Understanding supply and demand is key to becoming a successful and profitable forex trader. Learn the basics about fx supply and demand, identifying their zones in the charts and how to use them for a good forex trading strategy.

What is supply and demand in forex trading?

Supply and demand are the principal factors that affect the pricing of foreign currencies, as well as all other markets. Supply is the amount of any one asset that is available or in circulation (for example, the US dollar) while demand is the general desire for that asset.

Together, these two things – supply and demand – will determine how much a currency is worth.

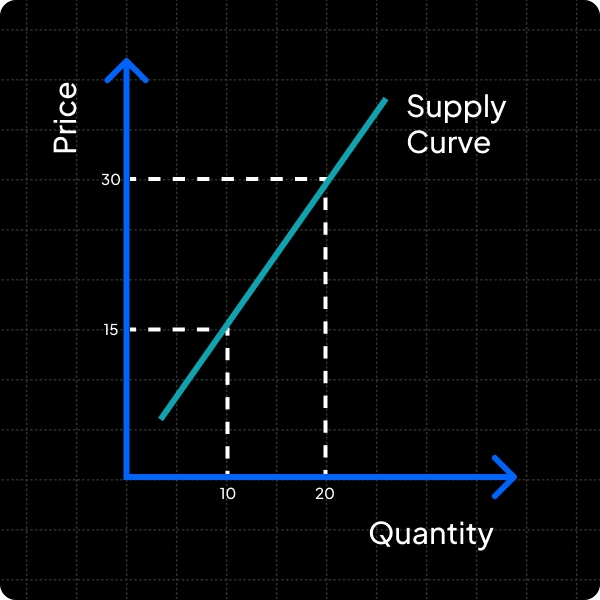

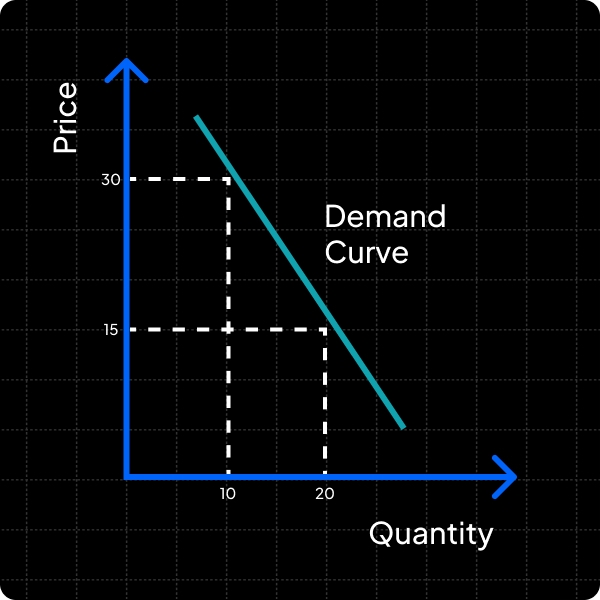

This is because of two pertinent economic terms called the law of supply and the law of demand. The law of demand dictates that the price of an asset will rise if the demand for that item goes up. The law of supply dictates that, if the amount of something goes up (without demand also going up), then the price of it will decrease. For the forex space, this could mean more of a certain currency on sale in the forex market, or more of that currency in circulation as issued by the central bank. However, if there is a scarcity and the demand is higher than the current amount of a currency on offer in the forex space or in circulation, then its price will increase.

The laws of supply and demand affect how every market behaves in the financial world, so understanding them is vital for trading success. And understanding how supply and demand affects assets’ rises and falls will significantly increase your chances of predicting market moves correctly.

How does supply and demand affect forex markets?

The principles of supply and demand are very much present in trading. In forex trading:

The amount of sellers = the supply

The amount of buyers = the demand

In forex, both will be affected by events happening in the general market, as these will either increase or decrease the number of people interested in buying/selling at a certain price. If an item of good news breaks on a certain country, for example, this will attract more buyers of this currency in the forex market. There may not be enough seeking to sell, thanks to all the demand, so buyers will have to offer at a premium. The same would be true if a significant bout of negative news broke and everyone wanted to sell – there might not be enough wanting to lift the offer hence price would fall further.

So, as a general rule of thumb, a wealth of traders looking to buy/go long on a currency will drive its price up, while a lot of sellers wishing to short or offload their positions on a certain currency will bring its price down.

Another major thing that affects forex markets’ value is the supply and demand factors that go into the US dollar itself, as almost all of the forex trades in the world (even those without the USD as half of the currency pair) are processed using US dollars in their transactions.

