- لغة عربية

- English

- 简体中文

- 繁体中文

- ไทย

- Español

- Tiếng Việt

- Português

I spend a lot of time mulling over and trying to determine what the single most important theme driving markets may be, and what the best way of visualising said theme is.

Right now, and as it has been for much of the last couple of years, it is inflation that remains the primary factor upon which most investors remain squarely focused; this is particularly important given that it will be confidence of inflation returning to 2% that permits central banks to begin policy normalisation, in turn making the backdrop for risk even more supportive than it is at present.

While disinflation continues, the process has become somewhat bumpier over the last quarter or two, raising concern that the ‘last mile’ of the journey to restoring price stability may indeed prove to be the most difficult.

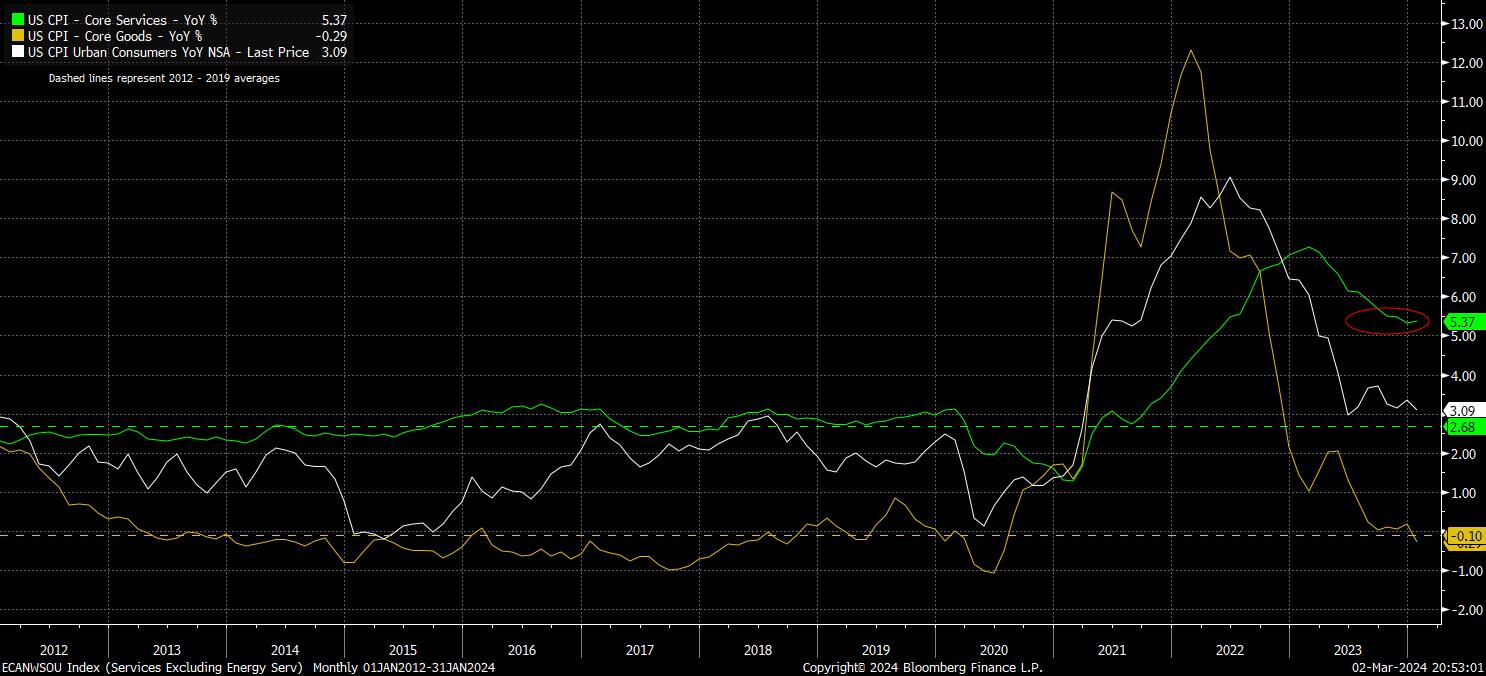

For instance, in the US, headline CPI has remained above 3% YoY since last June, with disinflationary progress having stalled as a result of sticky price pressures in the services sector, with goods disinflation having continued at a quickening pace.

Putting recent YoY core goods and services inflation rates into context with their respective pre-pandemic averages may shed some further light on the issue here.

On the one hand, core goods inflation has fallen below the 2012-2019 average, with disinflationary trends seemingly well-embedded at this stage, particularly if one takes a glance at the continued downward trends seen in both headline and core PPI. On the other hand, core services inflation looks to have settled well above 5% YoY, around double the rate averaged in the pre-pandemic ‘old normal’.

Services prices are likely continuing to be underpinned by the incredibly tight labour market, with headline payrolls growth having shown little sign of slowing in recent months, resulting in average hourly earnings rising at their fastest pace in almost two years in January, in turn pushing annual real earnings growth to 1.4% YoY, just shy of the cycle high seen in mid-2023.

Clearly, policymakers will be paying close attention to price pressures in the services side of the economy over coming months, as the FOMC continue to be guided by incoming data when assessing the appropriate timing for the first rate cut. Markets currently price the first 25bp cut for June, which remains my base case, though naturally this timing would likely be pushed back further into the summer upon receipt of one, or both of, another strong labour market report (Feb figures due 8th March), or another hotter than expected CPI figure (due 12th March).

For now, the debate in terms of market pricing will likely remain one of when the easing cycle begins, rather than how much easing is delivered this year, particularly with the OIS curve now priced as near as makes no difference in line with the FOMC’s median dot for the year ahead. Hence, with the base case assuming that both inflation and rates will continue to move lower in the months ahead, the policy picture should remain supportive for risk over the medium-term, with the path of least resistance continuing to point to the upside for equities.

Nevertheless, this is not a view without its risks, all of which could pose a stiff headwind to risk if they were to prevail, including:

- Services inflation fails to roll over, as the labour market remains tight, with job creation continuing apace, unemployment close to cycle lows, and upward earnings pressures intense. In other words, rather than a ‘soft landing’, the US economy has ‘no landing’, with the economic cycle therefore continuing. No landing would likely be accompanied by no, or significantly fewer, Fed cuts

- Services inflation does roll over, but does so at a sluggish pace, leading to headline CPI settling in a 2% - 3% band, with the 2% target acting as a floor, rather than the ceiling that it proved pre-pandemic. While this disinflation would likely see rate cuts being delivered, in order to prevent a mechanical tightening of policy via a higher real fed funds rate, said easing cycle would be much shorter and shallower easing cycle than the prolonged move back to neutral markets currently price

- Goods disinflation ceases, with price pressures in this side of the economy re-emerging, perhaps as a result of continued geopolitical tensions, particularly in the Middle East, a rise in commodity prices, or some other catalyst. A resurgence in goods inflation, coupled with elevated services price pressures, would obviously exert upward pressure on the overall headline inflation rate, in turn also likely leading markets to price a shallower easing cycle, much more akin to that seen in the late-90s

Related articles

لا تُمثل Pepperstone أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. البيانات، سواء كانت من جهة ثالثة أو غيرها، لا يجب اعتبارها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لعرض لشراء أو بيع أي أمان، منتج مالي أو صك؛ أو المشاركة في أي استراتيجية تداول معينة. لا تأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار الخاصة بهم. ننصح أي قارئ لهذا المحتوى بطلب نصيحته الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو إعادة توزيع هذه المعلومات.