- English

The Daily Fix: It seems the 50/55-day MA is guiding everything

Certainly, our GBP flow has been lumpy with traders magnetised to the movement post-BoE and the calls that they were engaging with regulators on how to impose negative rates. You can look at the UK bond market now and see 2-year gilts at negative 11.8bp, or looking into the UK rates markets and see 18bp of cuts priced through end-2021. Cable traded into 1.2865, before rallying back to the flat line at 1.2968.

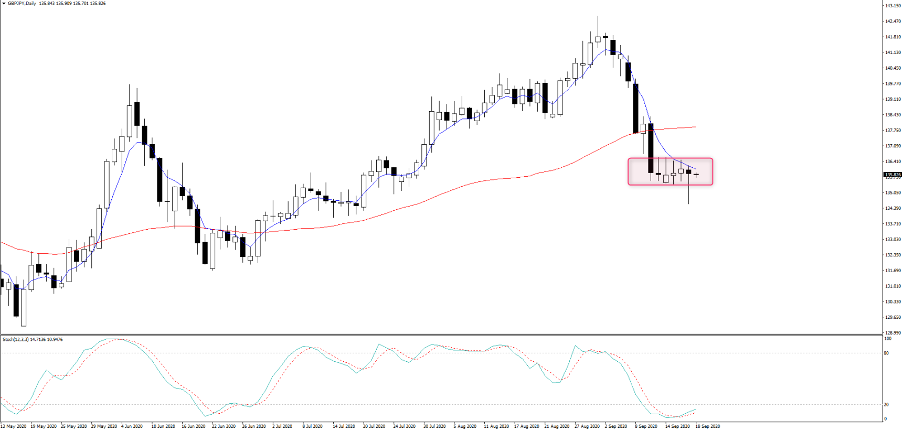

I also have GBPJPY on the radar, where the daily really highlights the solid bid off the low and we are left with an interesting candle. In fact, I see this is there is a real battle between bulls and bears in this cross and a close above 136.60 seems key for a bull trend to emerge. Or, we see a renewed turn lower and all those who covered and bought through 135.43 will be the wrong side of the trade and price may establish a trend lower – one for the watch list, as when this goes it will compel. EURAUD is another that remains on the focus-list, with the pair getting ever closer to the low of the range it has held since May. This cross has been a true range traders paradise and once again it is holding on for dear life. I am looking for levels to be long here a low-risk trade, but I’ll wait it out and into 1.6100 price gets more stretched – should it get there. The options market puts a zero probability the pair trades sub-1.61 in the next week, so I may be waiting. AUDNZD also has potential, with the cross sitting on the 3 September swing – do we bounce here? Another for the 15-minute charts to assess price for supportive buyers.

EURAUD is another that remains on the focus-list, with the pair getting ever closer to the low of the range it has held since May. This cross has been a true range traders paradise and once again it is holding on for dear life. I am looking for levels to be long here a low-risk trade, but I’ll wait it out and into 1.6100 price gets more stretched – should it get there. The options market puts a zero probability the pair trades sub-1.61 in the next week, so I may be waiting. AUDNZD also has potential, with the cross sitting on the 3 September swing – do we bounce here? Another for the 15-minute charts to assess price for supportive buyers.

AUDJPY has held the 9 September low well, but price is holding below the 5-day EMA and that interests me in that this could be the start of a more bearish trend. The JPY is in fashion though, even if the biggest percentage moves on the day (vs the USD) have come from the ZAR, MXN and NZD. But there has been a general shun of USDs. The move in the USDX should be noted, with price moving into the top of its range and the 9 Sept high/ 50-day MA, before sellers moved in. Perhaps the market is having a second look at the Fed meeting, as they move to their new chapter of never raising rates.  It’s interesting that we see US equities lower and notably while the S&P500 closed -0.8%, we’ve seen the 55-day MA hold in yet again – the number of people who have flagged this on social and direct to me via emails tells me how many are looking at it, but it seems to be a guide for the market and the view is if this breaks we head into the 200-day MA at 3102.

It’s interesting that we see US equities lower and notably while the S&P500 closed -0.8%, we’ve seen the 55-day MA hold in yet again – the number of people who have flagged this on social and direct to me via emails tells me how many are looking at it, but it seems to be a guide for the market and the view is if this breaks we head into the 200-day MA at 3102.

Tech has underperformed again, yet risk FX has broadly worked, and there has been limited movement in the bond market (UST10 -1bp). We also see the VIX index up smalls at 26.46%, while crude is +2.0% with the Saudi’s detailing a determination for OPEC+ members to not exceed the set production quotas.

Gold (XAUUSD) sits -0.76% at 1944 having traded into 1932, and we see the move also defined by the 50-day MA, which seems to be a loose stop guide – happy to stand aside on gold for now, but will warm to longs should we see price break above 1973. Gold is just super relaxed at the moment though and needs a spark – 1-week implied volatility sits at 15.1% and trending lower, the market (by way of example) sees gold holding a range of 1979 to 1915 (with a 70% level of confidence) over the coming week, and risk reversals (the skew of call to put implied volatility) are perfectly neutral – the gold market needs awaking from its current slumber and either that means a move in the USD and/or deeper relative real rates.  Not a huge amount of event risk to worry over the coming 24 hours, with UK and Canada retail sales the highlight. While in the US we get University of Michigan confidence numbers, I can’t see these being vol events.

Not a huge amount of event risk to worry over the coming 24 hours, with UK and Canada retail sales the highlight. While in the US we get University of Michigan confidence numbers, I can’t see these being vol events.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.