- English

Trading Week Ahead Playbook — US-China Trade Headlines, US CPI and China Data in Focus

While the futures re-open should be uneventful, we'll look to see if the buyers of risk play their hand and state their dominance, or whether we see broad disagreement in the flows, resulting in increased choppy price action.

Traders remain highly attuned to risk and aware of the potential for elevated volatility around U.S. earnings reports. However, as we enter the new week, there’s a prevailing belief that U.S.–China trade headlines will remain skewed toward a positive outcome. Following last week’s dovish speech from Jay Powell, and with the Federal Reserve now in its blackout period, expectations are high that the Fed will cut rates at both the October and December FOMC meetings.

The week ahead is rich in scheduled event risk, but as always, positioning, flow, and sentiment will dictate the market price action. Cross-asset volatility remains under close watch — where a sustained upside break of 6,766 in S&P 500 futures or 25,179 in NAS100 futures would bring new all-time highs into play.

Gold saw increased volatility last week, with long positions now looking to hold the line above 4,199 to contain further downside. Globally, with strong demand for physical gold amid chaotic scenes to transact in vendors — from both buyers and sellers — the precious metals market looks set for another potentially volatile week.

In FX, the U.S. Dollar Index (DXY) pulled back from 99.50, finding support at the 50-day moving average (98.00). USD bears will be looking for a decisive close below that 98.00 level. With key inflation data due from the U.S., U.K., Japan, Canada, and New Zealand, moves across USD pairs could screen prominently on traders’ radars this week.

