- English (UK)

FX Outlook: Three biggest risks this week

At any point in time — day or night, holiday or not — a news bomb could drop, sparking big moves in currencies and equities. So, while there’s fewer market-moving economic reports on this week’s calendar, the potential for big moves remains high.

There are three big risks we’re watching this week. The most important of which will be the Federal Reserve’s annual summit in Jackson Hole. A number of Federal Reserve officials will be speaking on Friday, including Chairman Jerome Powell. When we last heard from the central bank, they made little mention of the need for further easing. But given all of the developments since July, their language could or should change. We’ll also be watching eurozone PMIs. EUR/USD took a hard beating last week. If the PMIs disappoint, 1.10 could be broken. Finally, keep an eye on the FOMC and Reserve Bank of Australia minutes, because both central banks weren’t nearly as dovish as the market thinks they should be. So, a positive or negative tone could trigger a response in currencies.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- CPI 0.3% vs 0.3% expected

- CPI ex food and energy 0.3% vs 0.2% expected

- CPI YoY 1.8% vs 1.6% expected

- Retail sales 0.7% vs 0.3% expected

- Retail sales ex autos and gas 0.9% vs 0.5% expected

- Philadelphia Fed survey 16.8 vs 9.5 expected

- Empire State survey 4.8 vs 2 expected

- Industrial production -0.2% vs 0.1% expected

- NAHB housing market index 66 vs 65 expected

- Housing stats 1,191K vs 1,256K expected

- Building permits 1,336K vs 1,270k expected

- University of Michigan Consumer Sentiment Index 92.1 vs 97 expected

Data preview

- Existing and new home sales: Housing activity should be supported by lower interest rates.

- FOMC minutes: It’ll be interesting to see if other policymakers express more pessimism than Powell.

