- English

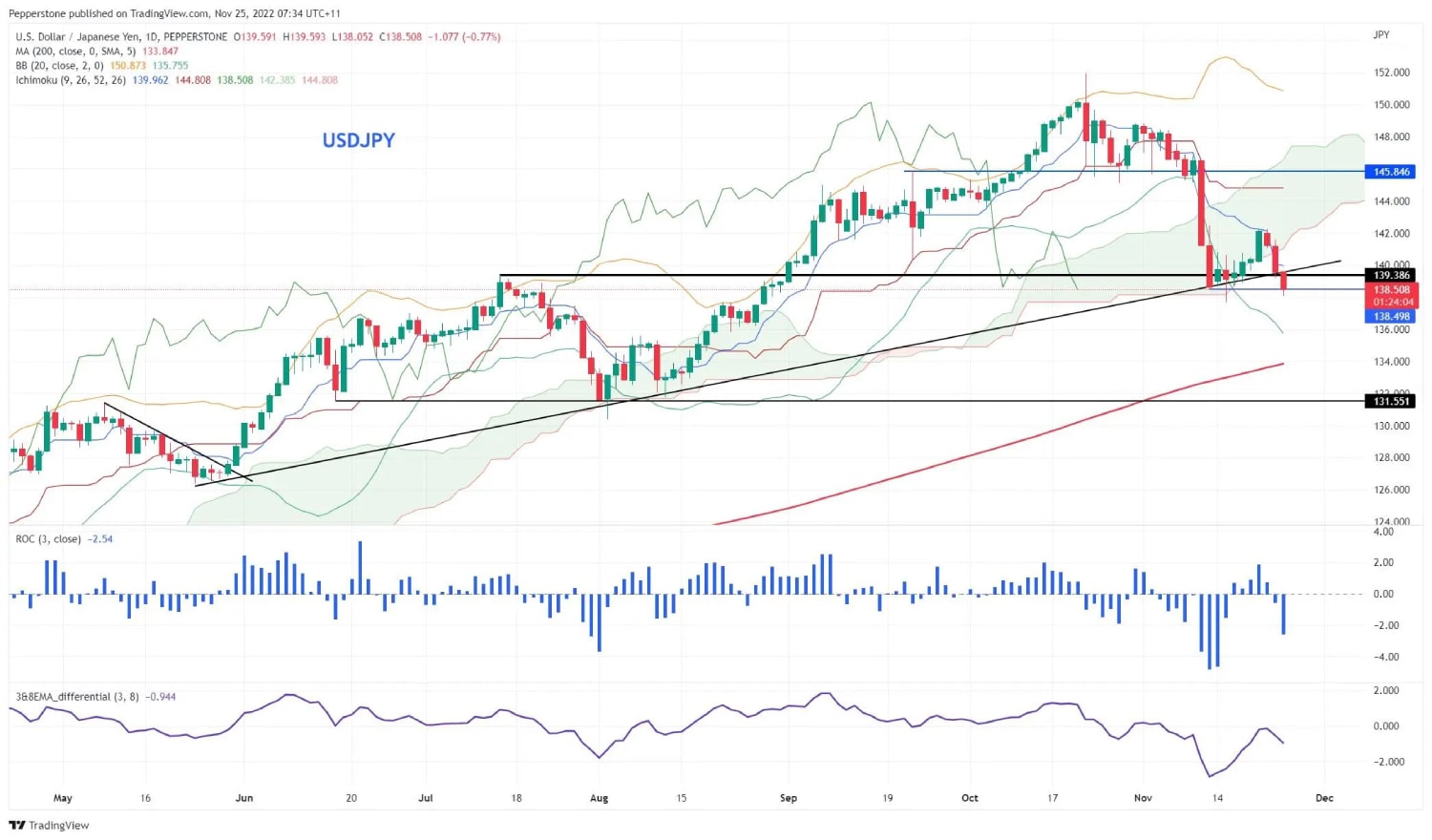

USDJPY - breaking key support as we roll towards NF payrolls

We can see a marked increase in the 3-day ROC and a close through the 11 Nov lows of 138.46 could see the pair start to bear trend with the 200-day MA at 133.84 potentially coming into play.

Clients are perfectly split here on short-term direction, with an exact 50/50 split in terms of USDJPY open positions – however, should we see a closing break of 138.46 we’d likely see momentum accounts look to increase short exposures, as will our trend-follower traders. As many will attest to, most breakouts prove to fail, so price action will obviously need work. However, the technicals suggest the path of least resistance is lower, and when price is breaking key levels and trending using a simple 3- & 8-day EMA crossover system can keep you in the trade and remove the emotion of taking profits too early.

By way of event risk drivers – on the docket today we get Tokyo CPI inflation (10:30 AEDT), which is expected to rise to 3.6% YoY (from 3.5%) – we see this as a leading indicator for the national CPI print, which is almost at the highest levels since the early 90’s - however this data point, regardless of the heat, is unlikely going to move the JPY given the BoJ’s unwavering stance – that said, it will become more significant as we roll in Q123 with the market putting a huge focus on the end of Kuroda at the helm of the BoJ.

On the US side, as traders kick back to life next week after a mountain of turkey, the US labour market will get our full attention with the JOLTS job openings report (1 Dec 02:00 AEDT) and US non-farm payrolls (3 Dec 00:30 AEDT) – on the latter, the market expects 200k jobs to have been created, with the unemployment rate unchanged at 3.7% - earnings should fall to 4.6% (from 4.7%).

We’ll have a stronger read on consensus expectations next week, but a cooling of the labour market will see both nominal US Treasury yields and real rates fall and potentially even lower the fed funds terminal rate below 5%.

So some big event risk on the docket – the technicals favour downside, with conviction increased below 138.46. One for the radar.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.