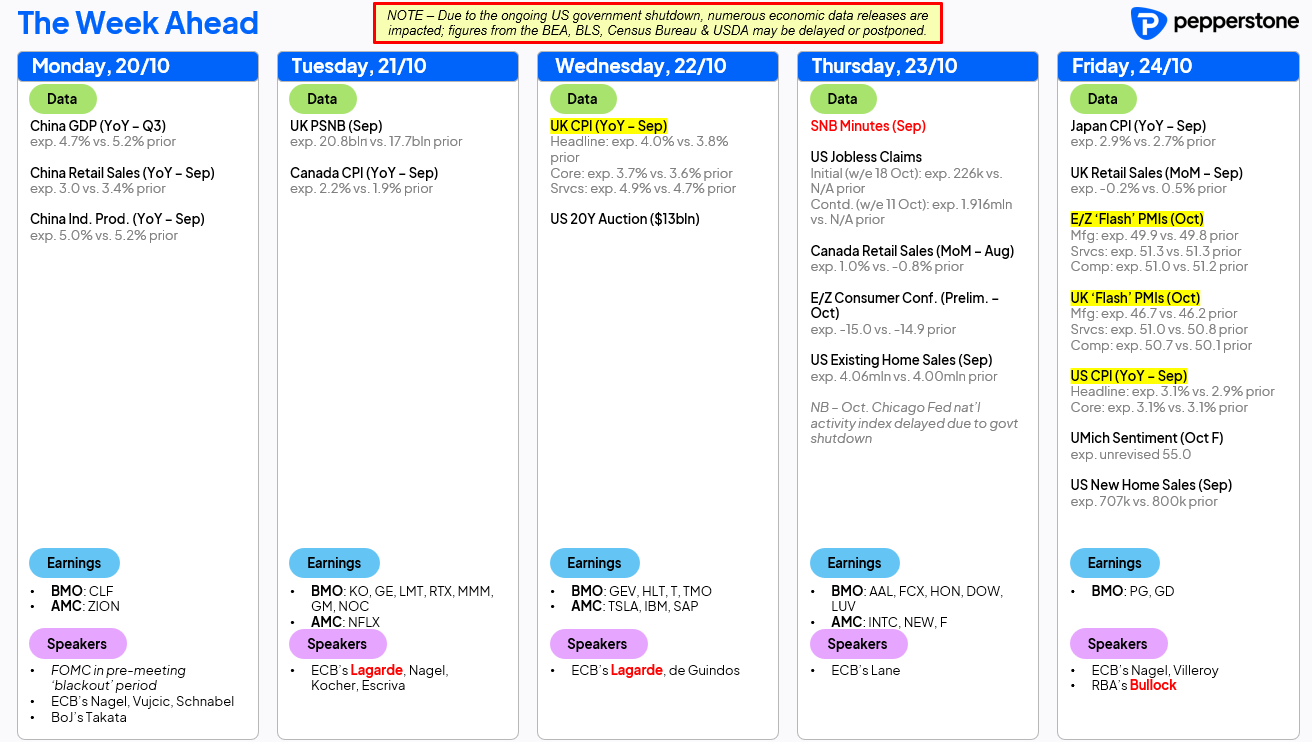

The Key Themes and Risk Events for the Week Ahead

• US–China Trade Relations: Developments here remain the major known unknown. Catalysed by Trump’s remark that high tariffs on China are “not sustainable,” markets appear priced for a positive or at least less-bad outcome. This week’s meeting between Scott Bessent and Chinese Vice Premier He Lifeng could set the tone for constructive dialogue between Trump and Premier Xi Jinping in South Korea on 31 October. The market’s base case now seems to be that China will offer concessions on its rare-earth export controls, paving the way for the U.S. to extend the current 30% “tariff truce” by another 90 days beyond its 10 November deadline. However, one does question whether markets misprice the risk that China may not back down—maintaining its rare-earth export restrictions beyond 1 November—which would see Trump’s 100% additional tariffs on Chinese imports take effect and prompting China to retaliate with 100% tariffs of its own.

• US Government Shutdown: As the shutdown enters its 20th day, the impact on markets so far has been negligible. The absence of key economic data has, if anything, reduced cross-asset volatility. A vote on the Affordable Care Act (ACA) could take place this week; if an agreement is reached, it could reopen the government and have major implications for Trump’s push to deliver US $1 trillion in healthcare-related cuts under the “One Big Beautiful Bill Act.”

• US Q3 Earnings Season: Roughly 15% of the S&P 500’s market capitalization reports earnings this week. Key names include Netflix (Tuesday after-market), Tesla (Wednesday after-market), IBM (Wednesday after-market), Intel (Thursday after-market), and Newmont Corp (Thursday after-market). Guidance will be crucial, and those stocks that have rallied strongly may face harsh treatment if they fail to meet lofty expectations. Traders can position for or trade the post-earnings reaction through Pepperstone’s US 24-hour share CFDs.

• European and UK Corporate Earnings (STOXX 600 and FTSE 100): Earnings momentum ramps up this week across Europe and the UK, with Barclays, Lloyds, NatWest, UniCredit, and SAP (22 October) among the key names to watch. Notably, SAP carries a 13.8% weighting in the German DAX (GER40). With SAP options pricing implying a ±6.3% move on results day, if that materializes, it would translate—all else equal—into an approximate ±0.9% swing in the DAX.

• US CPI (Fri): Despite the ongoing government shutdown, the CPI report will still be released this week and stands as the marquee scheduled data event. Consensus expects core CPI to rise 0.3% MoM, keeping the annual rate steady at 3.1%. With US interest-rate swaps fully pricing a 25 bp cut at both the October and December FOMC meetings—and the Fed now in a blackout period—only a materially hotter CPI print would challenge market pricing given the already-elevated expectations for rate cuts.

• Global Inflation Data: Beyond the U.S., we’ll also see CPI figures from the UK, New Zealand, Canada, and Japan this week. Each has potential to influence local interest-rate expectations and, by extension, their respective FX markets.

• US Preliminary S&P Global PMIs (Fri): In the absence of Tier-1 official data—and with U.S. GDP tracking near 3%—the S&P PMIs may prove more market-moving than usual. Eurozone PMIs (also Friday) could shift the EUR and modestly influence sentiment toward European equities.

• China’s Fourth Plenum (20–23 Oct): Top Chinese policymakers convene to discuss the Five-Year Plan. The focus will be on boosting domestic demand and advancing structural reforms, though expectations for major market-moving headlines remain low.

• China Monthly Economic Activity Data: In the session ahead, China releases new and used home prices, Q3 GDP (consensus 4.7% YoY), retail sales, and industrial production. The PBoC will also announce its 1-year and 5-year Loan Prime Rates, with consensus expecting both to remain unchanged at 3.0% and 3.5%, respectively.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.