- English

Some basic information about Purple Group

Purple Group, short code PPE, owns brands offering various financial services from investing in property, to trading and portfolio management.

The Purple Group has a market cap of 2.589 billion ZAR and a P/E ratio (Price to Earnings Ratio) of 45.2.

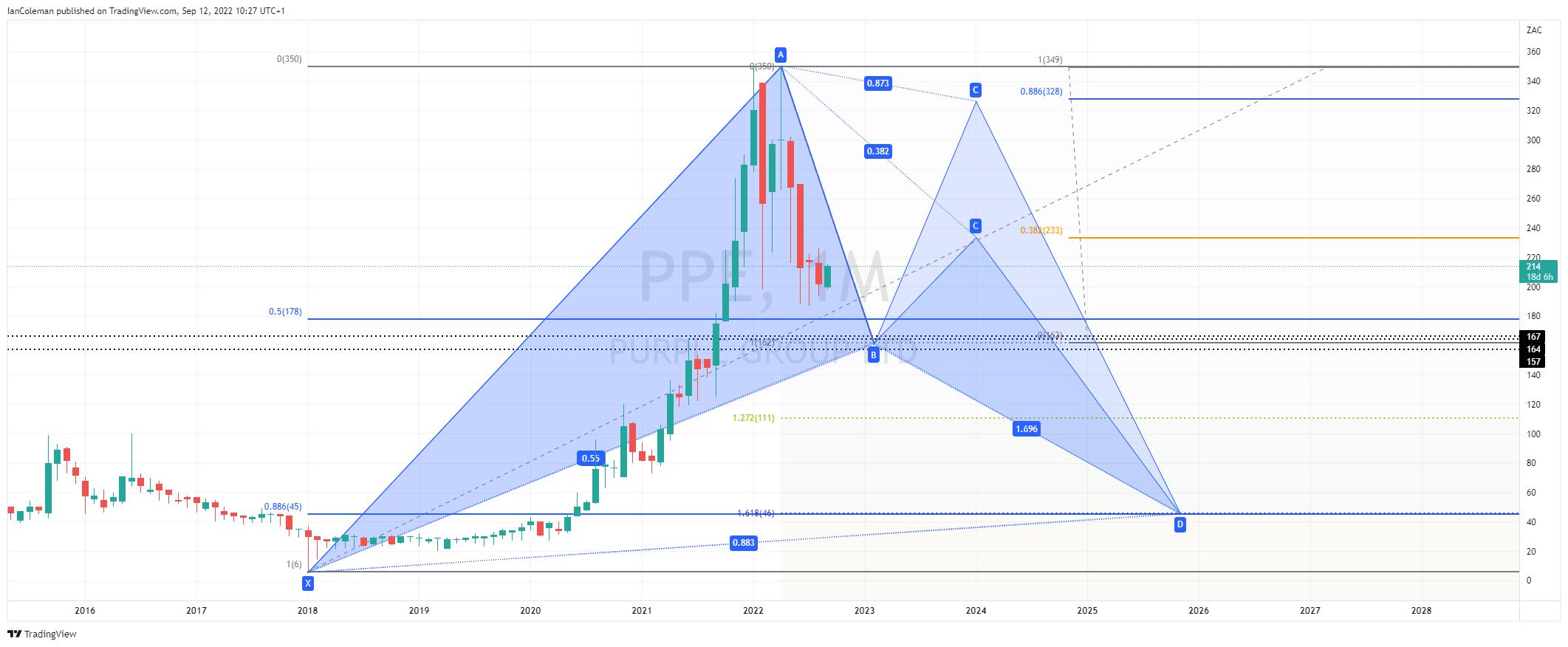

Figure 1 Trading View PPE 12/09/2022

The rise in Purple Group share price

In January 2018 the Purple Group share price posted a multi-year low of 6 ZAR. In June 2020 we started to see a steady rise in the share price that gathered strong momentum through 2021 and 2022. This resulted in a 6225% increase to the high trade of 350 ZAR in April 2022.

This was in line with the onset of COVID-19 and a rise in the interest of on-line investing.

Figure 2 Trading View PPE share price increase of 6225%

A look from a fundamental perspective

The group's last results were for the 6-months period ending in February 2022. The highlights are:

- Group revenue increased by 36.0% to R137 million;

- Group costs increased by 39.7% to R93 million, however, the operating cost per invested EasyEquities client decreased by 24.7% to R80 per client, compared to the prior comparative period; and

- Profit attributable to shareholders increased by 114.2% to R17.7 million, compared to a profit of

- R8.3 million in the prior comparative period

An interesting note in the adjoining letter from the CEO “Revenue per EasyEquites’ customer has returned to pre-Covid levels.”

With an interest in on-line flattening off since the world returned to some form of normality, can the strong growth continue?

For more information about fundamental analysis click here.

A look from a technical perspective

We must look all the way back to 2005 -2007 before we can note a cluster of support and resistance levels. Often, what has previously acted as support will do so once more. This offers a ‘zone’ between 167 and 157 ZAR.

Figure 3 Trading View PPE previous support and resistance zone

We have a possible technical support level at 162 ZAR. A rejection of this level would form the AB leg of a cypher pattern known as Bat formation.

This would then suggest a possible upside correction towards 233 ZAR and possibly 328 ZAR.

Figure 4 Trading View PPE possible BAT support

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.