- English

Silver has come into the crosshairs of traders and on the daily chart we see price above the 5-day EMA, while the 20-day EMA holds the day trading lows (not just the closing lows) – a break of $28.24 and the rally is on. Put it on the radar if you haven’t already. A break of the rising trend support at $27.60 would suggest more choppy conditions.

(Source: Tradingview)

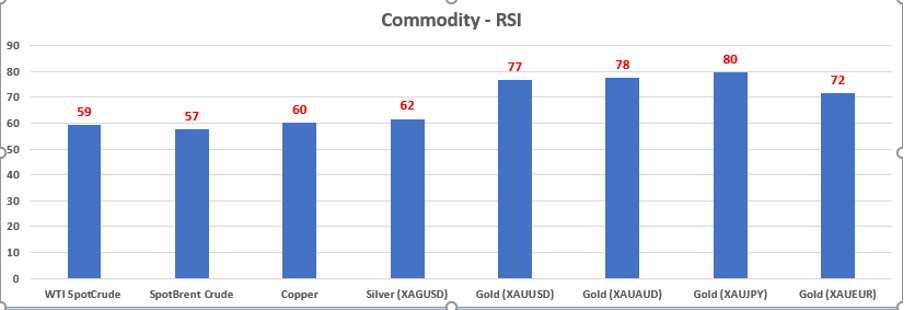

With Gold, one of the compelling aspects of our CFD metals offering is the ability to trade in currencies other than the USD, where Gold in JPY terms (XAUJPY) has been a real performer of late - helped by USDJPY rising into 110.00 and the JPY getting absolutely shunned broadly by the FX community. While clients will always skew trading towards USD-denominated gold (XAUUSD), we can maximise our gains by buying in the weakest currency and shorting Gold in the strongest currency. The weak currency of late has been the JPY, and we see in the series of RSI’s that XAUJPY has the highest of the instruments I’ve scanned.

We can also look at inflation expectations and see that US breakeven rates have been falling, with the US five-year breakeven inflation rate dropping from 2.72% to 2.57%. Yet Gold is working like a dream. Why? Gold in my out of consensus view, is a far more effective hedge against future disinflation forces. Not as everyone believes, a hedge against inflation. Some of Golds biggest bull trends in the last 15 years have occurred through disinflationary environments. I'll leave the inflation hedge to the banks, energy, materials, industrial and bulk commodities, and shorting long-end bonds.

Consider the three fundamental factors that drive Gold – nominal and real bond yields and the USD.

Let’s take nominal US Treasuries, we recently saw April year-on-year US inflation rising 4.2% - the fastest pace since September 2008 – yet the US 5yr Treasury is pushing the bottom of the range its held since April. The 2s vs 10s Treasury yield curve has flattened, where a closing break of 1.4% would be incredibly interesting given every sell-side broker is bearish long-end rates and expects the benchmark 10yr to breach 2%.

Gold is relishing the lower bond yield regime – Gold has no yield, so when the yield on offer in the bond market is increasing there's an opportunity cost for holding the asset, especially if equities and Crypto are positively trending. It's not just lower bond yields, but Crypto is a tough gig right now. The tape is messy and Bitcoin could easily break hard one way or the other – I would assume that Silver, Gold, as well as meme stocks, have attracted some Crypto capital, specifically in the altcoins.

The fact is we’re seeing Gold trending strongly higher in an environment where the Fed is laying the groundwork to talk about tapering. While at the same time, the Norges bank, the RBNZ, BoC and BoE have turned more hawkish too – this is having an adverse effect on inflation expectations, but not Gold.

There's also no doubt in my mind that traders are sensing that the year-over-year change in US inflation will peak later this year and fall back to 2% and may be lower, where the somewhat hawkish turn from central banks is having an effect.

(Source: Tradingview)

Base effects are largely behind this. However, by reducing liquidity and cutting the various asset purchase programs, textbook theory would suggest this should pushes long-end (10 and 30-year) Treasury yields higher – and maybe it might – in which case Gold will reverse lower as both nominal and real bond yields will rise and likely put a bid in the USD. Let's see the reaction from Friday’s US payroll as a guide.

However, the fact that precious metals are bull trending could simply be a sign of flows into an unloved space. Yet, while overbought the move is telling me that lower liquidity may in fact not lift bond yields – which is the conventional wisdom - but actually cause bonds to attract buyers causing yields to fall, a Gold positive. One to watch, but if indeed the inflation narrative, one that's a huge consensus trade and one that so many are positioned for, does prove to cannibalise itself, then Gold will be a loved asset and could be the message we’re hearing. Ready to trade the opportunity?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.