Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Your Guide to Nvidia Earnings, US Data Trends, and Key Global Market Risks This Week

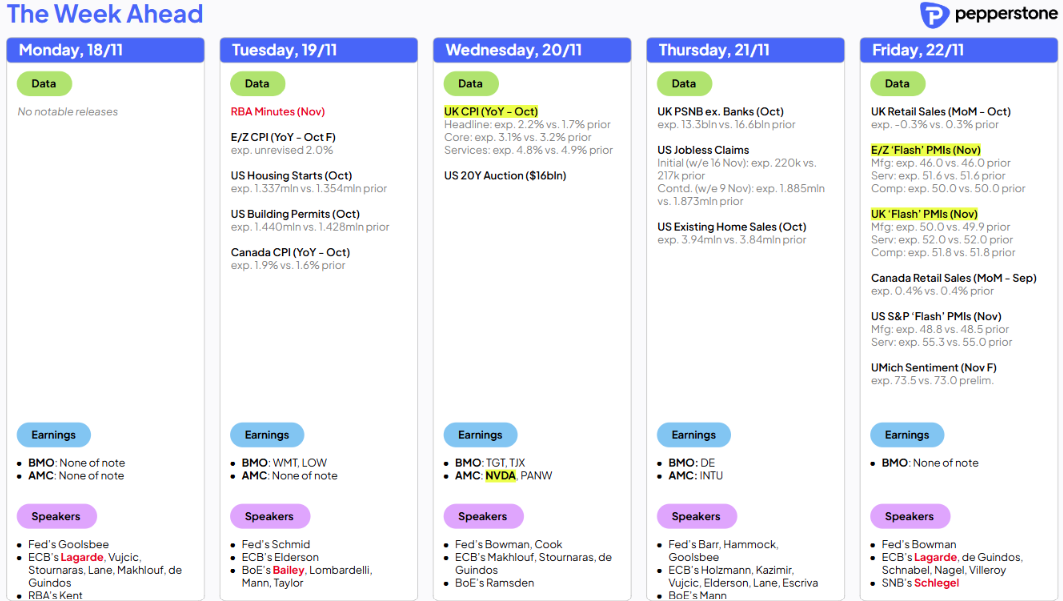

For traders, the lack of marquee event risk due this week might come as a welcome relief and a chance to trade their strategy with fewer concerns that arise when holding positions over the higher impact data points (e.g. nonfarm payrolls).

That said, we could feasibly see a reaction to the US November data/survey releases (i.e. conducted after the US election), which include the NY Fed services index, US S&P Global PMIs, the University of Michigan survey & the Kansas Fed manufacturing survey.

The market may give these releases additional focus, notably after Friday’s release of the NY Empire manufacturing report, which showed an impressive rise of 43 points, driven in part by a sizeable shift higher in new orders. Importantly, the survey was conducted after the US election, suggesting businesses are seeing a positive impact on business conditions and the certainty that comes with a firm election result.

While the NY Empire survey is just one survey and from one region, we now consider if other surveys conducted after the US election, also show strong improvement from the Trump bump.

For Traders, Price Is All That Matters

Fundamentally, we assess whether further impressive US data results in increased US inflation expectations, and reduced interest rate cut expectations which fuels further USD appreciation and large-cap equity drawdown.

Should the improvement seen in the NY manufacturing report be seen in other November data points we look to see how this reconciles into financial markets and how collective votes dynamically – It will be the price action and the technicals that matter most, and there really is no better way to visualise the aggregation of all beliefs and behaviours and how market participants are voting through order flow.

As we lay out below there are markets (such as the USD pairs) that remain in a trending state, and there are markets testing range limits, and others (such as the S&P500 & NAS100) that have reversed off ATHs, and where we see an evolving short-term change in sentiment.

Nvidia is due to make its awaited return to the centre stage

With so much recent attention placed on US election trades and the initial discounting of Trump 2.0, Nvidia comes back firmly into the spotlight, with its Q325 earnings, and its guidance for Q425 (due Wednesday after market) expected to result in sharp moves in the post-market session. Naturally, one would expect any volatility in Nvidia’s share price to influence the global semis space, as well as the broader S&P500 and NAS100.

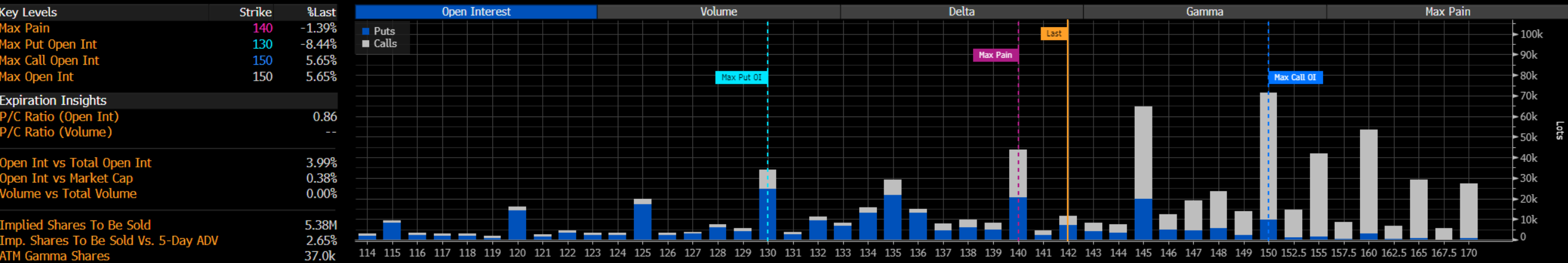

For context, the options market prices an -/+8.8% move in Nvidia’s share price on the day of earnings, in line with the average (absolute) move seen on earnings over the past 8 quarters.