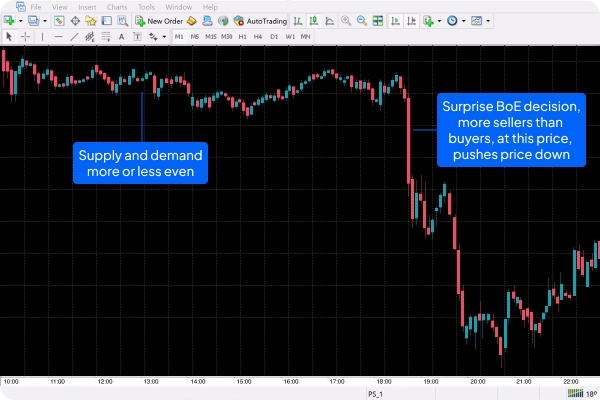

A supply and demand example

Let’s look at a hypothetical example to relate this to forex. Say that the Bank of England is due to make an interest rates decision. This fuels a lot of interest in the GBP/USD pair. Markets are largely happy with the decision, and buyers flock to go long on the GBP/USD, which results in a lot of demand. Because demand has increased significantly, the price of the pair rises.

Attracted by the price, sellers flock to offer cable. However, after a time, this means that the GBP/USD becomes overpriced in some people’s opinions. Buyers’ interest (demand) wanes, meaning that those who want to sell the pair (suppliers) have to do so at a discount. Because there isn’t such a high demand anymore, sellers’ prices automatically lower to attract more interest. In other words, there’s more supply than there is demand and so the GBP/USD price drops.

Factors that shift the supply and demand in forex

As we’ve seen, anything that attracts the interest of buyers and sellers will affect the supply and demand of a currency pair, and thereby its price. These things include:

- Big, global news items

- Monetary policy announcements

- Changes to the macroeconomic cycle – for example, shifting from a bull to a bear market

- Changes to inflation or the interest rate

- Political uncertainty in that country or global uncertainty at large

- Significant changes in pricing for a country’s major export

What happens when supply is higher than demand

In forex, if there are more people wanting to short a currency pairat a certain price than there are buyers wanting to go long, there may not be enough demand to lift that pair’s buy price. Without that demand, sellers would need to sell the pair at a discount, driving the price down.

What happens when demand is higher than supply

Sometimes, if the demand for an item was higher than its availability, suppliers will make more of that item to capitalise on this. If enough of the item is subsequently made, then this will even out the item’s price, maybe even depreciating it if this tips into oversupply.

In forex, this looks like many traders selling at a point when the price of a pair is high, in order to take profit from the high amount of buyers. something in the market causes an overwhelmingly bullish sentiment and there is more interest from buyers wanting to go long on the pair at a certain price than there’s interest from short sellers. This means there is an imbalance of supply and demand for that pair at that price. The suppliers (sellers) will then need to offer the pair at a discounted rate to attract more interest. This triggers a ‘sell off point’, which will drop the price of the currency pair.

How do you use supply and demand in forex?

Supply and demand are natural laws of trading that affect all markets – including forex pairs. If you understand that, in forex, sellers means ‘supply’ and buyers means ‘demand’, you can use the natural rhythms of both to your advantage. For example, they can help you decide on whether to go long or short a pair.

Looking at a forex chart, you’ll notice patterns of movement over time. These movements can be classified as ‘zones’.

A time period when a currency pair’s price seems to increase dramatically is called the demand zone – there’s a lot of buyers interested in the pair, which drives the price up. Conversely, there’s a time when a pair’s price depreciates because there are more sellers than buyers. This is called the supply zone.

All in all, there are four identifiable zones on any forex chart:

- The demand zone (also known as the accumulation phase – when demand is going up)

- The markup phase (when demand continues to go up even after a spike)

- The distribution phase (when the demand curve has flattened itself out and sellers and buyers are more or less in equal measure for that pair, and the price flattens)

- The markdown phase (when there’s more selling of the pair than buying, driving the price down. This can also be known as a supply zone)

This is the natural rhythm of any market. To look at it another way, imagine a market for televisions. Let’s say that an exciting new TV is announced and there’s a lot of demand for it. The TV is released and there are many buyers. Encouraged, the TV manufacturers hike up the price as they’re making a profit – while people are still buying. Over time, perhaps due to the higher price or the novelty wearing thin, less people buy the TV and demand evens out. As this continues to happen, there are now more televisions than there are buyers. So, shops mark down the TV’s price to entice more buyers.

The same principle applies to forex markets. If you can identify the four zones of any one currency pair correctly, you can better understand where your currency pair is in the flows of supply and demand – which may provide some clues as to what it’ll do next. For example, if you can see that your currency pair’s chart looks to have been in a markup phase, you know that your market is likely to enter a downturn as demand evens itself out in a distribution phase or falls below that to move into a supply zone.

Where are the supply and demand zones on forex charts?

Unfortunately, there’s no set number on a forex chart that announces whether a currency pair is currently in an accumulation, markup or markdown phase. You’ll have to find these supply and demand zones for yourself – but there are ways to do so.

To start with, look back through your forex chart’s history (let’s say it’s a candlestick chat to keep things simple). You’ll first identify sections with prominent big green candles with long wicks, or sections where the red candles with long wicks are more prominent.

