- English

Gold Outlook: Price Challenges $4,600, Eyes on U.S. CPI and Retail Sales

.jpg)

Over the past week, gold’s bullish momentum intensified, briefly topping $4,600 on Monday to hit a record high. Rising geopolitical tensions and weak U.S. nonfarm payroll data are the two main drivers behind the rally. At the same time, however, the Bloomberg Commodity Index (BCOM) annual rebalancing serves as a reminder for bulls to stay cautious.

Looking ahead to this week, U.S. December CPI and November retail sales will be key data points. Both could have a notable impact on gold’s short-term trajectory and serve as an important gauge for the next phase of the market.

Technical Observation: Path of Least Resistance is Up, $4,600 Is Key

On the XAUUSD daily chart, bulls have regained control. Last week, gold broke through $4,400 and $4,500, posting a cumulative gain of roughly 4.1%. Momentum extended into Monday, with intraday highs briefly reaching $4,600. The rapid buying suggests the short-term path of least resistance remains upward.

If gold can hold above $4,600, further upside could open up, with the next target around $4,700. Conversely, if it meets resistance at $4,600 and retreats, the December high near $4,550 and the $4,500 level could serve as key support zones, giving bulls a chance to regroup.

Rising Global Turbulence Boosts Safe-Haven Demand

Geopolitical tension remains the core driver of the current gold rally.

Markets are closely watching developments in Venezuela, while Iran continues to experience social unrest amid rising prices and currency depreciation. In Greenland, some political parties have explicitly opposed U.S. proposals, further straining transatlantic relations. The Russia-Ukraine conflict remains unresolved, and multiple U.S. cities have seen large-scale protests. These overlapping geopolitical risks are pushing safe-haven flows toward gold.

Uncertainty surrounding the Fed and U.S. institutional stability is also rising. Powell is reportedly under scrutiny in a criminal investigation concerning Fed building renovations, and the Supreme Court has delayed a ruling on the legality of Trump’s tariffs. Markets are reassessing the Fed’s independence and the broader institutional framework, further amplifying safe-haven demand.

These factors combined are gradually eroding confidence in the established order, which creates fertile ground for gold’s sustained gains.

Amid the trend of “de-dollarization,” central banks’ demand for gold has continued to strengthen. As of December 2025, the People’s Bank of China had increased gold holdings for 14 consecutive months, and the World Gold Council reported that global central bank net purchases reached 219.85 tons in Q3 2025. Ongoing official buying provides solid medium- to long-term support for gold prices.

Structural Weakness in Nonfarm Payrolls Makes Rate Cuts a Matter of Time

Beyond geopolitical risks and institutional uncertainty, weak U.S. employment data in December also supports gold bulls.

Specifically, December nonfarm payrolls increased by only 50,000, well below expectations, with job losses in construction, retail, and manufacturing. Yet the unemployment rate unexpectedly fell to 4.4%.

In my view, this seemingly mixed data is not contradictory; it points to a clear conclusion: the U.S. labor market is not collapsing, but growth momentum is clearly slowing.

This outcome has quickly reduced market bets on a Fed rate cut in January, and March cut probabilities have also fallen to around 30%. However, the structural weakness revealed in the nonfarm data reinforces the case for two potential rate cuts later this year.

It is precisely this ‘delayed but inevitable’ rate-cut environment that plays into gold’s favor. Historically, the mid-to-late phase of a Fed easing cycle—when rates are low but still have room to fall, the economy has not hard-landed, and policy uncertainty is accumulating—has often been the period when gold performs strongly.

Passive Selling Window Opens, Gold Faces Technical Test

While the overall environment remains supportive, a short-term technical headwind warrants attention.

The BCOM annual rebalancing has begun, running from January 8 to January 15, with roughly 20% of the adjustment executed each day. This could result in roughly 2.4 million ounces being mechanically sold over a few trading days, applying short-term technical pressure on gold.

However, this rebalancing window also offers valuable insight. If gold holds—or even rises—despite the mechanical selling, it would signal robust underlying demand rather than gains driven solely by momentum or sentiment.

Conversely, if the market struggles to absorb these flows, short-term positioning could become fragile, increasing the risk of a technical pullback.

Focus on U.S. Inflation and Retail Sales

Overall, against a backdrop of rising geopolitical risks, weakening U.S. employment momentum, and ongoing central bank buying, the bullish case for gold remains solid. Buying on dips remains the dominant strategy.

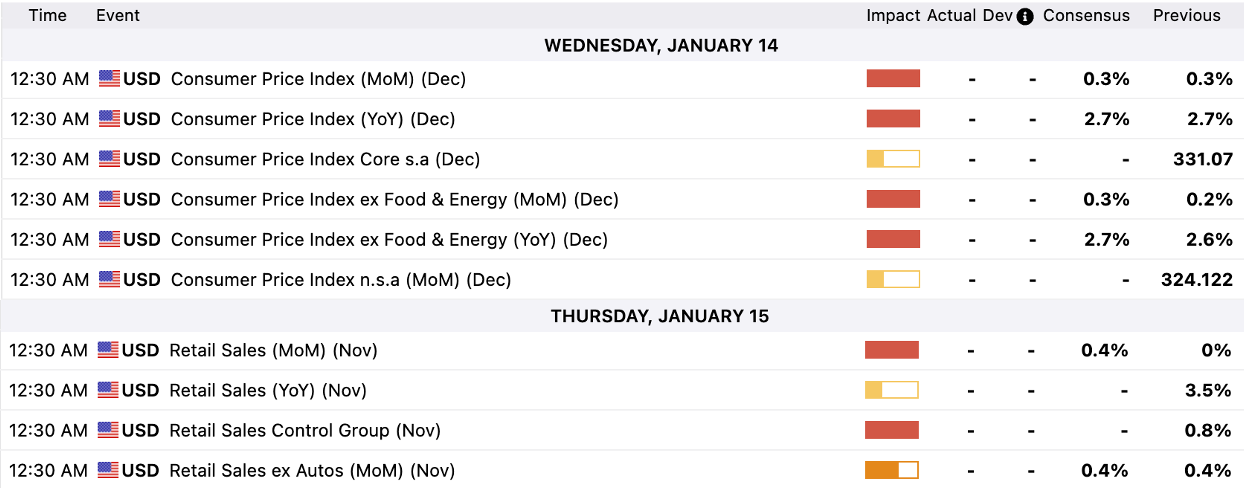

This week, in addition to monitoring geopolitical developments, attention should focus on key U.S. macro data: Wednesday’s December CPI and Thursday’s November retail sales (AEDT).

Markets currently expect December core CPI to rise 0.3% MoM (2.7% YoY), slightly above prior readings, while retail sales are forecast to rebound 0.4% MoM from flat previously.

While these figures alone may not shift Fed policy in January, any significant deviation from expectations could trigger short-term volatility.

If core CPI rises 0.3% MoM or higher and retail sales roughly meet expectations, inflation stickiness concerns may resurface, delaying rate cut discussions, which would likely support the dollar and weigh on gold.

Conversely, if core CPI comes in below 0.2% on monthly basis and retail sales are near zero growth, it would provide a more favorable backdrop for gold to maintain its bullish trend.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.