Learn to trade

Exploring The World of Agricultural Commodities Trading

Find out how to trade soft commodities

Create a live Pepperstone account

Agricultural commodities are often overlooked, but the humble asset class is often resilient in the face of inflation, uncertainty and economic turmoil - just look at how wheat and grain prices skyrocketed for months after Russia’s 2022 invasion of the Ukraine if you want proof. But how and why is this the case?

What is the definition of agricultural commodities? And what does that mean for you?

Agricultural commodities is the umbrella asset class term for products derived from farming. They’re often interchangeably called soft commodities. Unlike commodities like metals, gases or other hard commodities, agricultural products are things from natural resources. Examples include crops or other plants; and livestock, meat or other animal products.

As their name suggests, they're a subset of commodities that traders can gain exposure to, which are traded on global commodity exchanges and other markets. To do so, you'd speculate on the global prices of these certain commodities with a financial broker like us on a trading platform.

Types of agricultural commodities

The five subtypes of these forms of commodities are:

- Grains and Oilseeds (like corn, wheat and other cereal grains)

- Soft commodities (like coffee beans and cocoa)

- Livestock, meat and dairy products (like live hogs, whey, cheese and eggs)

- Bulky commodities (like cotton, rubber and wool)

- Processed foods and beverages (like chocolate, sugar and coffee)

Overview of the agricultural commodities market

Agricultural markets where traders speculate on the price fluctuations of things like corn, coffee or cattle are some of the oldest ways to trade, and date back all the way to the Dutch East India Company in the early 1600s and beyond.

How these markets function

Similarly to other asset classes, these are largely traded on commodity exchanges. Famous examples of these include the Chicago Mercantile Exchange (originally called the 'Chicago Butter and Egg Board') and the Intercontinental Exchange.

There, commodities will be speculated on in terms of how their prices are affected by a wide variety of factors from weather conditions to the macroeconomic climate.

Factors that influence them

Global commodity prices are determined by a range of factors. Changes in these factors often leads to volatility, which can cause extreme price swings. Some of these are:

- Weather patterns

- General demand worldwide for that commodity

- How stable supply chains are for that commodity

- Economic conditions for the markets at large

- Governmental policies and international trade agreements in countries which are big producers of a popular commodity

How to trade on agricultural commodities

Traders won’t gain exposure to agricultural commodities by buying physical livestock or huge silos of grain. Instead, you’re able to access soft commodities by using a trading broker and trading products like CFDs.

Contracts for Difference (CFDs) are a type of derivative - financial products which ‘derive’ their value from the commodity that they track. Derivatives will mirror exactly the price movements of that commodity as its underlying asset, so you can trade on the commodity's price performance without buying any physical commodities.

When you trade on derivatives like CFDs, you’ll do so on a financial broker’s trading platform - like Pepperstone -where you can speculate on the price movements of your chosen agricultural commodity as the underlying market you’ll be trading.

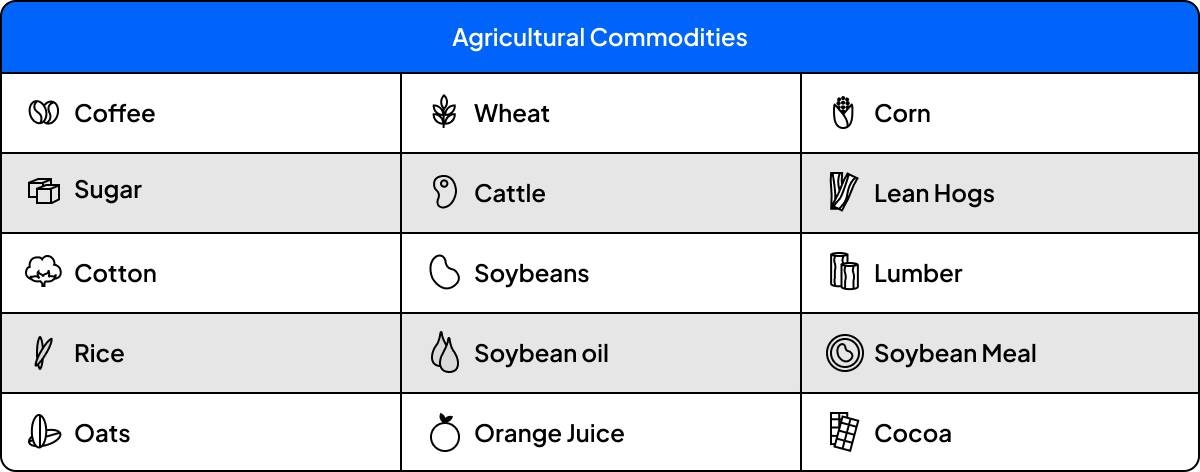

Which agricultural commodities can you trade with Pepperstone?

