- English

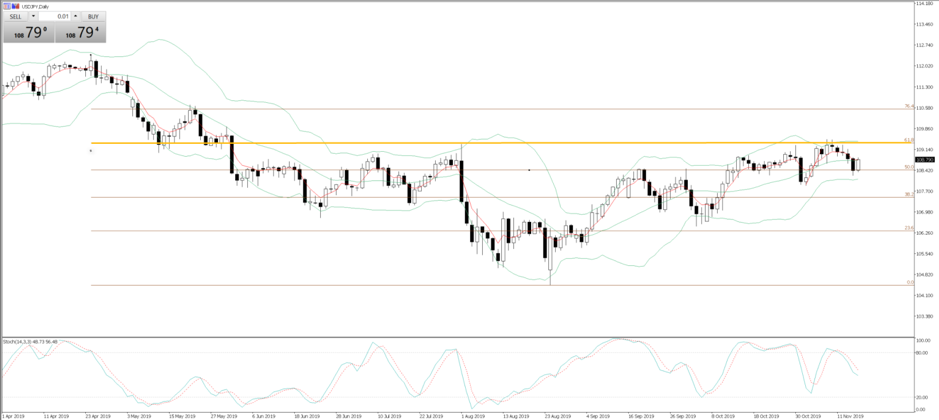

"USDJPY daily chart"

Conviction trade view – Long USDJPY on a daily close through 109.33 for 110.50/111.00.

• Along with USDCNH, USDJPY has the strongest correlation with the US 10-year Treasury yield, which has moved from 1.43% in August to 1.97% (54 basis points) on 7 November. Having retreated a touch into 1.83% (taking USDJPY into 107.50), should we see a closing upside break of 1.94%, I would expect the benchmark Treasury to test 2.12% and potentially 2.2%.

• Given the correlation with USDJPY, a break of 1.94% should, therefore, see USDJPY close through the 61.8 fibo retracement of the April to August sell-off at 109.33, which we can clearly see as strong horizontal resistance. A break of 109.33 takes the pair into 110.50/111.00, although, I am a willing seller into here.

• Consider that one of the big debates in macro-discretionary trading circles at present is how much higher bond yields can go and whether the move higher has been predicated more on a better feel on US-China trade relations or better global economic data. Either way, traders certainly do not want to be long bonds (short USDJPY by proxy) if we hear a positive and tangible outcome in the talks. That would take the 10-year through 1.94% (USDJPY 109.33).

• Of course, the risk of disappointment is elevated, and I, like many are sceptical that we see the September US tariffs (Stage 4) rolled back, let alone the tariffs due to kick in on 15 December. An outcome China has made clear they need to see before they will commit to agreeing to a ‘Phase One’ deal and a sizeable amount of US agricultural products. One suspects Trump will be keen to meet the market, which is a risk if short. That said if short, the idea to square and reverse into long positions on a daily close through 109.33 seems highly prudent.

• Short positioning, held by large speculators (or ‘non-commercials’) in the JPY has increased to 34,997 contracts, showing the big money is moving into short JPY exposures. However, considering this is the 59th percentile of the three-year range, one could consider positioning as quite neutral.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.