- English

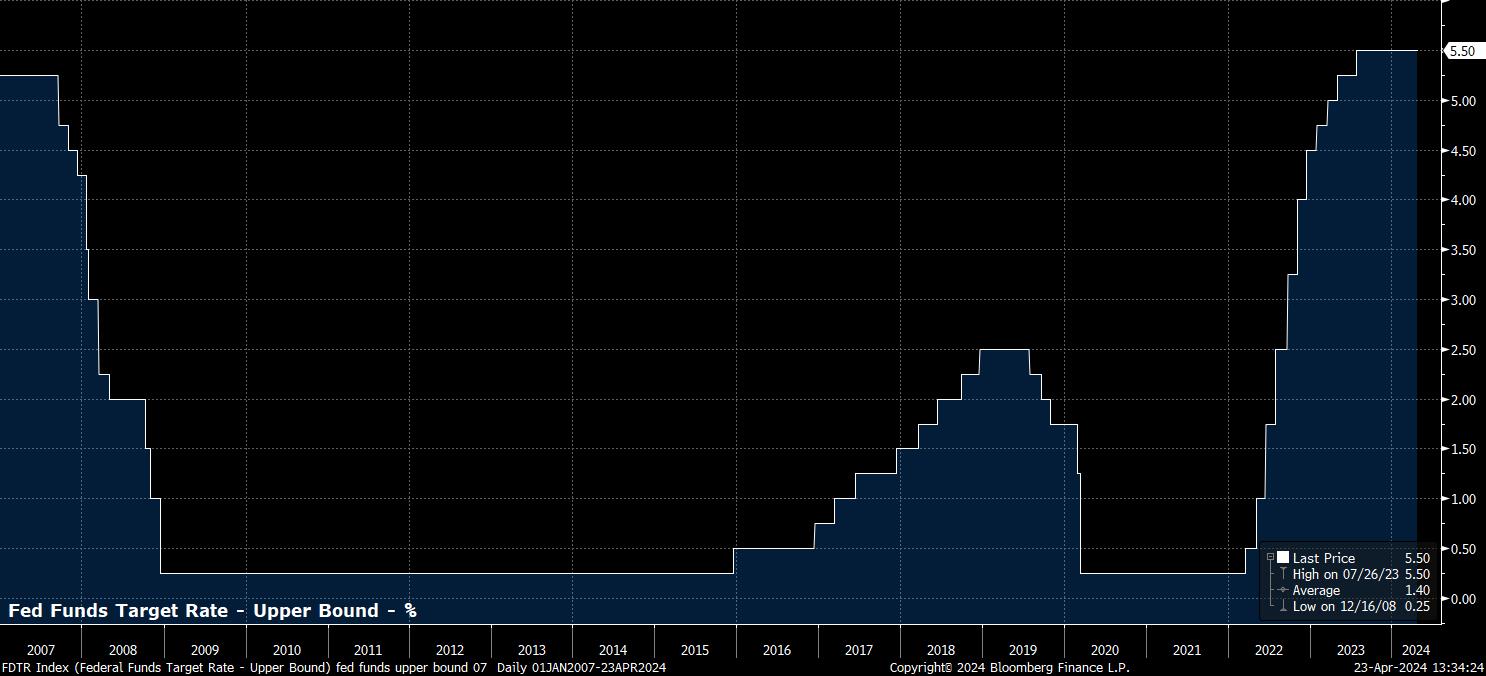

As noted, the target range for the fed funds rate should remain unchanged at 5.25% - 5.50% at the conclusion of the May FOMC meeting, the 6th consecutive meeting that has resulted in rates remaining on hold. The USD OIS cure prices precisely no chance of any shift in rates at this meeting, while the decision to stand pat should, once again, be a unanimous vote among FOMC members.