We are the proud home of more than 1200 financial markets for you to trade on - including agricultural commodities. All of these soft commodities that you can trade with us are:

How you can trade on agricultural commodities

While soft commodities like these are exciting, few people have the ability to purchase and keep assets like actual livestock or silos of grain! Instead, with us, you can trade on agricultural commodities using CFDs.

Instead of paying 100% of the cost of your commodity purchase (as you would when investing), CFDs are leveraged. That means traders are only required to put up a small percentage of the full value of the underlying asset, known as margin (a type of minimum deposit), which allows them to gain exposure to a larger position than they could with traditional trading methods.

This means that the remainder of your position’s cost is essentially ‘borrowed’ from your trading broker. It’s also important to remember that CFD trading holds inherent risk. That’s because the profits or losses that you earn - depending on whether you’re correct in your prediction or not - are calculated based on the full position size, not your margin amount. With leverage, this means that losses can accumulate quickly.

Find out more about trading on leverage

How to trade on agricultural commodities using CFDs:

- Research your chosen agricultural commodities’ markets carefully

- Open a demo account to practise and finetune your commodities trading strategy

- Create a live Pepperstone account and fund it to get started

- Open your first live trade on the platform

- CFDs are complex instruments, so consider setting up stop loss and take profit orders to maximise your risk management

- Monitor the markets and close your trade when ready

The benefits of trading in agricultural commodities

Supply and demand in your favour: Many agricultural commodities form the backbone of everyday life for many consumers, and so demand is often quite constant. If anything should disrupt the supply of that commodity, this may drive the price up, due to the laws of supply and demand.

Opportunity in tough times: Because of supply and demand, many soft commodities (that are staple goods for households) are known to be resilient asset classes in times of economic hardship and other uncertainty.

No ownership of the underlying asset: Purchasing agricultural commodities outright - like live hogs or cattle - is impractical for many, and often very expensive. But agricultural commodities trading, when you use derivatives like CFDs, offers you the opportunity to capitalise on price movements and access global markets without having to purchase any physical assets.

Overall, agricultural commodities can be an exciting asset class to trade in and offer plenty of potential for profit (as well as loss) if you have the right understanding of how these markets work. With Pepperstone, you can gain exposure to these assets using CFDs with a range of instruments available for trading.

The risks and downsides of agricultural commodities

Unpredictability: These commodities are live, grown things and not just asset classes. For that reason, they're affected by a host of other factors determining their value that other assets aren't. Things like weather conditions, price stability due to government regulations and even trade flows between nations affect agricultural commodities' prices.

Volatility: Because of this, commodity prices can swing hugely, meaning the potential for significant losses if you predict their movements incorrectly.

Heightened risk due to leverage: Because you'll be trading using CFDs, which are leveraged, you run the risk of losing much more than the margin amount you paid to open your position.

As with all markets, trading in agricultural commodities carries significant risk and requires a good understanding of its market dynamics. It’s important that you research carefully before going live with any trades. And use effective risk management strategies like stop loss and take profit orders to limit your risk of loss.

In conclusion: the TL;DR summary

- Agricultural commodities are farmed and grown commodities like lumber, grain, rubber, livestock and other food stuff.

- To trade agricultural commodities, you'd choose an online broker like Pepperstone who offered the soft commodities you're after and would speculate on their pricing using derivatives, rather than purchasing the commodities themselves outright.

- With us, you'd trade agricultural commodities using a financial derivative product called Contracts for Difference (CFDs)

- Agricultural commodities are affected by factors which don't affect other asset classes like stocks or bonds. Weather patterns, seasons, trade flows between countries and government regulations can all affect soft commodities' pricing. For this reason, they can be incredibly volatile and risky to trade at times.

- For this reason, an effective risk management strategy including things like stop loss and take profit orders is essential.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.