- English

September 2025 BoE Preview: On Hold With Balance Sheet In Focus

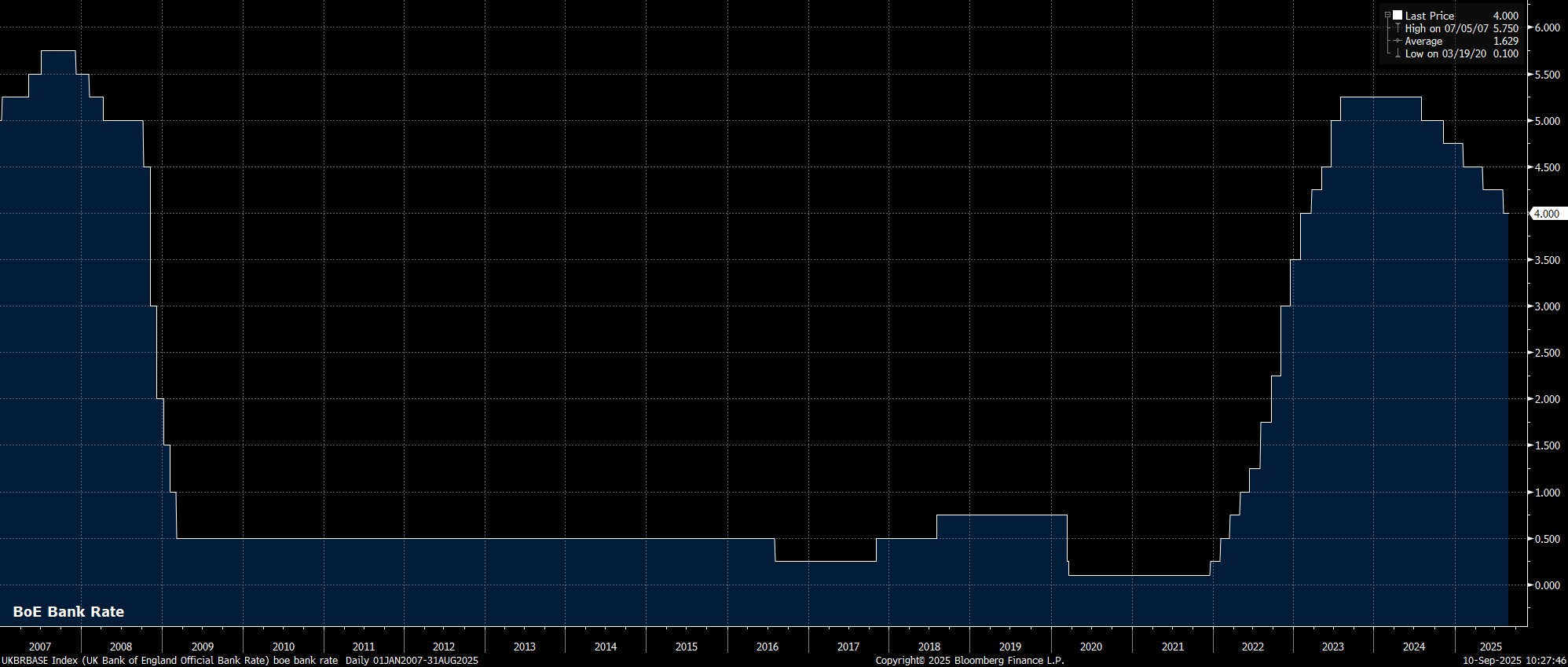

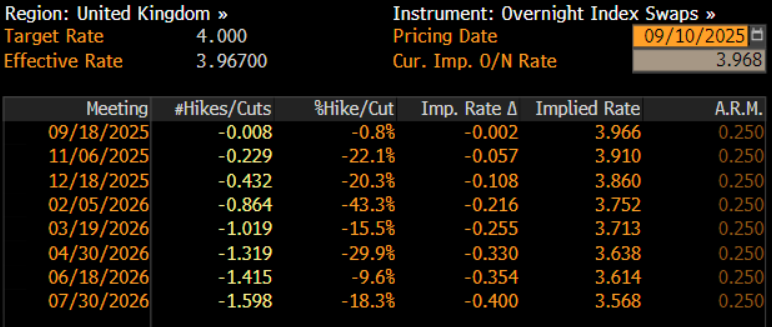

As noted, Bank Rate is set to be maintained at 4.00% at the conclusion of the September MPC confab, after policymakers voted by the narrowest possible margin to deliver a 25bp cut at the prior meeting, in August. Money markets, per the GBP OIS curve, price no chance of any rate moves this time around, while discounting just 10bp of easing by year-end. The next 25bp cut isn’t fully discounted until next March.

However, in keeping with almost all MPC decisions this cycle, the call to stand pat this time around is unlikely to be a unanimous vote.

A 7-2 vote in favour of holding Bank Rate steady seems to be the most plausible outcome, with external members Dhingra and Taylor dissenting in favour of a 25bp cut. Dhingra, owing to her typically uber-dovish policy stance, and Taylor owing to his initial vote for a 50bp reduction last time out, as well as recent commentary indicating his preference for ‘four to five’ cuts being delivered this year (we’ve thus far had 3, in total).

In any case, no matter the vote split, the MPC’s policy guidance is likely to be unchanged from that issued last time out, and the language with which participants have become familiar this cycle. Consequently, the statement is likely to reiterate that the MPC will take a ‘gradual and careful’ approach in terms of future rate reductions, while also repeating that the pace of future rate reductions will remain ‘data-dependent’.

