- English

The Japanification of the US - the truly bullish case for gold

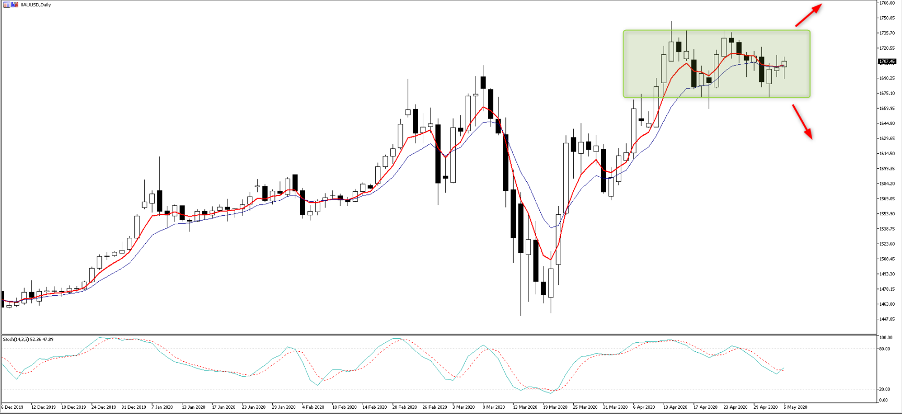

However, with gold trading a range of 1738 to 1678 since mid-April, and the investment backdrop at a very interesting juncture, I thought I would look at this more closely as I feel client interest will ramp up on a closing break of 1738 – where the probability of a continuation of the bullish trend seen between 20 March to 14 April would be fully in play.

Of course, a downside break of 1678 also needs to be respected, and could signal the yellow metal is headed to the 38.2% fibo of the March to April rally at 1638. However, the 5-day EMA is just about turning higher, and instinct tells me if it is going to break, it will be higher, so its good to be prepared.

Options markets not giving away much

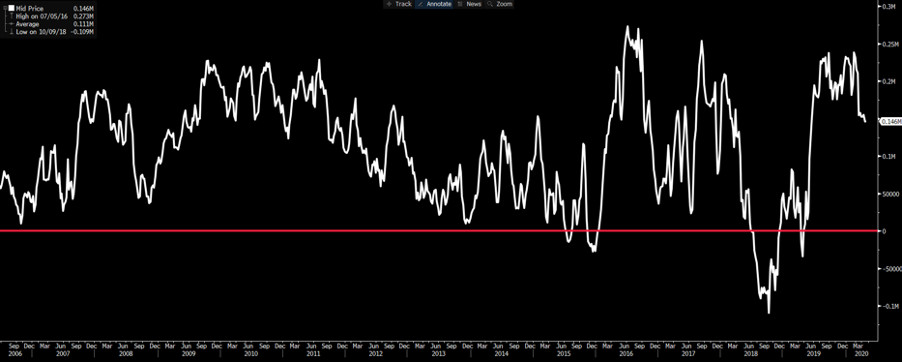

Before I head to the fundamental drivers, I do like to look at sentiment and positioning before any anticipated move. It is a genuine positive to see a clean structure, where positioning and capital is not stretched to form a solid and far better-quality platform for the move.

As we see from the weekly CFTC CoT report, and focusing on managed money (futures), the market is long of gold futures, but the net position of 146,000 contract is just 0.5 standard deviations above the long-term average. I would be far more concerned about longs if they were above 250,000 contracts.

(Source: Bloomberg)

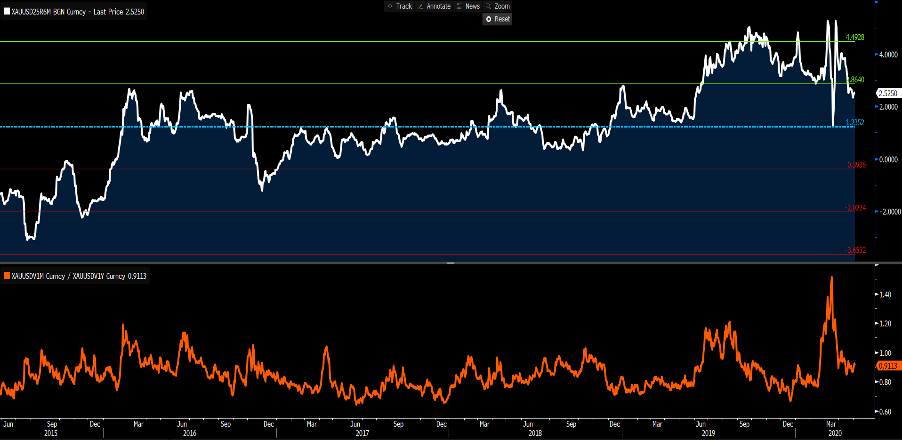

In the options world, we see that gold 1-month implied volatility (vols) has come down from the 19 March highs of 45% and currently resides at 19% - the 31st percentile of the 12-month range. Of course, vols in all markets have come down thanks to the central bank liquidity operations – but importantly, gold 1-month vols are still elevated relative to the last few years and still imply daily moves of 1.2% - compelling enough for short-term traders.

