June 2024 ECB Preview: A Cut, But What Next?

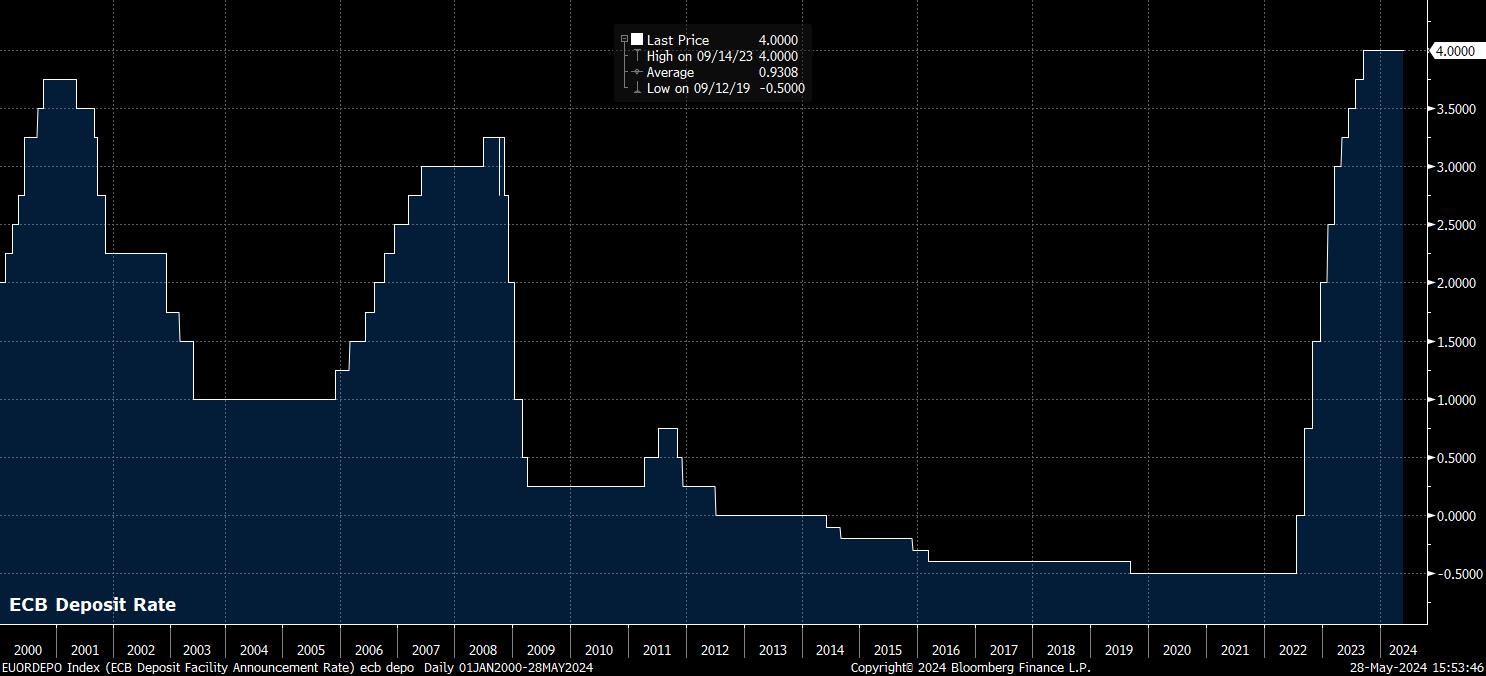

As noted, the ECB are near-certain to deliver a 25bp cut at the June policy meeting, the first rate move since last September, and the first rate cut since the middle of 2019.

Not only do markets, effectively, fully price such a move, but a cut has also been signposted for some time now. As far back as the March meeting, President Lagarde was noting that policymakers would know “a lot more” by the time of the first meeting of the summer, leaving the door ajar to a cut at the June confab.

