- English

So, while I write before the RBA meeting, from a fundamental and tactical basis I'm warming to a shift in the bearish trend in the AUD. Let's see if the technicals follow suite.

To start, China eased Reserve Ratio Requirements (RRR) by 50bp which was largely expected, but was perhaps a touch earlier than consensus – a clear message that the Chinese authorities are not hanging about and the actions should result in a positive reversal for China’s credit impulse, which I feel will move markedly higher from here into Q1 2022. Beijing also announced several other easing measures designed to support growth, while we’ve seen media reports that credit is turning, with real estate loan growth increasing Rmb 200b YoY in November.

There's other well-known risks to work through, however it seems that China may have turned a corner, to one where the policy focus is aimed at stabilising and boosting growth. The prospect of a reversal for China ‘proxies’ – such as the AUD – have therefore risen.

Eyes on the Hang Seng

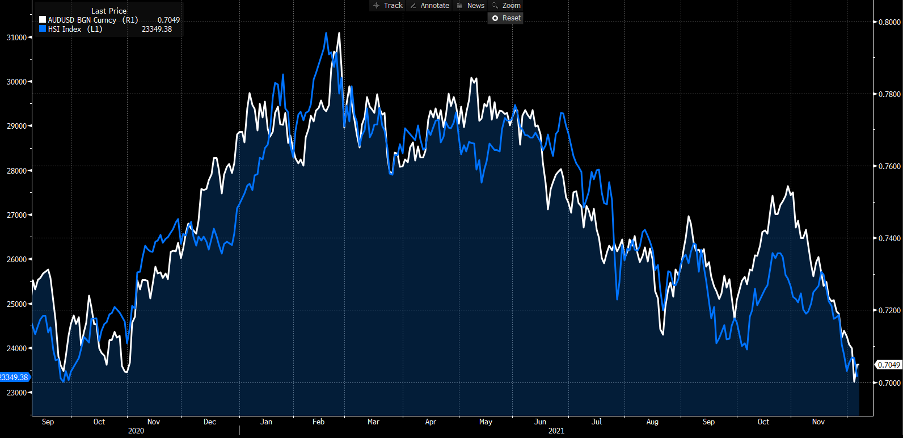

The AUD has held a strong correlation with the Hang Seng (HK50) index since Q3 20 – so with this in mind if the market sees this as a genuine dovish shift from the PBOC and the HK50 rallies into year-end then the AUD shorts should cover. This is of course a big assumption to make and we may well see the AUD diverge from the HK50 as correlations come and go, but if the HK50 has a better tape then the AUD should follow.

AUDUSD vs HK50

(Source: Bloomberg - Past performance is not indicative of future performance.)

Positioning - The market is very short of AUDs – leveraged funds are short 23k futures contracts, while asset managers hold a sizeable 78k short position. The second biggest exposure we’ve seen since records began in 2006. One should never trade on positioning in isolation, but if the trend in some of the AUD's key relationships does start to turn then shorts will be compelled to cover and this could cause a fresh wave higher.

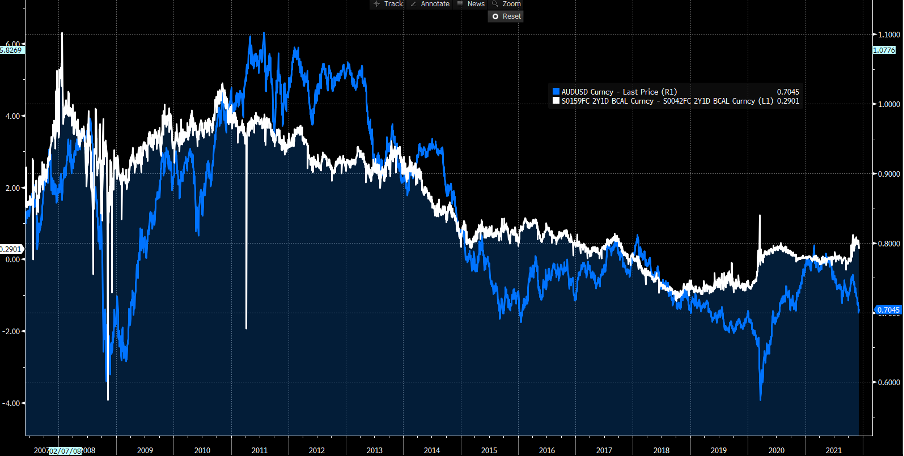

Valuation: The AUD could be considered ‘cheap’ - We can look at various models and see the AUD trading ‘cheap’, and suggesting that in theory the AUD should be higher than current levels.

In the rates market, we see Aussie 2-year swap rates trading at a 29bp premium to US rates.

(Source: Bloomberg - Past performance is not indicative of future performance.)

