- English (UK)

Welcome to a better way to trade

Spread bet with the best^. Experience the difference with a London-based broker and trade confidently today.

Aston Martin Aramco Formula One™ Team and Pepperstone: Better Never Settles

.jpg?&fit=crop&crop=center)

Aston Martin Aramco Formula One™ Team and Pepperstone: Better Never Settles

Two world-class teams. One shared obsession for better. Discover a partnership built at the pinnacle of performance — on the track and in the markets.

Because better never settles.

Our numbers speak for themselves

Data for the Pepperstone Group, correct as at October 2025

830K+

Traders

$1TN+

Monthly trading volume (AUD)

$100M+

Withdrawn each month (AUD)

10

Global offices

Trade gold tax-free* with Spread bets

Trade with deep liquidity, fast execution and 0% commission.1

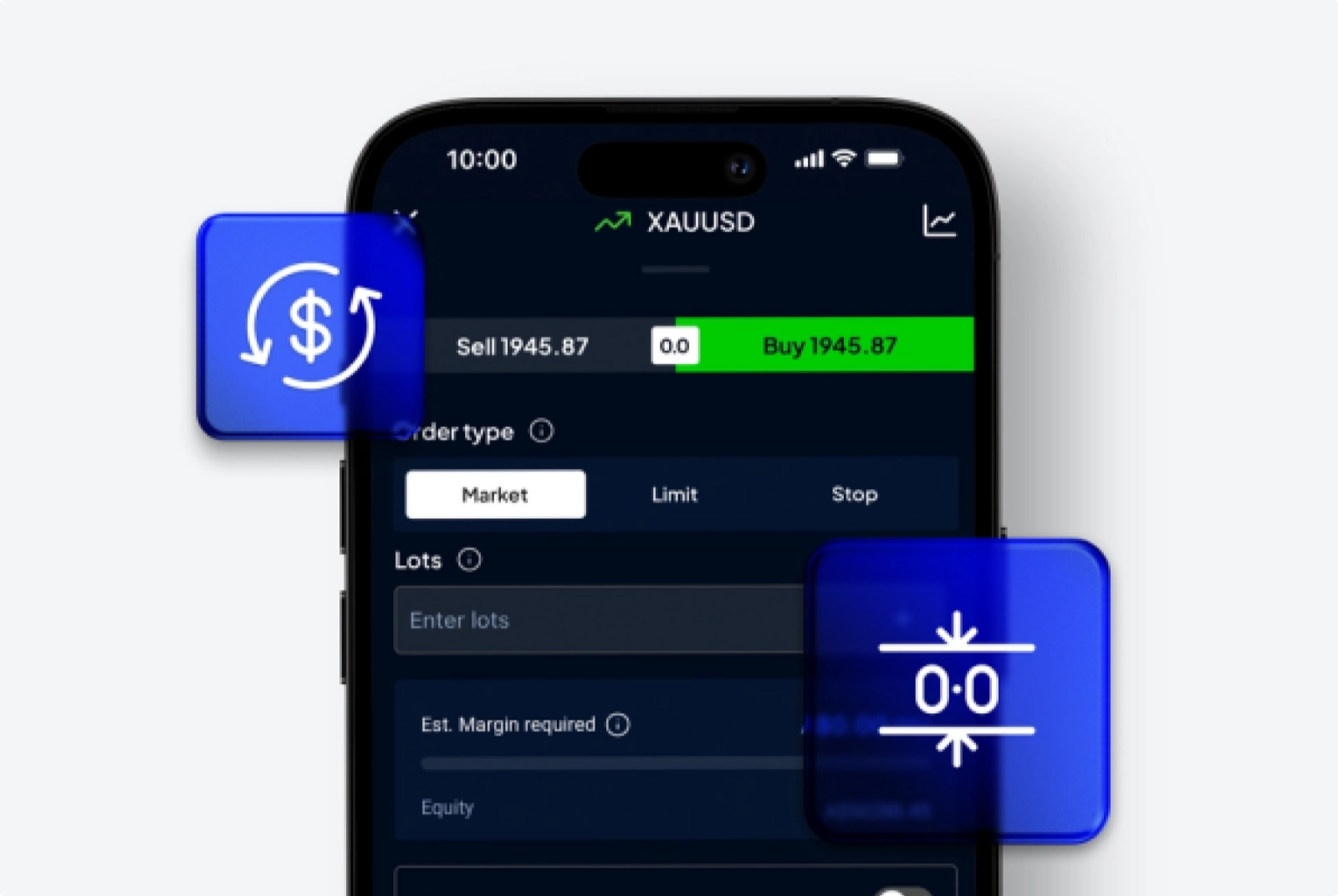

Upgrade your trades

Take your strategy to the next level with a broker who truly understands what traders need.

Super-tight spreads

Trade from 0.0 points on a Razor account.2

Fast and reliable execution

Receive a 99.59% fill rate, with no dealer intervention.3

UK-based team

Operating from the City of London.

Elite trading tech

Choose from MT4, MT5, cTrader, TradingView or our own platform.

Smart education

Upskill with webinars and guides for new & advanced traders.

Spread betting

Go long or short with no tax to pay on your profits.**

**In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change

Find your perfect platform

Trade the world's markets anywhere, anytime, with cutting-edge technology and customisable tools.

The Pepperstone platform

Enjoy a secure, smart and streamlined trading experience on our web platform and mobile app.

MT4

Automate your trading with the definitive FX platform. Customise with indicators, EAs and pattern-recognition software.

MT5

An even-more powerful version of MetaTrader? Let more markets, more order types, more features be your answer.

cTrader

Replicate an institutional liquidity environment and develop trading robots to automate on your behalf.

TradingView

Trade directly through show-stopping charts with hundreds of in-built indicators and strategies.

Get the edge

We bring you expert market analysis, insights and education, empowering you to make informed trading decisions.

Michael Brown

Senior Research Strategist

March 5, 2026

.jpg?&fit=crop&crop=center)

Dilin Wu

Research Strategist

March 4, 2026

Michael Brown

Senior Research Strategist

March 3, 2026

Michael Brown

Senior Research Strategist

March 5, 2026

.jpg?&fit=crop&crop=center)

Dilin Wu

Research Strategist

March 4, 2026

Michael Brown

Senior Research Strategist

March 3, 2026

We’ve been awarded by

We’re certified by

Ready to trade better?

Switch to Pepperstone now and join our global community of over 830,000 traders.⁴ Apply in minutes with our online application process.

1

Register

Sign up with your email address and get a free demo.

2

Answer

We’ll check our products are appropriate for you.

3

Verify

Your safety is our top priority.

4

Fund

That’s it! You’re ready to trade.

2 Only for Razor account. Other fees and charges may apply.

3 99.59%. Fill rates are based on all trades data between 01/07/2025 and 30/09/2025

4 Total number of accounts held with the Pepperstone Group globally, correct as at October 2025.

^Rated Best Overall Broker in Spread Betting in the Compare Forex Broker Awards 2026.

*In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.