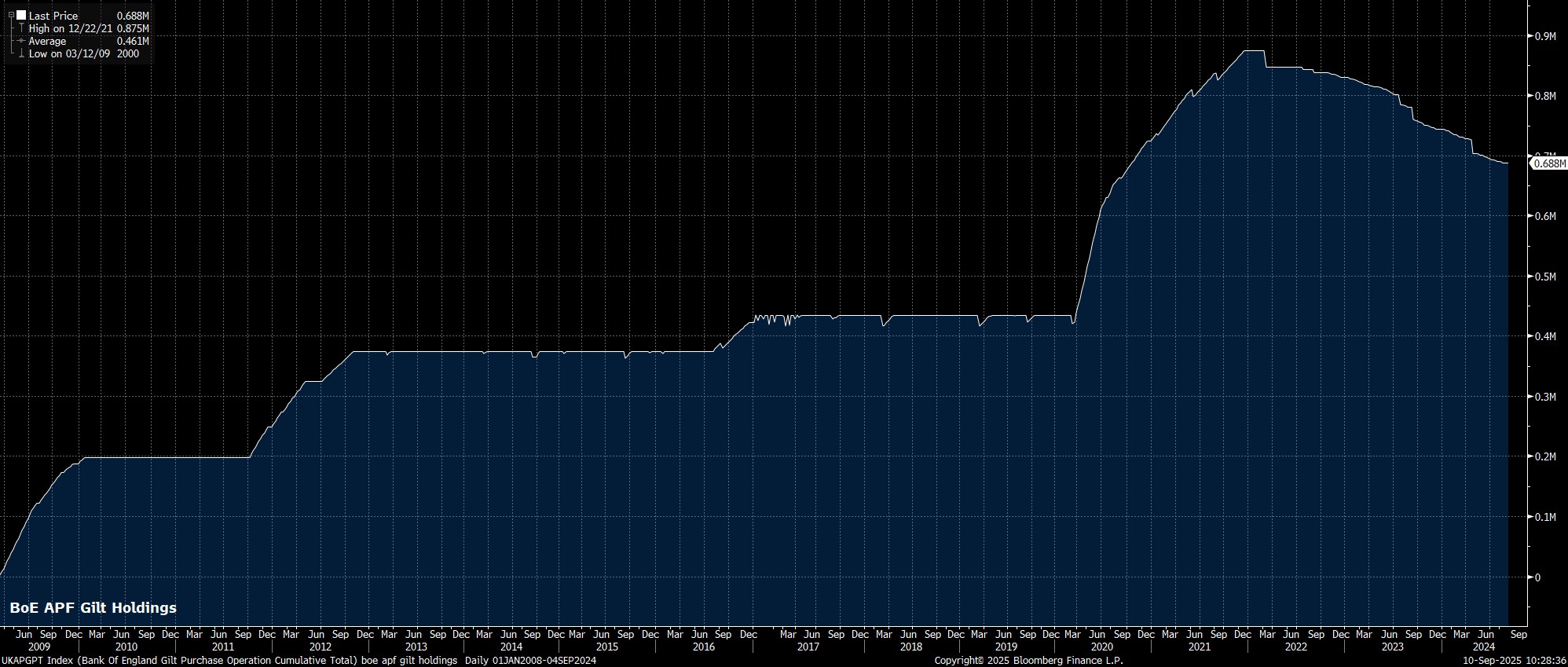

With the rate decision itself, and accompanying policy statement, both relatively predictable, the main area of intrigue around the September MPC decision will be the annual review into the Bank’s balance sheet.

For the last three years, the MPC has been reducing holdings in the Asset Purchase Facility (APF), which now comprises only Gilts, by £100bln per annum, with that pace split between the passive run-off of maturing securities which haven’t been replaced in the portfolio, and active sales of Gilts from within the APF.

While those active sales have proceeded relatively smoothly, at least in terms of their reception by market participants, the Bank’s own research points to the active sale process adding a premium of as much as 25bp onto the 10-year Gilt yield, and likely a higher premium further out the curve. In addition, these active sales also result in the Bank crystallising a loss on its holdings, for which it must be indemnified by HM Treasury, while also prompting a much steeper Gilt curve, compared to DM peers, as active sales take place in a market where demand for long Gilts is already waning significantly.

With all that in mind, and with the tightening impact of quantitative tightening (QT), to at least some extent, offsetting any easing impulse from ongoing Bank Rate reductions, the MPC are likely to trim the overall QT envelope this time out.

Maturing Gilts in the APF would passively reduce the size of the Bank’s holdings by around £50bln in the twelve months from the upcoming review, with the question then coming down to the amount of active sales that the MPC would seek to conduct. Anything greater than the 2024/25 amount of £13bln seems implausible, which likely leaves the overall reduction will land at around £60bln over the next 12 months. Ending active Gilt sales would be a pragmatic option to ensure market stability, though tilting sales increasingly towards shorter maturities to avoid a disorderly rise in long-end yields seems a more plausible choice.

Turning to other matters, with there being no new economic forecasts due this time around, there is also no post-meeting press conference scheduled. That said, Governor Bailey may make some media remarks, though these are likely to be very much in keeping with recent comments, namely that rates remain on a ‘downward path’, but that the MPC should neither cut too quickly, nor too much.

Taking a step back, besides the aforementioned balance sheet developments, the September MPC decision is unlikely to offer especially much by way of fresh information on the outlook for Bank Rate.

Still, by retaining the ‘gradual and careful’ guidance, the MPC will clearly retain an easing bias, and a preference to deliver rate cuts at a predictable, quarterly pace. As such, the next 25bp cut is still likely to come at the November meeting, though the release of the September CPI report, due 22nd October, may threaten such a call, if headline inflation rises north of the MPC’s projected 4% peak.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.