Since then, guidance towards such a move has only increased in both frequency, and concreteness. Almost all GC members, in recent appearances, appear to favour such a move, even typically hawkish policymakers such as the Austrian central bank Governor Robert Holzmann. Chief Economist Lane, seen by most as the ‘brains’ behind ECB policy shifts, also made the case for a June cut in a recent FT interview, noting that “at this point in time there is enough in what we see to remove the top level of restriction”. In other words, Lagarde & Co. are ready for a June cut.

Of course, with such a move fully expected, and already discounted by financial markets, attention naturally turns to what may come next.

On this front, policymakers appear to have two choices as to how they wish to frame such a cut.

One school of thought suggests that policymakers could frame a June cut simply as a reversal of the 25bp hike last September, which some saw as a ‘safety net’ to ensure that disinflation embedded itself at the tail end of last summer. Such a framing would diminish expectations of the ECB embarking on a prolonged easing cycle, representing a more hawkish path than most have currently pencilled in.

More likely, however, is that the ECB signal a June cut as indeed being the beginning of a more deliberate process of policy normalisation. While any concrete guidance as to the timing of future rate cuts is likely to be thin on the ground, with data-dependence remaining the policy mantra, the policy statement should allude to further reductions in the level of policy restriction, so long as “confidence” that inflation is returning to target in a “sustained manner” persists.

