What does the VWRL ETF invest in?

The VWRL ETF stands for the FTSE all-world Exchange Traded Fund (*ETF). It is an investment fund that acquires securities with the intention of tracking the performance of the FTSE All-world Index.

*An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, commodities or, in this case, an index. An ETF is traded like shares on a stock exchange. It is a pooled investment fund. Trading CFD ETFs through Pepperstone is a derivative of the underlying product.

The Objective

The VWRL fund seeks to provide long-term growth of capital by tracking the performance of the index, a market- capitalization weighted index of common stocks of large to mid-cap companies in developed and emerging countries.

Weighted investments

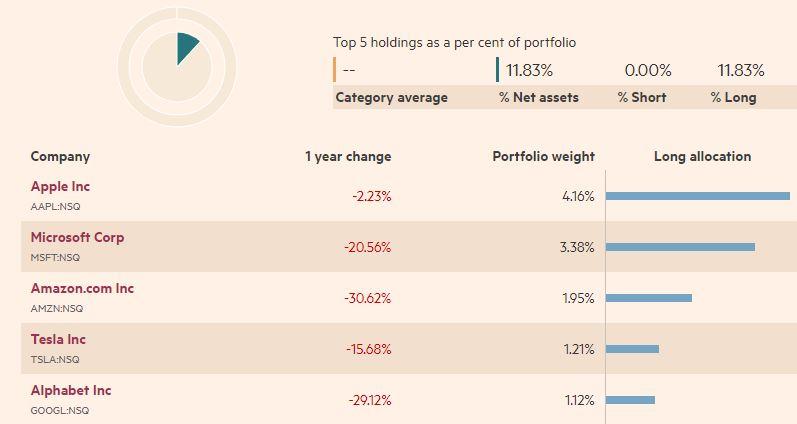

The top 5 holdings within the fund make up 11.83% of overall investments with over a 4% allocation in Apple Inc.

Figure 1 marekts.ft.com 10/10/2022

Invested Sectors

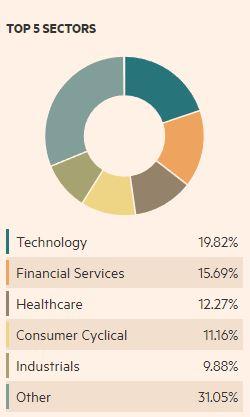

It is plain to see from the single stock allocation that the VWRL is weighted towards the technology sector.

Figure 2 marekts.ft.com 10/10/2022

A look from a technical perspective

Historic price

Since its inception in May 2012, the VWRL ETF witnessed an increase of nearly 200% (from a 31.18 low to a 93.36 high).

Figure 3 TradingView VWRL rally

Although we have seen a correction the downside, we are still holding within a bullish channel formation with trend line support located at 68.50.

Figure 4 TradingView bullish channel

A look from a technical analysis perspective.

VWRL Weekly Chart

The weekly chart offers two possible bullish technical formations for the ETF:

- We look to be holding within an Expanding Wedge formation (dashed black lines). This pattern has an eventual bias to break to the upside.

- The last rally stalled close to the 78.6% Fibonacci level of 90.07 (from 93.36 to 77.90)

Figure 5 TradingView Expanding Wedge and 78.6%

If 77.90 holds (the swing low from the week 13th of June), we could see an extension to the upside to complete a Cypher pattern known as a bearish Butterfly formation.

Figure 6 TradingView possible Butterfly pattern

To learn more about technical analysis, please click here.

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。