At its core, the business cycle refers to the fluctuations, at a broad level, between economic expansion, and contraction, helping to define the overall state of the economy at a given time. Many indicators can be used in an attempt to time the economic cycle, including - GDP, interest rates, employment, and spending.

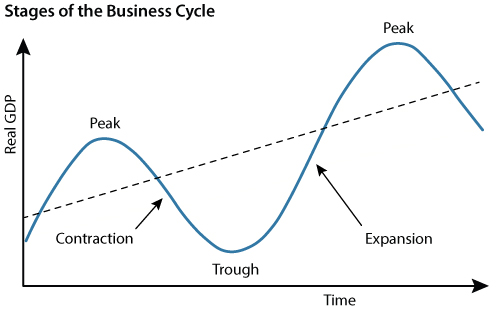

Typically, the business cycle is split into the four stages below. However, it is important to note that no two cycles are identical; the length of expansions has varied wildly over time, as has the length of recessions/depressions, while the amplitude of the peaks and troughs in the cycle also varies over time.

Cycle Stages

- Expansion: During this phase of the cycle, the economy experiences a rapid pace of growth, with interest rates tending to be relatively low, as output increases across most parts of the economy. Employment tends to increase, and earnings - as well as corporate profits - begin to trend higher. This rise in earnings, coupled with an increase in the money supply, does however pose the risk of spurring higher inflation as the economy expands.

- Peak: The cycle’s peak is seen when growth hits its terminal velocity, a point at which various indicators of prices and economic output typically experience a period of stability, before correcting to the downside. This stage of the cycle often creates imbalances between supply and demand (of goods, services, and/or labour) which must ultimately be corrected.

- Contraction: The opposite phase to an economic expansion, and one where growth slows, employment falls, and prices either stagnate or decrease. Often, businesses are slow to adjust to such a contraction, leading to a surplus in supply of goods and services as demand deteriorates, contributing to the aforementioned downward pressure on prices. A contraction is often defined as a recession, technically only if it results in two consecutive quarterly contractions in GDP growth, and may deteriorate further into a depression if it becomes prolonged.

- Trough: The cycle’s trough is when economic growth bottoms out before an eventual recovery begins to take hold. This is the worst moment of the cycle for the economy, where spending and income are at their lowest level, and the labour market has dramatically weakened, with hiring coming to a halt, and unemployment having risen substantially. Following a trough, the economy will begin to recover, and re-enter the expansion phase.

A graphical representation of this cycle can be found below, courtesy of the St Louis Fed:

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。