Demand zones are identifiable because there are strong signs of a predominantly bullish sentiment in the market – for example, big green candles with long wicks. Demand zones almost always take place after the pair’s price has dipped somewhat and is lower than it has been for a while – although how long this ‘while’ will be and how far the price has dipped will depend on prevailing market conditions.

Supply zones, on the other hand, are identifiable because the price appears to be in a downtrend, with bigger red candles sporting longer wicks. Supply zones often come just after the price of the pair has peaked higher than it has in a while – again, this will vary depending on the pair and in different market scenarios.

Once you have identified what you feel is a clear supply or demand zone, it will be easier to anticipate which phase come next. In simple terms: a supply zone comes after a clearly identifiable accumulation zone has peaked, after a period where prices are clearly rising more than they are falling. A demand zone comes after the price has lowered for some time. A distribution phase will come in between these, as the market pivots and changes from supply to demand and back again.

With this chart history, you can try figure out where you are in your forex market’s phases right now – are you in the accumulation, markup or distribution phase? The simplest way to find out is to check the buy and sell prices on your chart. If the buy price is noticeably higher, you’re likely in an accumulation phase, i.e., a demand zone – or, at least, not in a supply zone.

However, it gets more complicated from this point on – because cycles of supply and demand don’t always move in steady, binary patterns like a seesaw. Forex charts may cycle through several markup, accumulation, distribution or markdown phases before progressing to the next one, depending on what the markets are doing. And just because you’re able to identify a demand zone doesn’t mean you can tell how long it’s going to last and when your chart will fall enough to enter a supply zone.

If you’ve heard of support and resistance level, this is where these come in. When a currency pair’s chart has entered markdown phase, it often seems like there’s an invisible point where the price can’t go any higher – called a resistance level. At this point, there are more sellers than buyers at a certain price. After a markdown phase, when the pair’s price suddenly rallies, seeming to always go up whenever it hits a certain ‘low’, that’s called a support level.

However, market conditions change all the time, so there are no hard and fast rules as to where your pair’s support and resistance levels may be at any given time. Knowledge of this will only come through rigorous study of your chosen market.

Which timeframe is best for your supply and demand forex trading strategy?

Once you know your supply and demand zones of the forex chart you’re speculating on, you can work supply and demand into your trading strategy. But different trading styles and strategies have different timeframes that they work in, for example scalpers and day traders will look at different timeframes compared to longer-term traders. So, how do you know which timeframe best suits a supply and demand trading strategy?

Longer-term trading styles like swing and position traders may benefit from using longer timeframes, such as one week, one month or even longer, to get a ‘bird’s eye view of a market’s supply and demand trends. Scalpers and other shorter-term traders need to be strategic about their timeframes, finding a balance between the shorter timeframes they may be used to and longer timeframes to be able to get a better sense of a chart’s supply and demand rhythms.

Are you a scalper? Watch this free video on how to scalp forex using supply and demand!

The time of day and the actual day you trade or what time of the day can influence timeframes too. The more liquidity there is in your market (i.e. the more buyers and sellers there are), the better a supply and demand strategy will work. This might mean trading at the time of day when there are the most active traders online, or around periods of suspected volatility, like preceding big announcements such as central banks changing the interest rate, for example. In these instances, a short timeframe will work – one minute or less – as there’s significantly more volatility and speculation than usual.

FAQs:

Is supply and demand important for trading?

Yes, understanding supply and demand is important in order to be successful at trading. They are the natural rhythms and principles that dictate the movement of all markets, including forex, and so you need to know where you are in the accumulation/distribution cycle in order to have the best chance possible of anticipating what your forex pair will do next, and thereby making a profit.

Is supply and demand a good strategy?

Firstly, supply and demand in and of themselves are laws of the charts – they’re not a strategy, any more than knowing gravity will make something drop is a strategy. However, identifying and using supply and demand zones as part of a trading strategy could be effective.

This is because correctly identifying supply and demand zones on a forex chart, as well as support and resistance levels that your currency pair frequently comes up against, will go a long way to helping maximise your chances of correctly predicting what your forex pair will do next.

That being said, no one can tell you what’s a ‘good’ trading strategy for you – the most profitable, rewarding way to trade is a personal thing determined by you, your goals, risk appetite, timeframes and trading style.

Not sure what the right forex trading strategy for you is yet? Try a free demo account and test out different techniques and markets with the virtual funds that a demo provides.

Find out the benefits of practising your forex strategy on a demo account

How do you master supply and demand trading in forex?

The key to mastering a good supply and demand strategy in forex is knowledge. That’s because knowing your supply zone from your demand zone is all about context. Research your currency pair’s chart thoroughly to familiarise yourself with its movements and its support and resistance levels. All markets have patterns – knowing yourself will help you correctly identify accumulation, markup, distribution and markdown phases (or supply and demand zones), which is the key to mastering a supply and demand trading strategy.

Find out more about mastering supply and demand, as well as forex trading strategy, with our educational articles on forex, including learning the top forex day trading strategies.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。