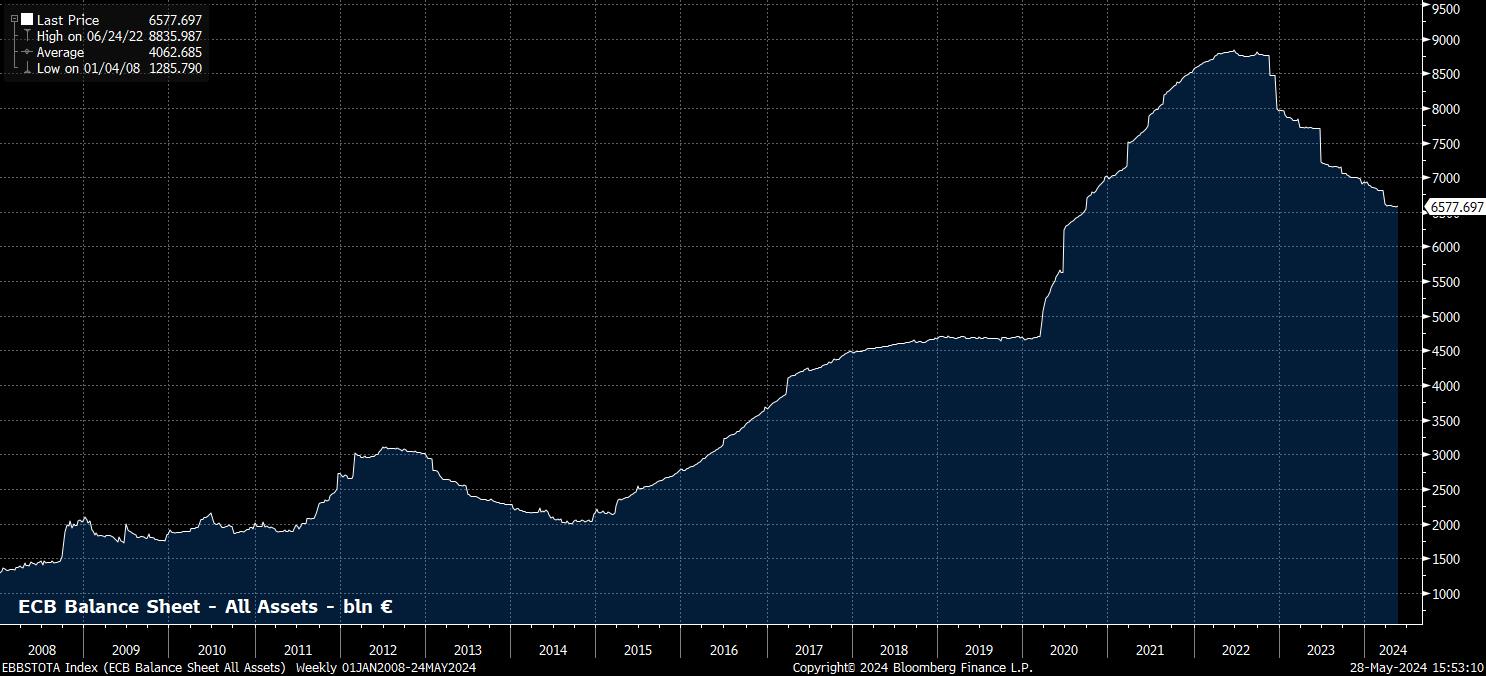

Naturally, policymakers are unlikely to pre-commit to a specific rate path, instead preferring a more ambiguous and agile approach, allowing increased flexibility to react to incoming data. Despite that, the base case remains that the ECB will proceed with further cuts beyond summer, likely at a quarterly pace (i.e., in September & December), seeing a total of 75bp worth of cuts delivered this year. Risks, however, are skewed to a more hawkish outturn at this juncture. In any case, balance sheet reduction should continue in line with the plans previously outlined, with PEPP reinvestments still set to conclude at the end of the year.

The aforementioned hawkish risks to the rate path owe principally to two factors – an apparent stalling in the pace of disinflation, and diminishing downside growth risks. Handily, the ECB will provide their latest round of staff macroeconomic projections to accompany the June decision.

On inflation, there are likely to be few changes to the HICP path outlined during the last forecast round in March, with price pressures having evolved broadly in line with the prior projections, and with the condition assumptions underpinning this forecast round unlikely to differ significantly from the last. Hence, the projections are again likely to point to the 2% HICP target being achieved in 2025, followed by a modest undershoot the following year, implying markets continuing to price too hawkish a rate path.

Of course, it’s important to note that the May ‘flash’ HICP figures are due on Friday 31st, though are highly unlikely to alter the policy path, and will come well after the cut-off for the latest forecasts. Some upside forecast risk does, however, present itself, by virtue of stubbornly high services prices, as goods disinflation slows.

Meanwhile, on growth, the latest forecasts may paint something of a more upbeat picture, at least in the short-term, compared to those issued three months ago.