Nevertheless, there has been a significant hawkish repricing of the market curve since the March meeting. Then, swaps priced around an 85% chance that the first 25bp cut would be delivered in June, while also pricing just over three 25bp cuts being delivered during 2024 in its entirety. Now, however, with inflation proving stickier than expected, and after an upside surprise (the third in a row) in the March CPI figures, swaps don’t fully price the first 25bp cut until November, while seeing just 38bp of easing over the year as a whole.

Despite this repricing, it seems unlikely that the guidance in the FOMC’s policy statement will be altered too significantly from that issued at the conclusion of the March meeting. Once again, the Committee will likely reiterate that they seek “greater confidence” that inflation is falling “sustainably toward” the 2% target. This is a message that, by and large, recent Fed speakers have echoed, with even those typically counted among the ‘doves’ on the Committee having made frequent remarks along the lines of there being ‘no rush’ or ‘no hurry’ to begin cutting rates.

Other parts of the policy statement are also likely to be a ‘cut and paste’ from that delivered around six weeks ago.

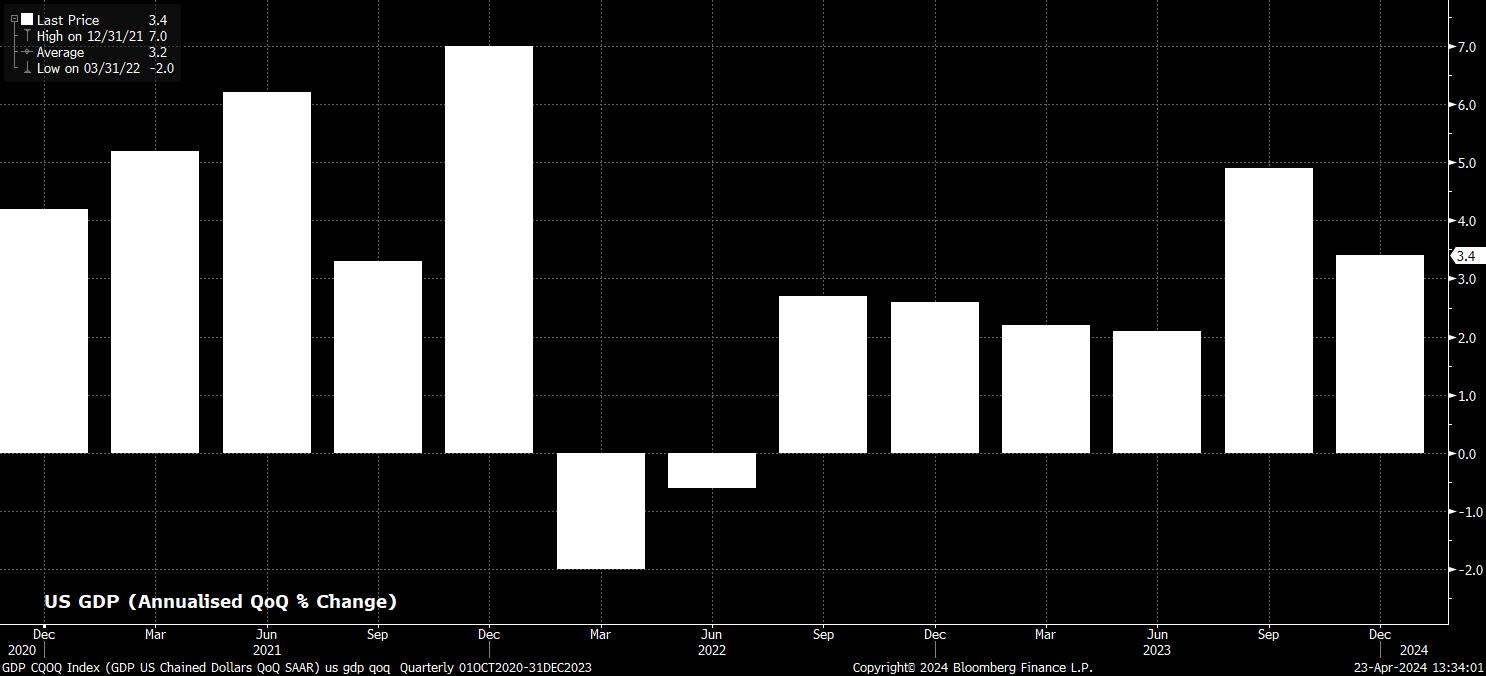

On growth, it is still apt to describe the US economy as expanding at a “solid pace”. GDP growth, on an annualised quarterly basis, has been north of 2% for seven consecutive quarters, while said expansion appears to be broadening across sectors, particularly after the ISM manufacturing PMI rose north of 50.0 in March, signalling an MoM expansion, for the first time since October 2022.

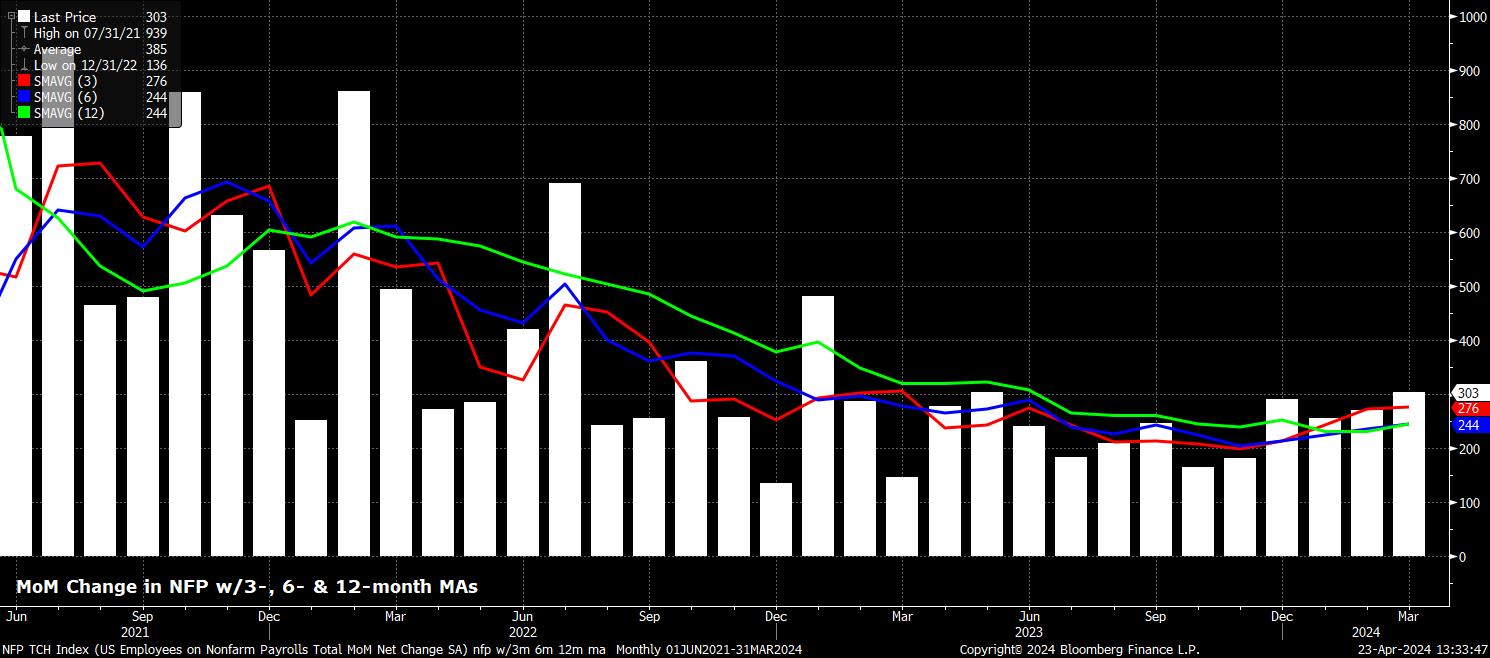

Meanwhile, as already noted, the labour market remains resilient, with job gains still “strong”, and unemployment still “low”.

