- English

Market participants crave an election outcome – it is an event many want out of the way, so they can trade their strategy without the noise and emotion that the election brings to markets. The outcome brings a degree of certainty, offering increased efficiencies to price how the winning party’s policies could affect economics and even the Fed’s monetary settings.

The timing of the election matters

If the US election does prove to be a volatility event for broad markets, then the timing matters for day traders and notably for those who refrain from carrying risk over when they aren’t in front of the screens and able to react.

Mail-in votes will play a role in the timing of the results, and the numbers could be higher this election given recent weather-related disruptions. We should also consider that early voting has already started in some states and will be open to other states before 5 November. However, for those who choose to vote on 5 November, there is still the possibility of disruptions on the day. If the initial vote is close in individual states, just as we saw in 2020, then we may well see recounts and that may delay the result.

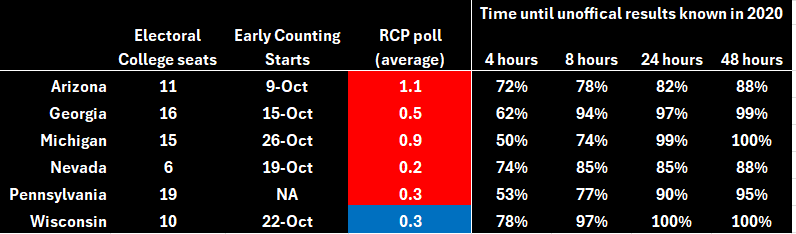

Recounts and delays matter most in the 6 key battleground states – Arizona, Georgia, Michigan, Nevada, Pennsylvania, and Wisconsin. These are the states which will decide the election outcome, so any delays in knowing the outcome in key states such as Pennsylvania (PA), could impact the timing of the overall election result.

Consider, that in the 2020 election once AP called the result in PA it gave Biden an electoral college majority and set him up to win.

Time until the unofficial results were known in 2020

As we see in the table, in the 2020 election, most votes in the key battleground states were known within 24 hours, although the election wasn’t officially called until 2 days later 7 November – which inconveniently for many market players was on a Saturday.

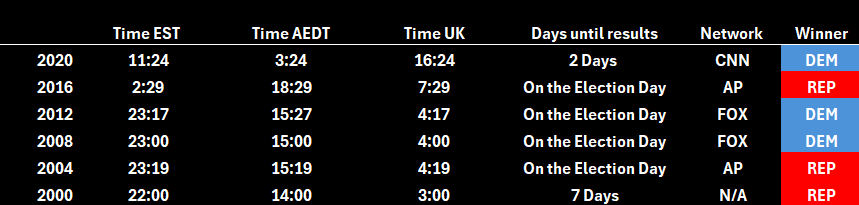

Key times – when the result was known in the past 6 elections

If we look at the past six US elections, 4 of these were called by a network on the 5 November between 11 pm to 2 am EST (6 Nov). Delays were seen in 2020 and 2000. As it stands, the betting markets imply Trump ahead in all key battleground states, except for Wisconsin. The RealClear Politics (RCP) average of all polls also shows a similar dynamic, although the majority in most are within the margin of error.