Key levels

- Support 105.00

- Resistance 107.00

Are dollar bulls back in control? Nope

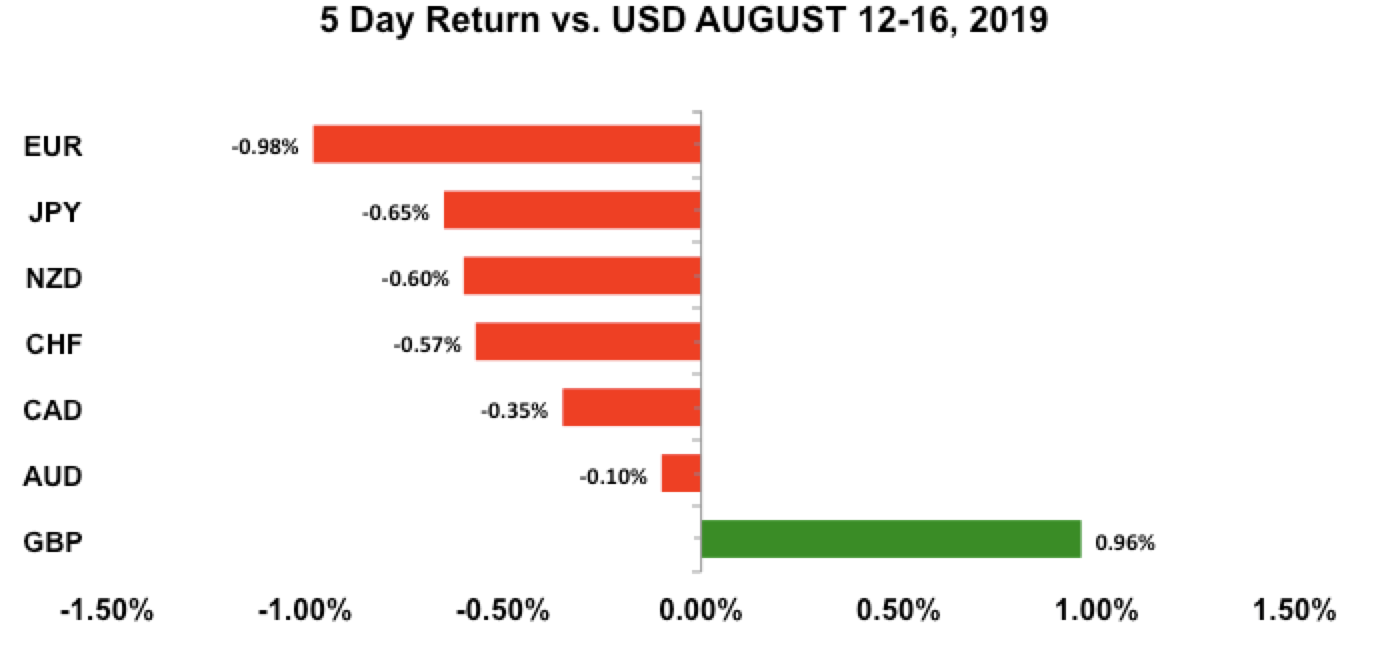

The US dollar recovered against most of the major currencies. The one exception was sterling, which coasted on stronger UK data. The dollar’s rally was driven primarily by better-than-expected US data. Retail sales doubled expectations, while year-over-year CPI growth edged closer to the central bank’s 2% target. These reports validate Powell’s recent comments about the economy’s resilience and his positive assessment of the labour market. What it doesn’t do is reduce the chance of easing. Fed fund futures are still pricing in 100% chance of a quarter point rate cut next month. So, it’ll be very difficult for dollar bulls to remain in control. So far, we haven’t heard many Fed officials say that a rate cut is coming. Typically, when the Fed’s guidance is misaligned with market expectations, they become more vocal and, in this case, could be holding off until Jackson Hole.

The Jackson Hole summit would be the perfect venue for the Fed to set or reset market expectations. If they’re committed to lowering interest rates in September, we should hear central bankers downplay the improvement in spending and retail sales. Some may even overtly press the case for easing, which would be very negative for USD/JPY and USD/CHF. If, however, they emphasise the uptick in data, the dollar could soar on the notion that they may delay a rate cut.

We also expect a lot of talk about the yield curve. The market went into panic when the yield curve inverted for the first time since 2007. The inversion was brief, but it raised widespread concerns about recession because the inversion accurately predicted the last three recessions. But the Fed has often downplayed the importance of the yield curve, and there have been many false positives over the last few decades. They feel there are other factors that influence the curve’s shape besides the future strength of the economy — like the low level of term premiums caused central bank buying, which would undermine the accuracy of the yield curve as an indicator of economic activity. This is also the first yield curve inversion since 2007 and 2008. When premiums are low, inversions can become more frequent without an increased risk of recession. With that said, we shouldn’t ignore the signal. Well before the yield curve inverted, central bankers across the globe have been talking about weaker growth. Many resorted to easing monetary policy to boost inflation and activity. More accommodation is expected in the next few months from major central banks like the Fed and European Central Bank. Between the intensifying US–China trade war, Brexit, protests in Hong Kong, and political trouble in Italy, portfolio managers and investors have a lot to worry about. Any one of these issues could tip one country, if not many, into recession. So, regardless of the durability of the yield curve inversion, the risk of recession of this cycle is greater than it’s ever been. And if the curve inverts again in a more serious way, stocks will extend their slide, taking USD/JPY and USD/CHF down with it. Aside from the FOMC minutes, there are no major US economic reports scheduled for release this week.

AUD, NZD, CAD

Data review

Australia

- NAB Business Conditions 2 vs 3 previous

- NAB Business Confidence 4 vs 2 previous

- Westpac Consumer Confidence 100 vs 96.5 previous

- Wage price index 0.6% vs 0.5% expected

- Consumer inflation expectations 3.5% vs 3.2% previous

- Employment change 41.1K vs 14K expected

- Unemployment rate 5.2% vs 5.2% expected

- Full-time employment 34.5K vs 21K expected

New Zealand

- Card spending -0.3% vs 0.1% previous

- REINZ House Sales 3.7% vs -3.8% previous

- Food prices 1.1% vs -0.7% previous

- Business PMI index 48.2 vs 51.1 previous

Canada

- Existing home sales 3.5% vs 3.3% expected

Data preview

Australia

- RBA minutes: Investors will be eager to hear a deeper explanation of the central bank’s optimistic outlook.

New Zealand

- NZ PMI services: likely to be weaker given the sharp drop in PMI manufacturing

- NZ PPI Q2: potential upside surprise given rise in CPI

- NZ retail sales: potential upside surprise given low forecasts and strong employment

Canada

- CPI: potential upside surprise given uptick in price component of IVEY

- Retail sales: potential downside surprise given weaker labour market conditions

Key levels

- Support AUD .6700; CAD 1.3150; NZD .6350

- Resistance AUD .6900; CAD 1.3350; NZD .6500

AUD: strong data offset takes backseat to trade tensions

It’s very difficult for the Australian and New Zealand dollars to rally when US–China trade relations remain so chilly. One of the biggest stories last week was President Trump’s decision to delay tariffs on China from September to December. Unfortunately, the delay is a move to help US businesses and consumers, and not a reflection of improved trade relations. President Trump said: “We’re doing this for the Christmas season. Just in case some of the tariffs have an impact on US customers.” US Commerce Secretary Wilbur Ross confirmed there was no quid pro quo with China. In response, China accused President Trump of breaking the Osaka Agreement and threatened to retaliate if 10% tariffs go into effect. Both countries made it very clear that trade tensions remain high, so it should only be a matter of time before China follows through on their threat of countermeasures.