Headline nonfarm payrolls growth has remained impressive in recent months, with employment rising +303k in March, bringing the 3-month average of job gains to +276k, a 12-month high. While population growth, principally via higher immigration, has raised the so-called ‘breakeven’ payrolls rate, and is also contributing to the recent solid pace of employment growth, it is clear that there are few, if any, cracks emerging just yet in the labour market.

The most recent BLS household survey helps to stress this point, with unemployment having dipped 0.1pp to 3.8% in March, and having remained below 4% in every month since January 2022. At the same time, labour force participation has begun to recover from an unexpected drop towards the end of 2023, with March’s 62.7% participation rate standing just 0.1pp shy of the cycle highs seen during Q3 23.

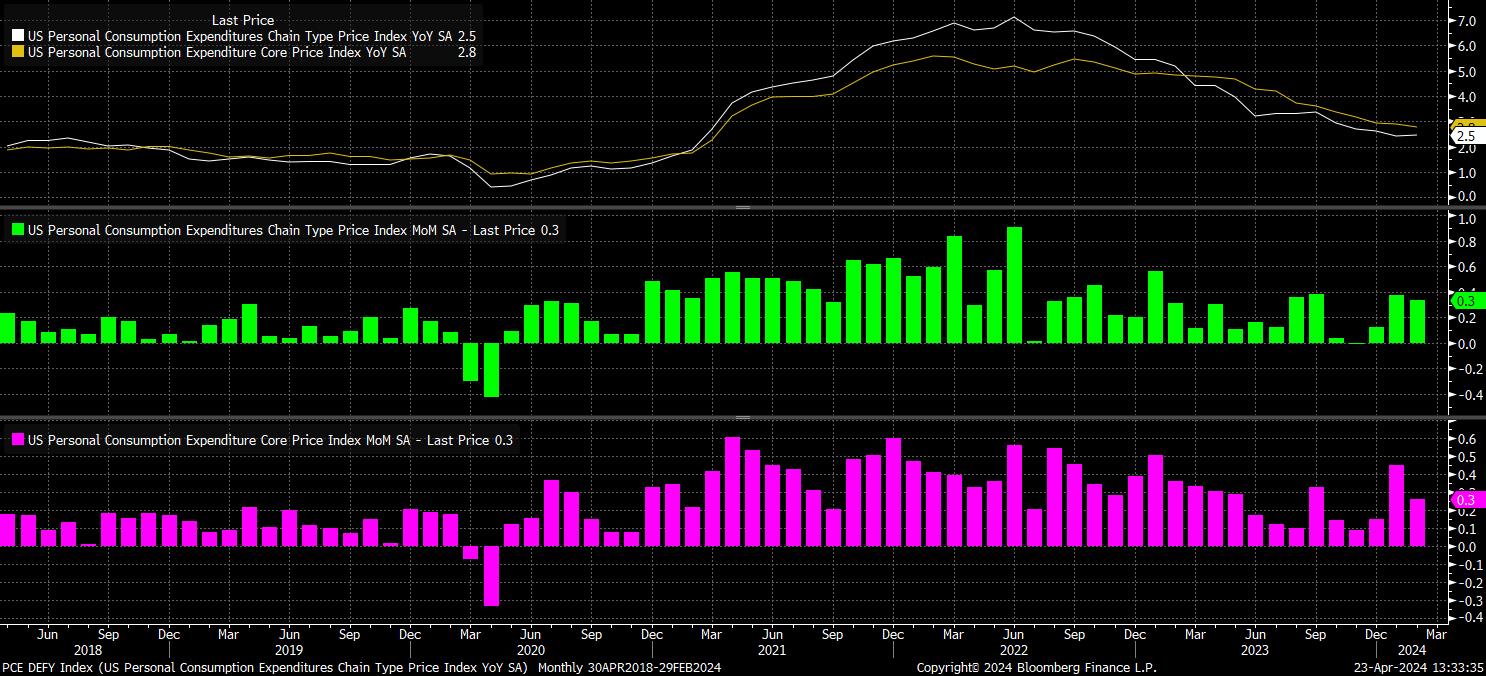

The inflation picture, in contrast, is somewhat murkier, though it is still valid for the FOMC to repeat that price pressures have “eased” over the past 12 months, but “remain elevated”. Though the characterisation of price pressures is unlikely to be changed, it is undeniable that recent data has not provided policymakers with the confidence that they seek that inflation is on its way back to target.

