- English

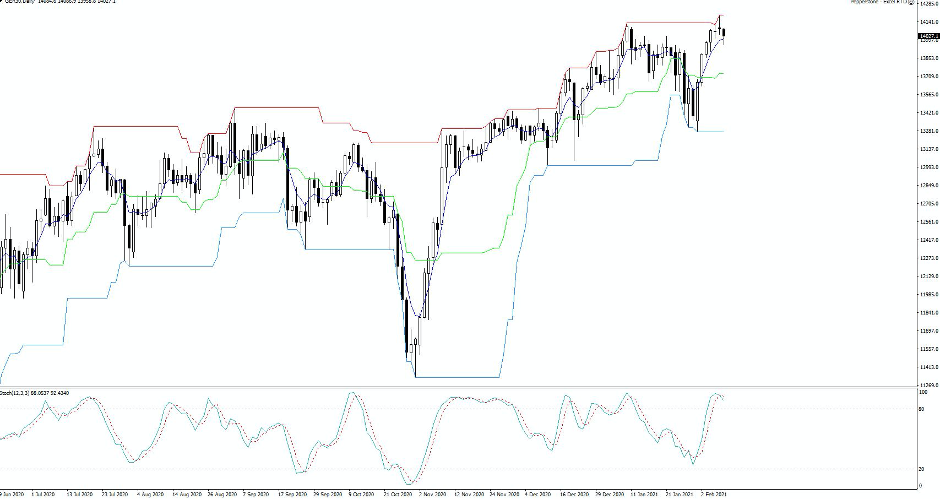

EU equities were mixed with the GER30 once again testing the upper bounds of 14,100 and forming a potential double top. One for the radar, with a break likely to get increased focus from the “buy strong” crowd.

US equities are up smalls although the Russell 2000 outperforms and just keeps on going and the equity reflation trade guides ever more capital towards small caps. The S&P 500 has traded a range of 3917 to 3902 in the cash session, with comm services, industrials and REITS performing fairly well, while energy is bottom of the pack and 1.4% lower with profit-taking evident after a good run.

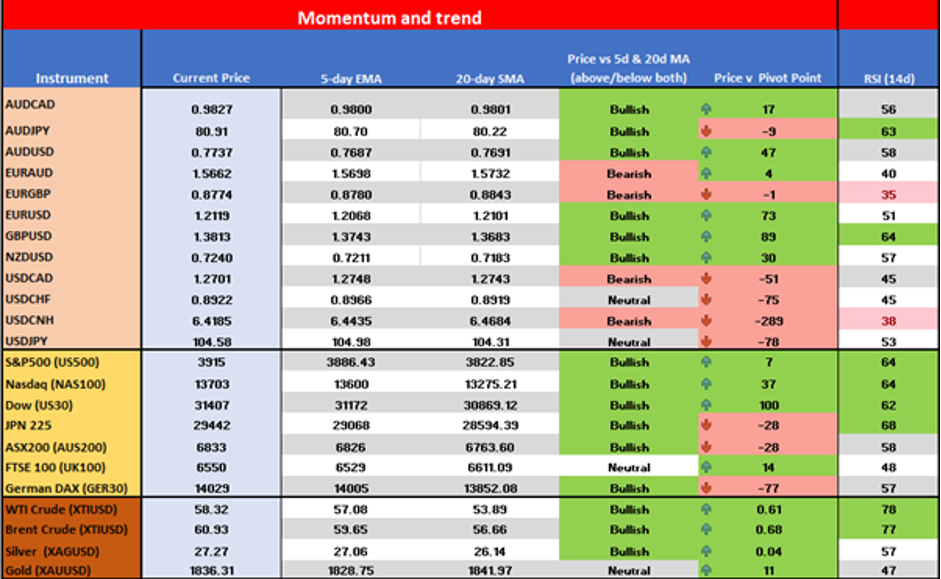

My equity momo and trend scan – a simple scan I’ve set up in excel to show major markets trading above the 5-day EMA, 20-day MA and RSI >60 still has all equity markets still in bullish mode, except the FTSE100. Happy to maintain a bullish bias for now, based on my timeframes and time in the market and with the VIX pushing 21% which as you see from the vol matrix implies 1.3% daily moves in the S&P 500.

Crypto caught client attention yesterday with Bitcoin especially getting some good flow and specifically from the long side and trading into 48,218. Ethereum also getting some love, but less so when all the news was about commander-in-chief, Elon Musk, $1.5b purchase of Bitcoin. Although he was joined by the likes of Michael Saylor talking about Bitcoin being the ultimate scarcity asset and Michael Novogratz pushing his $100,000 target. The intensity has calmed and it wouldn’t surprise to see better two-way flow, with clients earning 7.75% on shorts swaps if held past rollover. That said, holding shorts in crypto for a period is tough and this power behind the trend is incredible – hard to see a collapse on current sentiment and the more pertinent question seems to be if buying weakness in this trend how far the dips will be. We watch for the break of $50k.

In FX, the USD is broadly lower with the USDX -0.5%, which seems a reasonable decline when there have been no moves to speak of in US bond markets, and real rates are only modestly lower. USDX is eyeing another tilt at the 90-handle, which should be supported. USDJPY has worked well to the downside with the 200-day MA (105.56) having been the place to fade with the benefit of hindsight. The sellers could take this into 104.39 to 104.17 and assess there, as there is good support on the daily, my vol matrix (based on overnight FX options) has the lower bound at 104.20.

GBPUSD looks interesting with price through 1.3800 and the highest levels since April 2018. Next stop 1.4000, where the probability of this being tested within a month is 21.7%. GBPJPY sits 144.43 and tests the March 2020 highs, which are levels tested before the pair collapsed into 124 on the COVID angst – is this the place to build shorts, or does a break take us into 147 /148?

EURGBP has found stability after the run from 0.9100 and seems to find buyers into 0.8761, so if this goes then we head into the swing low of 0.8738 and beyond. EURUSD has pushed back to 1.2100 and been the key driving force of the USDX, which it will when it holds a 57% weight in the basket. Price action looks strong, and I’d be looking for 1.2160 before we see far better supply.

Broadly commodities are higher, with Brent above $61, while WTI trades north of $58. This hasn’t had much effect on US breakeven inflation expectations and while this is giving limited catalyst to precious metals, the weaker USD is offering tailwinds. XAUUSD trades into $1836 with the 50-, 100- and 200-day MA all sitting between 1871 to 1854, so there's some wood to chop on the upside and this marries upside seen through mid-late Jan. I have no real strong ST trading on gold as there is a lot of chop in price.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.