We’re also watching the protests in Hong Kong. China has been ratcheting up its response, and Trump said China is moving troops to the Hong Kong–Shenzhen border. The protests are having a significant effect on Hong Kong’s economy, especially after airport shutdown. But there could be global ramifications if China brings in the People’s Liberation Army. Trump has made the US’s hands off position clear — he’s said that China has the capacity to resolve the situation. If we have another Tiananmen Square, however, in one of Asia’s most important financial hubs, the global markets won’t be spared. Risk aversion could return, driving AUD and NZD sharply lower.

For all these reasons, Aussie-dollar traders completely shrugged off strong labour market numbers. Australia’s employment report beat consensus by a wide margin, as jobs increased by 41K versus 14K. With full-time jobs rising 35K, the RBA could argue the case for keeping rates steady. But the unemployment rate is also rising, which could be a cause for concern. Investors will be looking to this week’s RBA minutes for more insight on how close the central bank is to easing again.

Meanwhile, for the first time since 2012, manufacturing activity in New Zealand contracted. This weakness kept New Zealand dollar under pressure, and raises the risk of softer Kiwi data this week. The Canadian dollar, on the other hand, could extend its recovery if retail sales and consumer prices surprise to the upside.

EURO

Data review

- German CPI unrevised at 0.5%

- German ZEW survey current -13.5 vs -6.3 expected

- German ZEW expectations -44.1 vs -28 expected

- EZ ZEW -43.6 vs -20.3 previous

- Q2 German GDP -0.1% vs -0.1% expected

- EZ industrial production -1.6% vs -1.5% expected

- Q2 EZ GDP 0.2% vs 0.2% expected

- EZ trade balance 17.9bil vs 18.5bil expected

Data preview

- EZ PMIs: significant deterioration in ZEW and lower industrial production signals weakness in PMIs

Key levels

- Support 1.1050

- Resistance 1.1200

Is euro set to break 1.10?

The worst-performing currency last week was the euro, which sold off four out of the last five trading days against the US dollar. Economic data has been mostly weaker, with the economy contracting in the second quarter, investor sentiment (as measured by the German ZEW survey) hitting its lowest level since 2010, and industrial production falling by the steepest amount since November 2019. Eurozone PMIs are scheduled for release, and there’s a very good chance that these numbers will come in softer, building the case for EUR/USD to break 1.10. However, euro found support at the end of last week from one very important headline about the German government preparing to boost public spending if the economy falls into recession. Germany’s economy grew in only one of the past four quarters, so recession is certainly in the realm of possibility. Fiscal stimulus would help a lot, but it may be months before the German government announces any new spending measures. The ECB will ease before then, and how the euro trades will depend on the extent of their stimulus.

BRITISH POUND

Data review

- Jobless claims 28K vs 31.4K previous

- Average weekly earnings 3.7% vs 3.7% expected

- ILO unemployment rate 3.8% vs 3.9% expected

- CPI MoM 0% vs -0.1% expected

- CPI YoY 2.1% vs 1.9% expected

- PPI input 0.9% vs 0.6% expected

- PPI output 0.3% vs 0.1% expected

- Retail sales 0.2% vs -0.2% expected

- Retail sales ex auto 0.2% vs -0.2% expected

Data previews

- No major data releases

Key levels

- Support 1.2000

- Resistance 1.2200

Temporary bottom for sterling

While euro was the worst-performing currency last week, sterling was the best. Nearly every UK economic report was better than expected, with wage growth accelerating, inflation rising, and retail sales growing. The Brexit situation remains as clear as mud, with Opposition and UK Labour Party leader Jeremy Corbyn flailing helplessly in trying to compose some sort of organised opposition to no-deal exit while Prime Minister Boris Johnson continues with his hard-nosed message, enjoying a bump in the polls. The true political gamesmanship isn’t due to start until Parliament comes back in September, and the Cable’s volatility may well return at that time. But for now, the markets have decided to focus on the fact that the UK is putting forth some of the best numbers on wage growth, jobs and consumer spending in the G7 universe — even as its business sector is reeling from Brexit uncertainty. Any compromise on the Brexit negotiations should quickly verticalise sterling through the 1.2500 figure, as most analysts believe the currency is deeply oversold due to political risk. At the same time, however, the prospect of a no-deal Brexit could create unprecedented uncertainty, and GBP/USD could quickly drop below 1.2000. But for now, the market has clearly decided in favour of the pound. The pair continues to recover, while politicians jockey for positioning during the last dog days of summer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.