While the FOMC do not target CPI, it is the most widely-watched gauge of price pressures. Headline CPI rose 3.5% YoY in March, the third consecutive print that surprised to the upside of consensus expectations, and the highest rate since last September. Gauges of underlying inflation, similarly, provided little in the way of good news, with core CPI remaining unchanged at 3.8% YoY, while so-called ‘supercore’ CPI (core services, ex-housing) rose to 4.8%, its highest in almost a year. Annualising the associated MoM prints provides further evidence of the bumpy disinflationary path continuing.

That said, while the timelier CPI report captures the bulk of market participants’ attention, it is the PCE, and core PCE, gauges to which policymakers pay most attention, and against which progress towards the inflation target is gauged. In this vein, it is important to note that the PCE metrics show substantially more progress – the overall PCE price index ticked just marginally higher to 2.5% YoY in February, while the core gauge fell further to 2.8% YoY. That said, the MoM prints have been a little less promising, emphasising how progress to target has been slower, and more volatile, than policymakers had forecast.

This is a message that Chair Powell is likely to repeat during the post-meeting press conference, which should, by and large, be a repeat of remarks made on 16th April at the IMF. As such, Powell will likely reiterate that recent data shows a “lack of further progress” on restoring price stability and that, as a result, it is “appropriate” for the FOMC to allow policy further time to work, while it will likely also take the Committee longer to obtain the confidence on inflation that they require in order to begin to cut rates.

While this script is, by now, well-rehearsed, the press conference does present something of a potential landmine for Powell to navigate. This is, of course, the question of rate hikes. While further hikes are highly unlikely at this juncture, with the vast majority – if not all – policymakers viewing the next move in the fed funds rate as being a cut, it is almost impossible for Powell to rule out the possibility of further rate increases if explicitly asked by the media, as seems likely. This, however, is simply ‘central banking 101’, in that it is never wise to become a hostage to fortune, and important to always leave all options on the table. Certainly, any such comments should not be taken as a policy signal, and any knee-jerk hawkish market reaction to such a remark would be ripe for fading.

Overall, Powell is unlikely to provide any significant hints on the policy outlook, or deviate from the present data-dependent stance.

