- English

Trader thoughts - testing big levels in EURUSD, EURAUD and gold

Looking at positioning from clients there is a growing view that the move lower in the USD is approaching an end – we’re seeing a greater skew to EURUSD and gold shorts and this does not surprise given so many trade counter to the trend, or mean reversion.

Levels to fade EURUSD

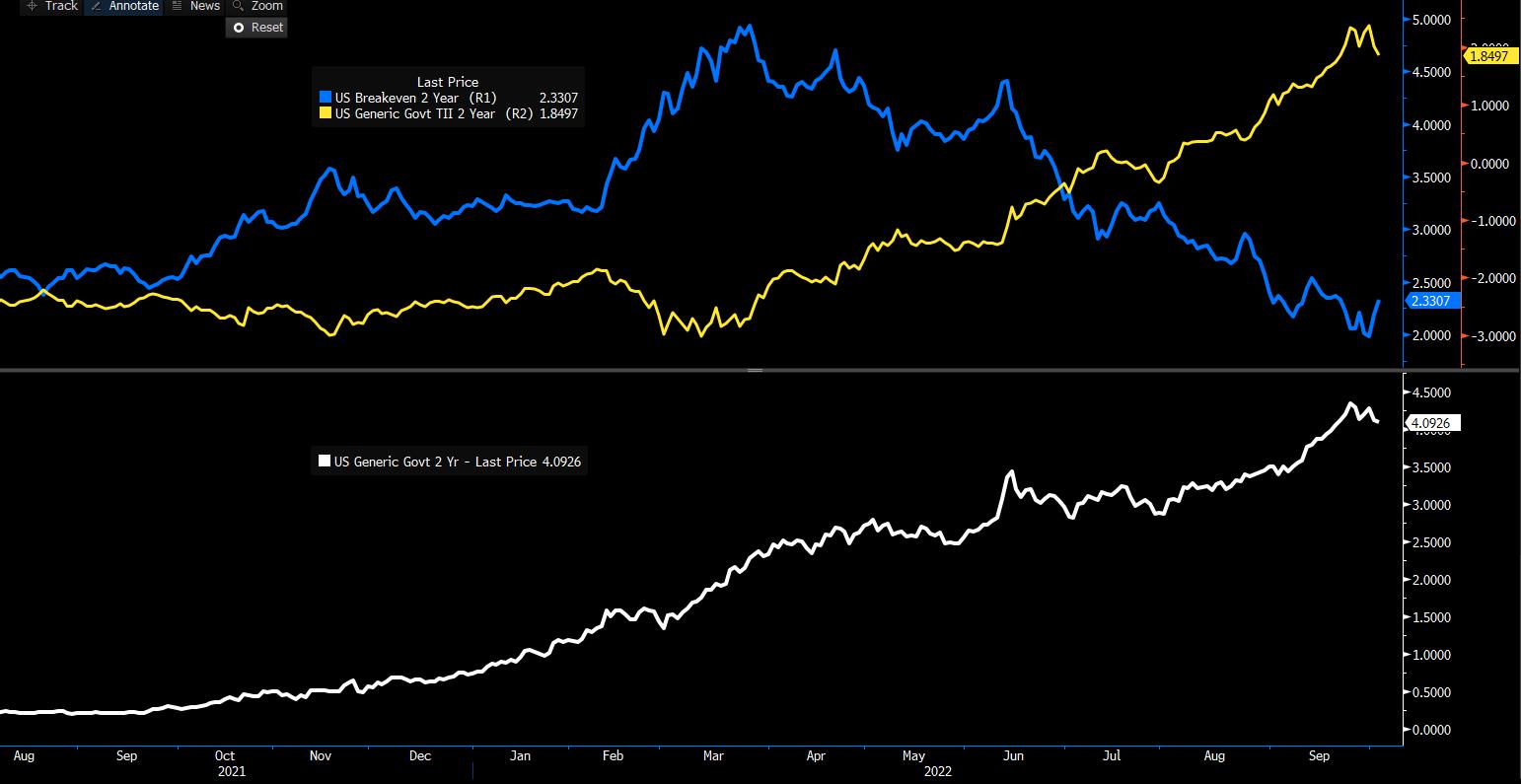

In US trade, EURUSD moved to whisker from parity and found supply into the big figure – its hard to pinpoint an exact reason, but without being on an investment bank flow desk, we can believe this has been driven by a reduction in USD longs as equity markets rage higher – we also know US real rates have cratered in the past two days and terminal interest rates pricing in the US has priced out a 25bp hike.

EUR shorts in the broader market have capitulated as we moved towards parity, and one suspects we’ve found a much cleaner structure – Much falls on moves in equity markets and whether there can be a further easing of financial conditions.

The levels to watch – intraday - are the 50-day MA and the top of the channel seen between 1.0016 and 1.0068. The 50-day MA has been an excellent trend filter all year, but we can also see that when price moved down to 0.9500 it was 4.6% away from this MT average – this is over 2 standard deviations from the average seen since 2000, and rarely does it extend past these statistical measures without some sort of price consolidation. We’re seeing that play out now, but the question is whether this is the level to reapply shorts. I think we can push a little higher but would be leaving limit sell orders for a day trade above the 50-day MA.

EURAUD – testing big levels

Using this logic, we see an interesting set-up in EURAUD (daily) – price is hitting big levels and is 4.3% above its 50-day MA; 2 std deviations above the mean from 2000. Sellers have kicked in above the June highs overnight on the RBA moves and it feels like some are seeing them as a canary in the coal mine and believing that if the RBA are getting closer to the end of the tightening cycle that others must be too – it’s hard to fade this as there is a bit of love for the EUR but the ST risk to reward trade-off is shifting.

EURGBP longs may be a better play – at least from a tactical perspective.

Gold – Nirvana-like conditions

Its probably no surprise that XAUUSD is also testing the top of its channel and its 50-day MA – this is similar to EURUSD, but price has progressed a little further. This has been gold’s time to shine as we’ve seen market-based measures of inflation expectation moving higher, while real rates have fallen – with a weaker USD these are nirvana-like conditions for the yellow metal – the question obviously is whether it can last?

I am not sure the Fed will be overly happy with the easing of financial conditions – they may push back but let’s see next week’s US CPI print – it seems key.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.