- English

AUD trader - the wind firmly to the back of the 'Aussie battler'

In the lead-up AUD exposures will be impacted by risk and sentiment in markets, where the tone will predominantly be driven by the reaction to the FOMC meeting (2 Feb 06:00 AEDT), as well as Friday’s US non-farm payrolls (4 Feb 00:30 AEDT) – however, getting set for the RBA meeting is an increasing factor, especially if trading the AUD through the crosses – AUDNZD, GBPAUD and AUDCAD.

The building concern is focused more on Aussie underlying inflation, which at 6.9% was significantly hotter than forecasts – it’s clear the rise in debt serviceability is not impacting household spending patterns as it should and while we can go into the various components (of the CPI basket), the fact is underlying inflation is far too sticky, and still headed the wrong way. While many other central banks still have high absolute inflation, at least inflation is moving back towards target.

The idea of pricing the RBA’s terminal rate in Australia is being heavily debated – the ‘terminal’ rate is the highest point or the peak in interest rate expectations, priced into the interest rate curve. As a result of the Aussie CPI print, the dispersion in views around the terminal is as wide as ever – when we get dispersions like this and the distribution of outcomes is varied, then we typically get higher volatility in the currency.

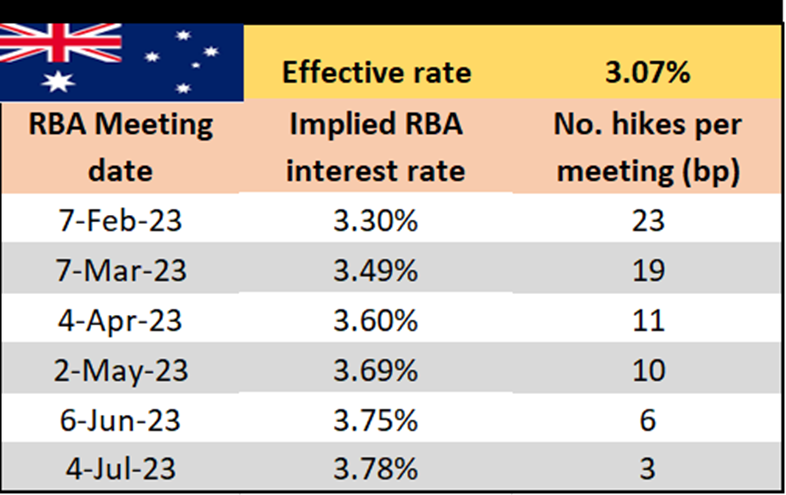

What we see now is the market is pricing 23bp of hikes for the RBA meeting on the 7 Feb – so essentially a 25bp (or 0.25%) hike is a done deal and the upcoming domestic data seen up to the 7 Feb is unlikely to influence that pricing.

Where we could see the reaction in the AUD is when we marry up the tone of the statement to future rate expectation and the market’s pricing on terminal – after this week’s CPI print the market lifted the terminal pricing by some 20bp to 3.75%. In effect the market sees the cash rate rising to 3.35% on 7 Feb, with an additional 25bp either in March or April and maybe one more later in the year.

Looking ahead at key dates on the domestic calendar, it feels like the market will place weight on these dates:

16 Feb – Jan employment report

22 Feb – Q4 wage price index

1 March – Jan (monthly) CPI

Ongoing – The RBA’s continual liaisons with businesses to understand the prospect of a wage-price spiral.

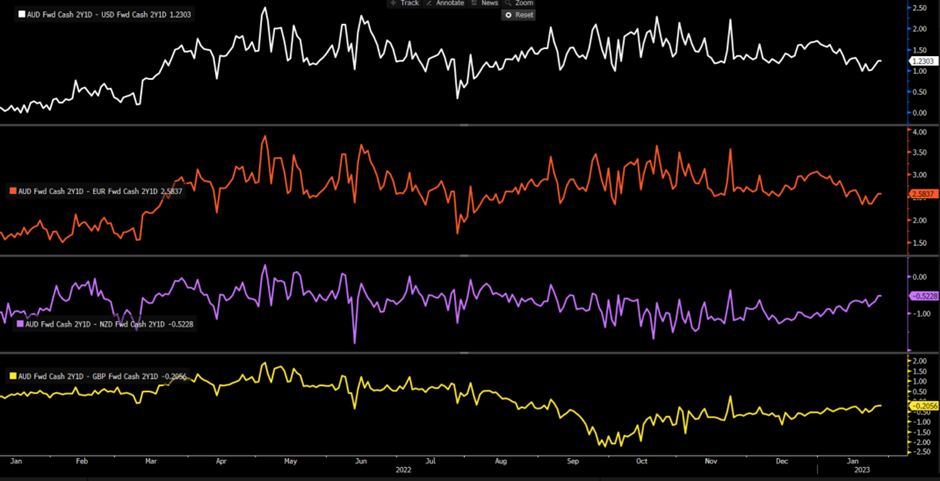

Relative 2YR swaps pricing

We can argue that from an inflation and monetary policy setting perspective, the increased divergence suggests the AUD deserves to be trading above 0.7100 – here we see 2-year relative swaps pricing recently moving in favour of AUD appreciation against the USD, EUR, NZD, and GBP – so relative expected rate-setting has offered a platform for the AUD bulls.

Another factor that is driving the AUD is the use of the AUD as a trading vehicle to trade changes in market sentiment/risk, as well as developments in China – we’ve seen industrial metals on a rip as China reopens and stimulus, but it’s the equity market that the AUD has a lock on to – for example, the 20-day rolling correlation between the AUDUSD and NAS100 is 0.95 (or 95%), while the correlation with CHINAH is 0.90.

So if Chinese and US equity markets are rising and the VIX stays low then the AUD should find buyers on dips and ultimately continue to print higher highs.

What’s the trade?

How much further the rally in the AUD has left is obviously yet to be seen – AUDNZD has been the stand-out economic and central bank divergence play and the risks are still for higher levels. In AUDUSD we see price testing August 2022 swing high, where a break would suggest a further extension to 0.7312. Taking a more systematic view, in times like this is to remove the emotion and stay with the flow of the market and simply cut on a daily close below the 5-day EMA or a 3 & 8-day EMA. The run is mature but if US equities kick higher next week given the deluge of earnings, then I stay in.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.