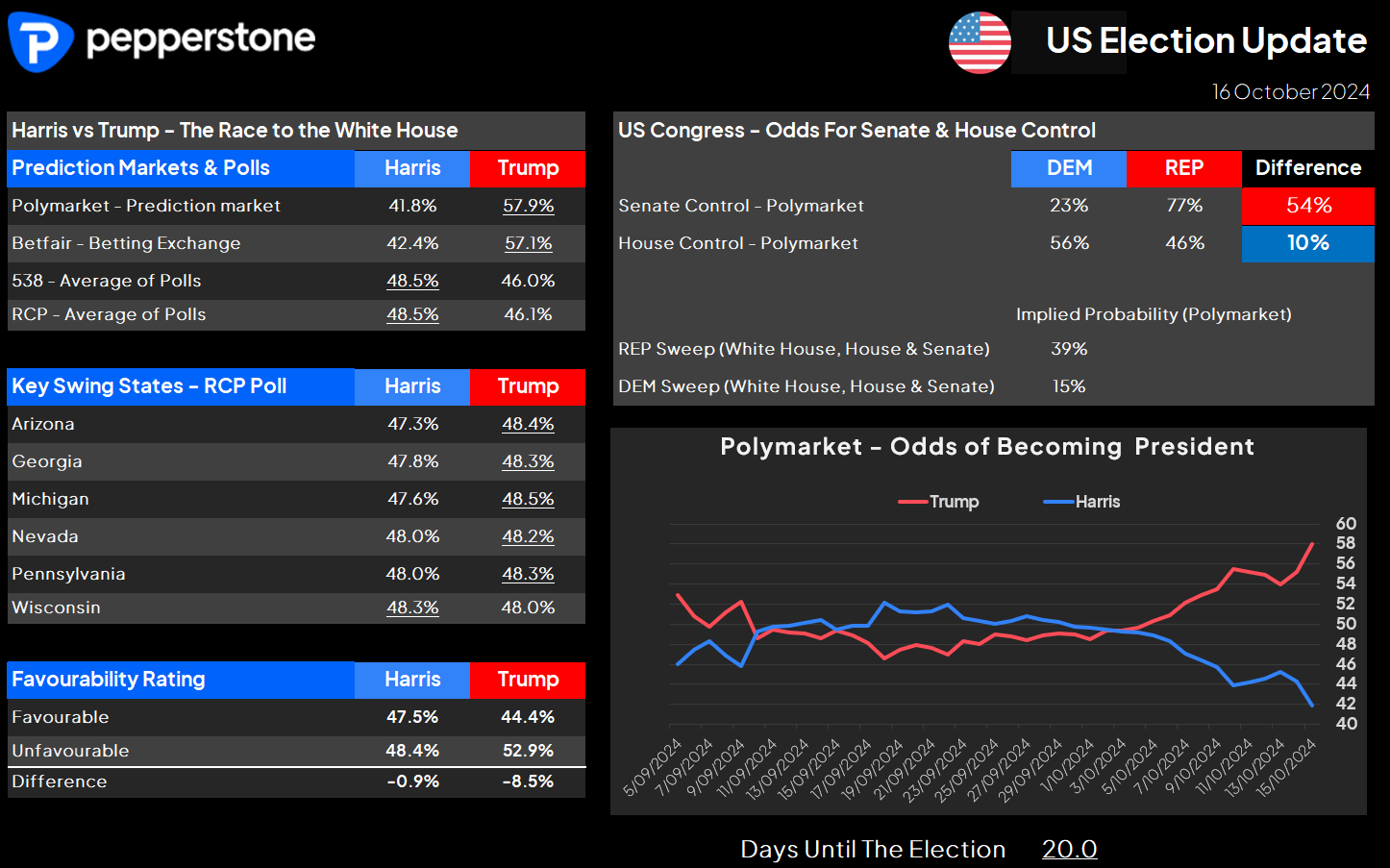

US Election Dashboard – the shape of the race

In theory, the polls suggests another closely contested race, which does increase the prospect of recounts in certain states – however, if we don’t learn of an official outcome on the night of the election, the chances of it being known on 6 November remain high, and most political analysts see a reduced risk of a re-run of 2020.

The other important factor to consider is the result of the Congressional vote, and which party controls the Senate and the House. While traders can price trade policy and tariff risk upon understanding who becomes president, the more outsized moves seen in the US bond market, the USD, oil and equity would be if Trump were to become president and the REPs win both the Senate and the House. A factor that is currently ascribed a 40% probability at present.

For market participants understanding the election process, and subsequently when we may get the clarity to price the potential effects of policy, matters a lot. History may not repeat, but it can be a useful guide.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.