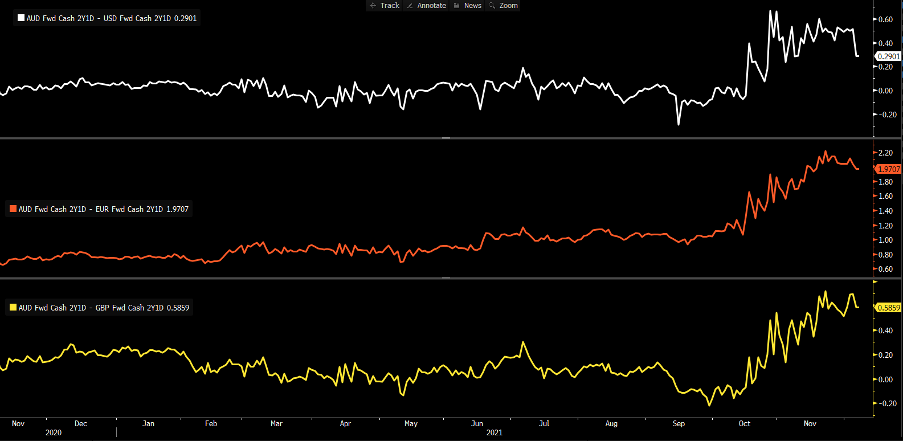

This is even more pronounced when we look at the Aussie 2-year rate expectations vs that priced in the EUR and GBP.

(Source: Bloomberg - Past performance is not indicative of future performance.)

One could argue relative interest rate (expectations) settings and the AUD should mean revert and the AUD play catch up. Of course, the counter view is that the Aussie rates market is priced too aggressively, with seven hikes priced over the next 2 years.

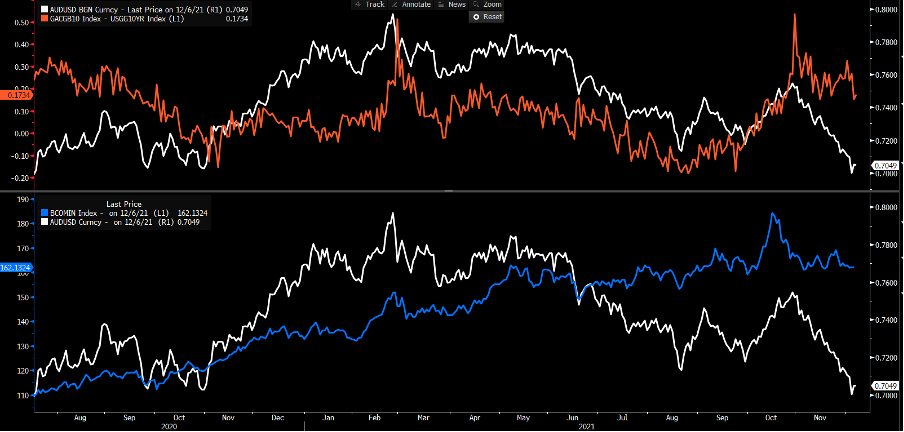

In the bond market, we see Aussie 10-year bonds trading at a 17bp premium to US 10yr Treasury, suggesting the AUD should be trading higher than the current level.

Upper – US-US bond yield differential, lower – AUDUSD vs industrial metals index

(Source: Bloomberg - Past performance is not indicative of future performance.)

Looking at the forward rates markets, we see the AUD has a relatively high level of carry. Carry trades typically perform work well when volatility falls – again, this leads us to sentiment derived from the Omicron variant – if we start to see good news that vaccines do indeed hold up, then equities could stage a solid run into year-end and the AUD will move in alignment, especially vs the CHF and JPY. However, there's obvious risk to this call.

We also see the AUD trading at a sizeable discount to industrial commodities. As I say, correlations come and go, and right now there is very little correlation. But, if commodities start to turn higher given the unfolding dynamics in China then the AUD and industrial metals may see a higher correlation.

Hard to be short USDs ahead of the FOMC

The other consideration is Friday’s US CPI and next week’s FOMC meeting (16 December) – it's hard to be short the USD ahead of these events, as both could prove to be big USD drivers. Perhaps we see AUDUSD fall into 0.6850 to 0.6780 post-US data, but I’d see this as a level where I’d be looking for a serious bullish turn and see the lows confined to here – perhaps the turn has already started.

Long AUDCHF is one way to play diverging policy paths although this is one of the true risk proxies – for AUDCHF to move markedly higher we’ll need to see equities rally into year-end and the VIX index to pullback towards 20%. This may not occur until after the FOMC meeting but given the stated dynamics above it feels that if the technicals do turn then the AUD is going to have a strong rally into year-end and beyond.

So one to watch for a turn, as the moves from China may indeed prove to be a game changer. As always, watch the flow in the technicals and price action, and keep an open mind. Ready to trade the potential opportunity? Trade it with Pepperstone.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.