- English

A traders’ week ahead playbook: the BoE and Powell take centre stage

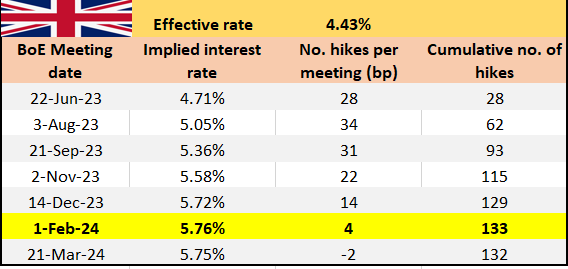

UK swaps pricing – expectations for BoE action

A full preview for the BoE meeting, and how markets may evolve, is here.

In Europe, data is light, but we get 9 ECB speakers with the market firmly of the view they hike on 27 July (the next meeting). EURUSD eyes a push into 1.1000.

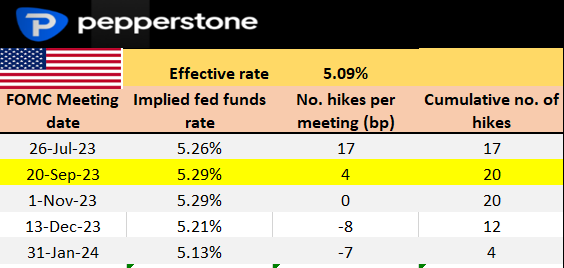

In the US, we have the Juneteenth holiday on Monday and throughout the week we get spluttering of tier 2 data – building permits, housing starts, existing home sales, leading indicators, jobless claims, S&P Global PMIs – the highlight will be the 11 Fed speakers and most notably Chair Powell who testifies to the House and Senate (22/6 and 23/6 respectively). The market sees one more hike from the Fed and then they’re done, seemingly at odds with the central Fed projection for another 50bp this year - whatever the Fed are selling the market aint buying.

US swaps pricing – expectations of Fed action per meeting

Clients are skewed long of USDs and countering the recent USD weakness.

In equity land, the NAS100 has broken to new cycle highs, regaining its fine form, having now rallied 4.1% in the past 5 days – the pain trade remains to the upside. The move in the NAS100 only bettered by the beast that is the JPN225, although if you price the NAS100 and we see the index up 5.4% in the past five days (as is the GER40).

NAS100 weekly – big levels overhead

.png)

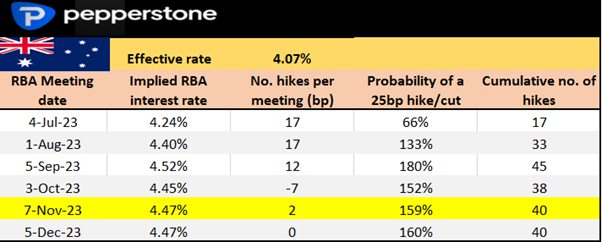

China will play a role in driving the AUD with further easing expected, where the market expects the PBoC to ease the Prime rate (due 20/6 11:15 AEST) – USDCNH has found better sellers of late, which is resonating in a weaker USD across G10 FX, while the HK50 index is working well and crossed the big level 20k – it's been easing city in China in the past 2 weeks and it feels like we’ve hit peak China fear.

In Japan another dovish tilt from the BoJ to reaffirm its ultra-dovish stance, and the JPY remains the no.1 funding currency and weakest play in the FX universe – everyone is short to the hilt now. Pull up a daily chart of ZARJPY, it has gained for 12 straight days and is absolutely ripping.

One consideration though as we look at Japan CPI this coming week is that Japanese Prime Minister Fumio Kishida announced there would be no snap election - in theory, this offers a chance for the Ueda BoJ to attempt a YCC adjustment at the July meeting – it would be a big deal for FX markets if they moved, but it's debatable.

In LATAM the Mex central bank steps up (23/6) and we’ll see if they move further on policy… prior to that, we get CPI and that may influence.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.