- English

It’s been a mad time on the floor - a few points I'm keen to flag:

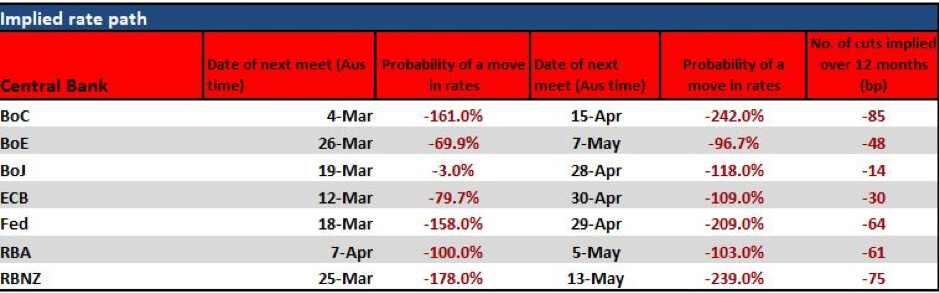

- The RBA set the scene yesterday delivering a cut of 25bp to take the cash rate to 50bp and we can see the market pricing the RBA cash rate at -7bp in 12 months. We are now pricing in Quantitative Easing (QE) in Australia

- The next RBA meeting is on 7 April and we are fully pricing another cut to get the RBA cash rate to 25bp – I expect QE to get a mention at this meeting and the idea the RBA will buy Aussie government bonds.

We then saw the anticipated G7 statement setting the tone: “We…are closely monitoring the spread of the coronavirus disease 2019 (COVID-19) and its impact on markets and economic conditions. Given the potential impacts of COVID-19 on global growth, we reaffirm our commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks." All pretty standard and no reason to buy risk and it has had little impact on sentiment.

- The Fed then went above and beyond expectations, cutting interest rates (announced 2:00am AEDT) by a sizeable 50bp overnight in an unscheduled emergency meeting – the first emergency meeting since 15 October 2008. These emergency meetings are obviously rare, and the market is naturally asking ‘what do the Fed know that we don’t’

- The reaction has been savage – First, the Dow rallies 2.5% off the bat, then panic kicks in and sellers took over - as I type the Dow is -4.7% from the highs. USDJPY is 1.1% lower, gold has rallied from 1606 to 1649 (although is a touch lower now) and the VIX has popped. I’ll be doing the gold weekly video soon

- US Treasury’s are flying, with 2’s -19bp, 5s -18bp and we’ve seen a solid bull steepening of the curve. 10s traded sub-1%, but have seen sellers emerge as the session rolls on

- We now head into the scheduled 18 March FOMC meeting with the market not just expecting another 25bp cut, but we see a 40% chance of another 50bp cut

- We’ve seen the Saudi’s cut rates by 50bp and all eyes on this weeks OPEC meeting with recommendations we see production quota lower by 600k to 1m barrels a day. Oil closed at $47.18, and a touch higher as a result of these expectations

- We get the Bank of Canada out tonight (2am AEDT) and the market is torn between a 25bp and 50bp cut – I’m going 25bp

- The market is pricing aggressive rates cuts from the RBNZ (meeting on 25 March), and action from the ECB and BOE later this month, although I don’t see the ECB cutting, more likely looking at liquidity measures

- Google halts international travel over covid-19: Bus Insider – a headline we’ll see far more often from multi-nationals.

It’s all looking somewhat reminiscent of the GFC, although the two situations are very different – in 2008 it was a banking and liquidity crises – banks didn’t want to lend to other banks for fear of counter party risk and solvency. This is an economic crisis potentially in the making, and more about the spread of a virus and how it alters people’s daily lives and spending habits, not to mention the ability to even get into work to offer services and create products. What started as a concern about the extent of fragility to the Chinese economy has mopped into a worldwide problem. It seems unclear what rate cuts will do though, but the market has demanded them, and central banks have no choice but to meet the market or risk causing more damage and higher volatility.

There are over 92,000 cases now. Spain and Chile have recorded their first cases overnight, Washington have reported two new deaths and seven more cases, and on my count I make it 76 countries. Although most of the cases (outside of China) are concentrated in Korea (5186 cases), Iran (2336) and Italy (2036).

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.