- English

One can assume that the BoJ are also one step closer to moving away from Yield Curve Control (YCC), and logically one could argue that the BoJ would like to be able to lift rates and remove YCC concurrently.

The result of Gov Ueda’s comments was an intense move higher in Japanese swaps and govt bond yields (Japan govt 5yr bonds closed +6bp at 28bp). The move in yields compelled the BoJ to intervene and limit the selling. USDJPY reacted, trading into 145.90 but has found buyers below the figure, and at the time of writing oscillates around the former breakout highs of 146.56.

Our client skew is fairly nuanced and while net long JPY, remains unconvinced on a more pronounced downside move, with 59% of open positions in USDJPY held short. This fits well with reported JPY positioning held by fast-money leveraged institutional funds.

While Ueda’s interview is certainly constructive for JPY longs, I refrain from getting too excited at this stage by what we’ve heard, where the actions are more of a medium-term issue. Wages are the core consideration for the BoJ, but we won’t get the outcome of the spring wage negotiations until April 2024, with November a potential date when we could see early estimates coming through. So realistically, the big catalyst won’t be seen for a while, and any changes in rate setting won’t happen for about six months, although the market lives in the future and will front-run these expectations.

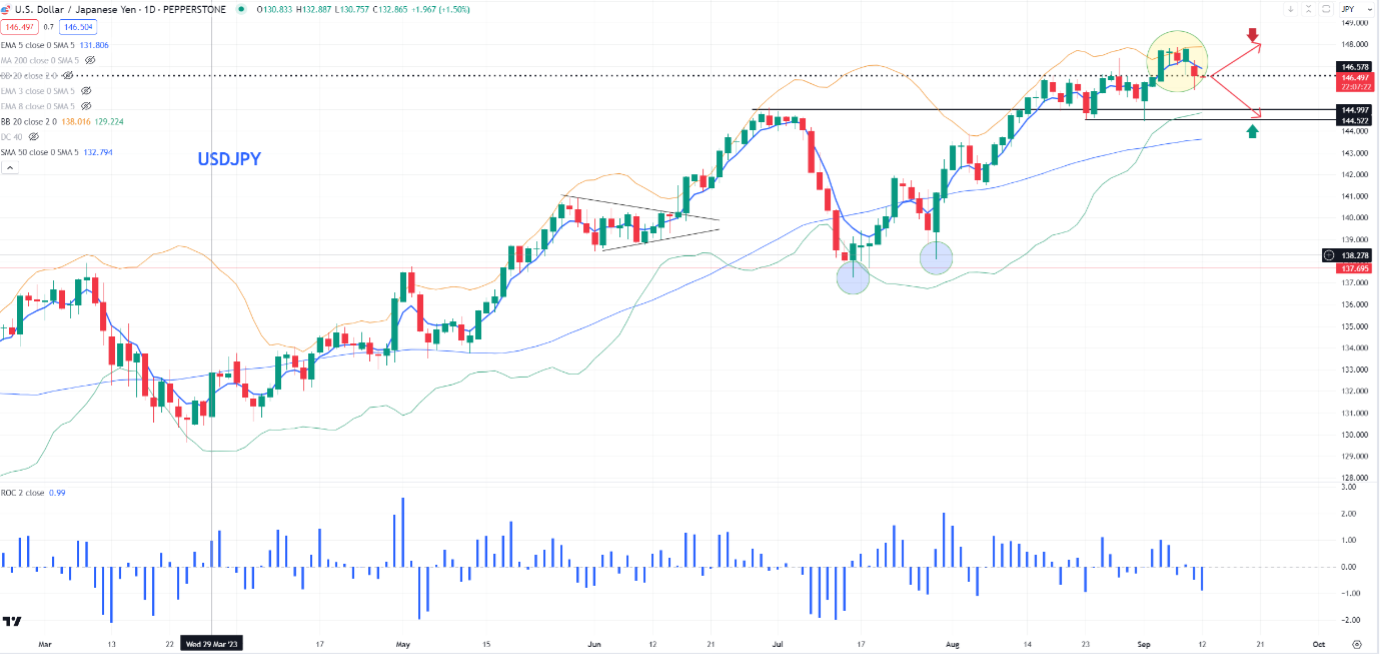

USDJPY daily chart

The case for FX funds to support USDJPY pullbacks

Near-term levels of statistical and implied volatility are still very low, and equity markets are supported, which continues to support a JPY-funded carry trade. The market is debating if the Fed hike in November and we navigate the US CPI print (Wed 22:30 AEST), which could influence expectations of another Fed hike and impact the USD. One could also argue that a further move higher in JGB yields isn’t going to cause a significant repatriation and reweighting from Japanese pension/insurance funds into Japanese bonds, given that 10-year JGBs (Japan govt bonds) already hold a 212bp (basis point) premium over US 10yr Treasurys on a currency-hedged basis.

Trading USDJPY – Play the range

With that in mind, tactically, I feel it most probable that traders will look to trade a range in the near-term, selling rallies above 148, while supporting and buying into pullbacks at the range lows of 144.50. Supporting this, USDJPY 1-week implied volatility trades at 9.07%, which equates to a 152-pip move (up or down) over the week. One can re-assess this view if US CPI is a significant blowout/miss to consensus, but for now, playing a range seems the most likely path.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420?quality=30)