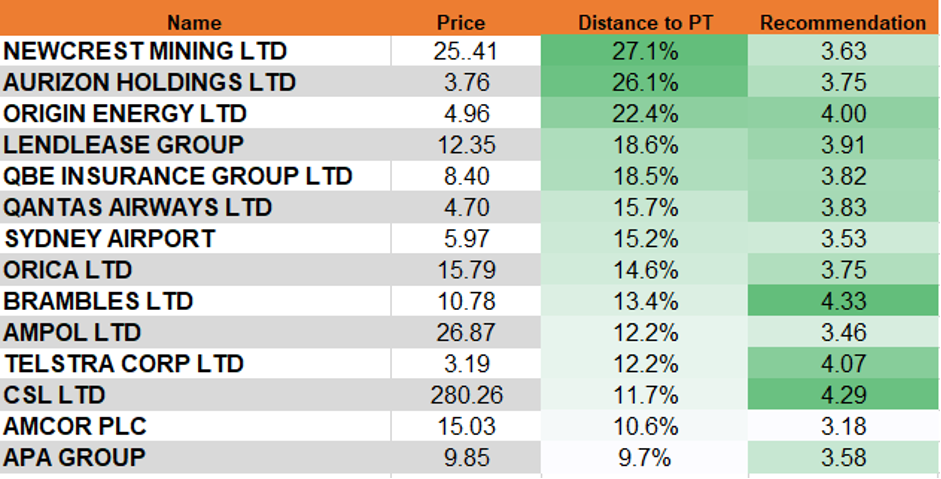

A few names that could be worth putting on the radar, as we roll into earnings (again within our universe of offering) are listed. We’ve scanned for those names where the price is 10% or more below the broker’s consensus price target and have a buy rating (0 =sell, 5 = strong buy).

Aussie corporate earnings season is upon us and whether you are an index or single-stock trader, this could prove to be a volatility event and one that you should prepare for and trade with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.