Expectations of a blowout number (relative to consensus expectations) seem low compared to prior reporting quarters and the analyst community feels quietly confident in their ability to model Q325 sales, earnings, and gross margins and investor positioning is also more closely aligned to prior guidance.

That said, options traded over Nvidia expiring 22 November show large open interest and heavy call buying in the $145, $145, and $160 strikes, suggesting that options traders see a greater risk of the share price kicking higher on the earnings release. Guidance from the hyperscaler businesses suggests demand for GPUs is incredibly strong, so one can understand why options traders are positioned for near-term upside.

Global Event Risk for the Radar

Away from the event risk in the US, we get CPI prints in Japan, Canada, the UK, and Europe. PMIs are also due out in Europe, and the UK. In China, we see the PBoC review its Medium-Lending Facility (MLF) and 1 & 5-year Prime Rate, although no changes are expected. Central bankers go hard on getting their voice head this week, with 9 Fed, 24 ECB and 4 BoE speakers due out, although we’re unlikely to hear anything that hasn't already been priced - so the effect on markets may be noise and offer little in the way of signal.

In Japan, Gov Ueda speaks (Monday 12:00 AEDT), while in Australia we hear from Assistant Gov Christopher Kent and Gov Bullock. However, with the rates market comfortable in its pricing for the first cut from the RBA in May 2025, it's unlikely we’ll be shocked at what we hear and the effects on the AUD or ASX200 should be contained. Trading and Directional Views – Markets front of mind

Trading and Directional Views – Markets front of mind

US500 (S&P500) – While the prospect of a seasonal rally into year-end remains a strong possibility, I am turning more cautious here, with momentum shifting to the downside, with the US equity benchmark looking vulnerable for a test of the 50-day MA at 5772 and the November swing low at 5700 (5724 in S&P500 futures). A test and a close through 5700 could accelerate the selling with long positioning further cut back, and flow-based dynamics (optionality and higher volatility) potentially leading the index lower. That said, it’s hard to be short with conviction given the influence of Nvidia, but a heavy tape on Friday suggests the sellers may be getting more of a say.

NAS100 – NAS100 futures fell 3.4% w/w, with downside momentum building on Friday. The November lows of 19,900 defines risk for those holding longs – again, it’s tactically hard to be short with Nvidia’s numbers out on Wednesday, but the set-up on the daily timeframe suggests near-term downside risk. A push higher in the US10yr Treasury above 4.50% would also be a trigger for tactical short NAS100 trades.

HK50 Index – After breaking the recent consolidation range lows of 19,822 the index finds support at the 61.8 fibo of the Sept-Oct rally at 19,355. The buyers need to step up or a downside break of 19,355 could be significant and suggest momentum accounts would build on short positions, with the potential for a re-test of 17k.

GER40 (DAX) – Held the range lows at 19k well, with the buyers clearly defending the big support zone and this could kick higher. However, a break this week of 19k would be technically important and would suggest trading the index from the short side.

USD – With the USD index (DXY) gaining for six of the past seven weeks we’re seeing modestly overbought conditions marry with a progressively well-owned USD long position. What is overbought can stay overbought, and until we see better relative buyers of US Treasuries to its G10 peers and yield differentials tighten, pullbacks in the USD should be well supported.

USDJPY was the weak link on Friday, and the low of 153.86 will be important – longs may use this to define risk, flipping short on a downside break. GBPUSD eyes the UK CPI print (Wednesday) – Further downside is hard to chase, but the trend lower is strong and until price can close above the 5-day EMA I am biased to sell into strength. EURUSD is at risk of consolidating in a 1.0500 to 1.0600 range, while AUDUSD looks towards the USDCNH and HK50 for guidance, where I am looking at initiating new shorts on a break of 0.6440.

Gold – Found buyers last week close to $2532 (the September breakout highs) but the trend is lower and it’s hard to be long until price closes (daily) above the 5-day EMA, which has defined the trend since 6 Nov. Consolidation in the USD could see gold trade $2525 to $2610 range for the week, and I’d be leaning into these levels through the week.

SpotCrude – Price is clearly weak and pushes into big support levels – a break of $66.96 and new YTD lows come into play. Needs to rally early this week or the sellers will go hard on the technical break. There’s not much to like in the fundamentals or technicals at present.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.