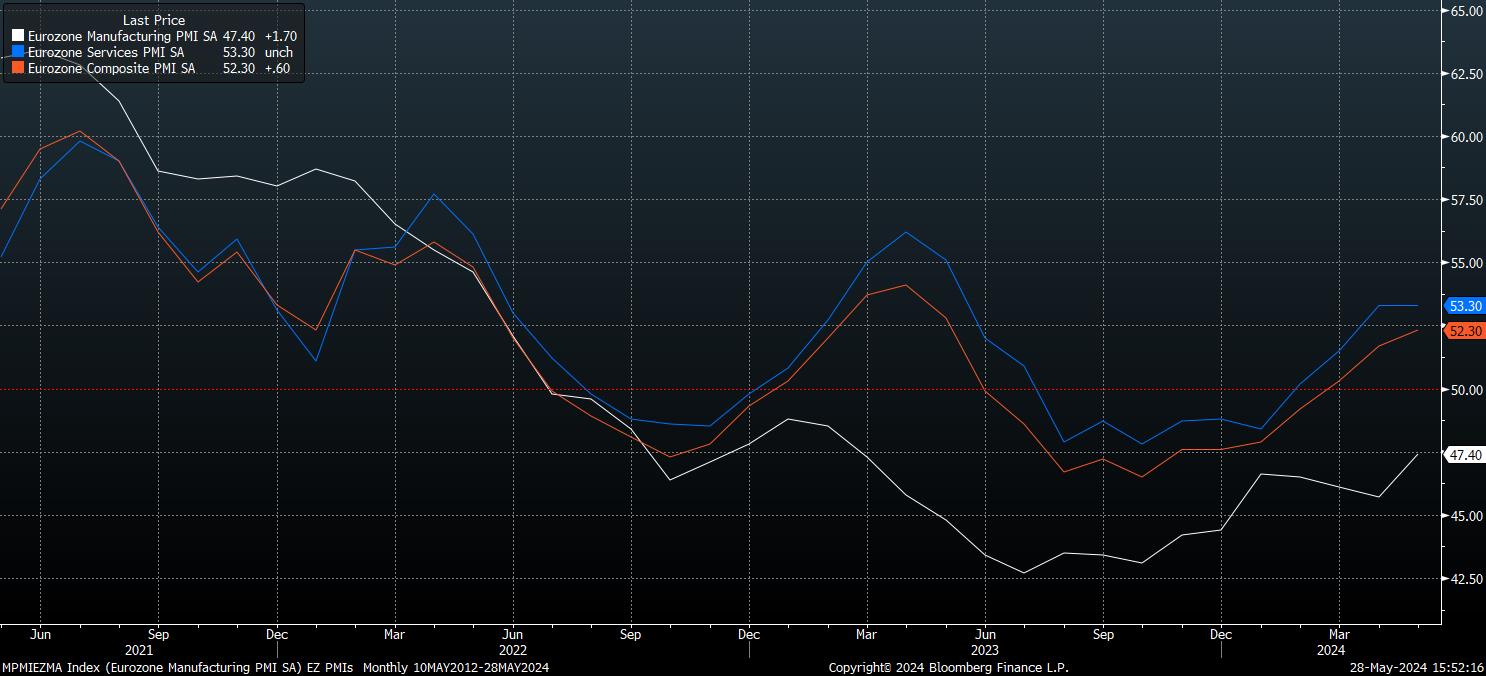

Since the March meeting, downside risks facing the eurozone economy appear to have diminished slightly. Not only has the macroeconomic impact of the present Middle East geopolitical situation remained relatively limited, tentative signs of recovery continue to emerge in China, removing a further potential headwind to eurozone growth. Furthermore, the bloc has continued to show signs of recovery, with the composite PMI having risen to a 1-year high 52.3, per the ‘flash’ May reading, driven primarily by a pick-up in output in the beleaguered manufacturing sector.

All told, this is likely to result in a relatively modest uplift to the current 2024 real GDP growth forecast of 0.6% YoY. However, with the 2025 and 2026 projections already relatively punchy, at 1.5% and 1.6% respectively, revisions further out in the forecast horizon seem unlikely.

Projections aside, the other main item of interest will be President Lagarde’s post-meeting press conference. In keeping with the statement, Lagarde is unlikely to give too much away, with pre-commitment to future policy shifts unlikely. A repeat of the prior three months, in which the timing of future rate moves was clearly signposted, seems unlikely, though the direction of travel for rates – namely, that further cuts are on the horizon – should be clearly communicated.

Once more, Lagarde seems likely to lean on the three factors outlined in the April policy statement – the GC’s assessment of the inflation outlook, underlying inflation dynamics, and the strength of policy transmission – as the key determinants behind when the second cut of the cycle will be delivered. While the door will not be entirely closed on the idea of another 25bp cut coming before the summer break, back-to-back moves appear relatively unlikely at this stage.

In terms of the likely market reaction to the June ECB decision, risks to the EUR appear tilted to the downside.

Of late, EUR OIS has repriced rather significantly in a hawkish direction, now pricing just 60bp of cuts, in total, by year-end, compared to the 75bp discounted prior to the April ECB decision. In other words, money markets now imply just a two-thirds chance of the ECB delivering three cuts this year, compared to the certainty that such a policy path was viewed as around six weeks ago.

Obviously, this leaves a relatively large amount of room for pricing to retrace, particularly with it being relatively unlikely for President Lagarde to endorse such a hawkish path, with any explicit guidance – were it to be provided – likely to lean dovish. Consequently, EUR bears may well wrestle control of proceedings, though the common currency seems likely to remain contained in a tight $1.08 - $1.09 range for the time being.

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。

_Daily_29_2024-05-28_15-51-57.jpg)