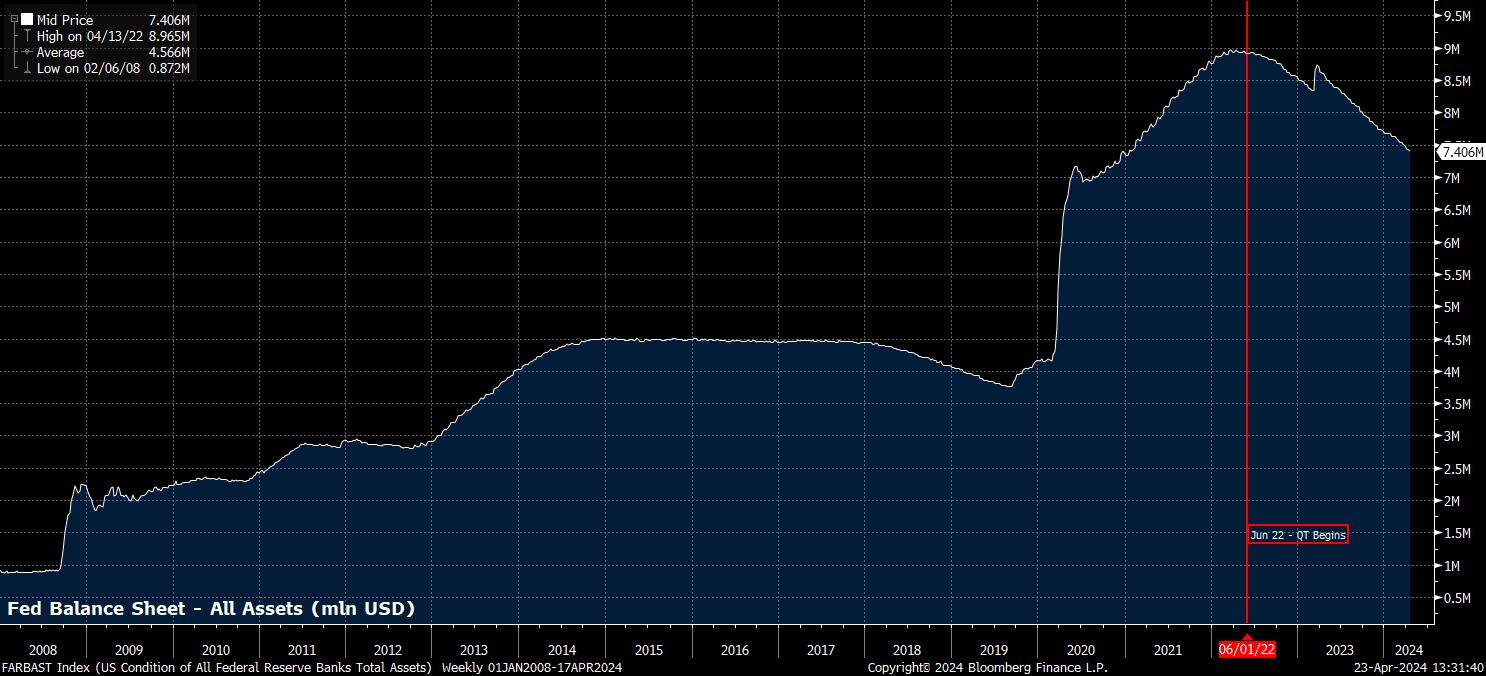

However, the statement and presser are not the only items worth highlighting when it comes to the May FOMC, with the balance sheet also in focus.

Six weeks ago, at the post-meeting presser, Powell noted that discussions regarding the balance sheet, and the pace of quantitative tightening, would begin “fairly soon”.

It seems reasonable to expect that “fairly soon” is code for ‘the next meeting’, and as such it is likely that the FOMC announce a tweak in the balance sheet runoff process at this meeting, to begin in June. This is especially prescient given that the FOMC’s resident balance sheet guru, Dallas Fed President Logan, seems to be in a hurry to get on with slowing the pace of runoff, likely wanting to do so before any semblance of funding stresses were to emerge. Doing so would, of course, have the added benefit of likely leaving the Fed with a smaller balance sheet in the long-run, as funding markets would likely cope much better with a longer and slower runoff, than a shorter but faster one.

While the FOMC are likely to maintain the MBS runoff cap at $35bln per month, with the current pace running well, the cap on maturing Treasury securities rolling off the balance sheet will likely be halved, to $30bln, from the start of June. These caps will then, probably, remain unchanged at least for the remainder of the year.

Overall, then, the May FOMC is yet another where the FOMC will repeat what is now a familiar statement – that confidence in inflation returning to target remains elusive, and that until such confidence is gained, rates will remain unchanged. In other words, ‘higher for longer’ in action. Both the statement, and Powell’s press conference seem likely to proceed along these lines.

For markets, the meeting may be tricky to navigate, though ultimately the present medium-term trends of upside in both the USD, and equities, should remain intact. The FOMC should remain substantially more hawkish than G10 peers, the majority of whom are likely to have cut by June, particularly in Europe, while the next move in the fed funds rate continuing to be a cut, along with the ‘Fed put’ again being in place, should see investors remain comfortable moving further out the risk curve, thus keeping the path of least resistance for equities leading to the upside.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.