Risk reversals are not giving away much either, with the premium currently paid for 25-delta 1-month call volatility sitting at a 1.06 vols over puts. Head out to six-month implied vols, and we see 25-delta calls trading 2.52 vols over puts (top pane). This is just under one standard deviation above the 5-year average (at 3.86 vols) and if options traders were truly bullish through this timeframe, call volatility would be trading at least 4 vols above puts. That is generally the level I look to reduce gold exposures as it represents the euphoric stage of a bull run.

(Top pane – 6-month calls vol – put vol, lower pane – 1-month vol – 1-year vol)

(Source: Bloomberg)

Staying in the options world, we can also see (in the lower pane in the chart above) 1-month gold implied volatility minus 1-year implied vol, sitting at 0.91. As the chart portrays, we see short-term vol subdued relative to long-term vol, and if traders were looking for a near-term explosive move then it would be moving higher like we saw in mid-March – again, this reeks of a sanguine short-term backdrop for gold to work in.

The bottom line is if gold is going to break and close through 1738, then positioning and sentiment is in no way euphoric, and actually held in quite a neutral stance – giving gold real room, as and when it does move.

The incredible funding task of the US government

Options traders may feel the prospect of a near-term impulsive or powerful move is slim, but the medium- to longer-term prospects look truly bullish. When you see headlines that the US Treasury Department will borrow $2.999t this quarter (Q2), and $677b in Q3 to fund the recent US fiscal measures you have to question how gold will fare in this backdrop. This is just such a staggering amount to raise from the bond market, and for context is some six times the previous record we saw in 2008.

Gold traders aren’t too concerned with exactly how Steven Mnuchin and the US Treasury (UST) Department finance this debt – whether it’s through the issuance of bills, FRN (Floating Rate Notes) or US Treasuries. What they care about is how easily this level of debt is absorbed by the private sector or foreign governments and ultimately if it causes gyrations in the bond market.

In the last couple of years, gold has traded as a zero-coupon bond and therefore does not respond well when we see higher nominal or real (inflation-adjusted) bond yields. Gold is a yield-less asset, so, when the relative ‘real’ returns become more compelling in other ‘risk free’ markets, gold finds sellers and vice versa.

However, with Congress likely to push for further fiscal stimulus, taking the fiscal deficit in excess of $4t this year, the need to attract financiers becomes ever greater and problematic. In theory, when it comes to bond issuance to fund the deficit, the UST Department will always find buyers as Primary Dealers are mandated to buy whatever is not taken up by the private sector (pension and insurance funds for example) and foreign governments – but having a high percentage take-up by Primary Dealers would concern.

In theory, bond yields should rise given the massive funding task of the US government, but that depends on whether we see inflation or deflation, and, of course, the level of bond purchases from the Fed to keep yields anchored. Yield curve control would be one answer to keeping yields suppressed (think BoJ).

We should also consider that the blow out in the deficit is not to invest in growth initiatives that would create higher nominal GDP. Whether we’re looking at the Family First program, the CARES Act or the Pay Protection Act, these policies are to stave off a deep-rooted depression - to put food on people’s plates and a roof over their heads. They will not create increased productivity, investment or even close the output gap. Government debt-to-GDP is going to be closer to 130% this year and that puts the US on a similar trajectory as Japan.

It all suggests the Fed will need to do more and bond yields will stay low, if not head to zero, with ever-flatter yield curves. We’re already seeing the debate as to the merits of the Fed adopting negative fed funds rate, although this would require a legal change to the Federal Reserve Act.

Inflation or deflation?

This is a core debate right now, where one camp is seeing a massive change in the velocity of money, with M1 and M2 money supply skyrocketing to levels not seen for decades. The idea is that when the demand side of the economy eventually turns, we could see inflationary pressures kick in. The other side believes low wages, higher savings rates, and subsequent low demand will see prices ease, and deflation will hit the economies. I favour this camp

The question is, which environment does gold work better in. One could argue that with the Fed keeping nominal yields low amid higher inflation, that lower real yields would be good for gold. But then again, I could also argue that higher ‘real’ yields driven by deflation, amid an inability for the yield curve to trade below zero should also be good for gold. As it just means the Fed’s balance sheet will expand towards $9t over time and there will be mounting political pressure, not just to add more fiscal stimulus, but perhaps do something even more radical from monetary policy – potentially involving changes to the Fed Act.

The bottom line

If we look at the immediate price action, options vol structure or positioning, it seems that gold may be missing a near-term catalyst. But the headlines that the UST are set to borrow incredible sums to pay for the humanitarian and popular programs, that won’t spur growth, has just re-enforced what the gold bulls have said all along - Gold is a hedge against a blow out in the fiscal deficit, it is a hedge against central bank experiments and fiat currency debasement and in for 2020 perhaps a hedge against a re-focus on the global pool of negative-yielding bonds. However, if we head into 2021 and beyond, perhaps one day it will be a hedge against inflation, but it will not be good inflation.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.