- English (UK)

FX Outlook: Can US dollar fall another 5% to 10%?

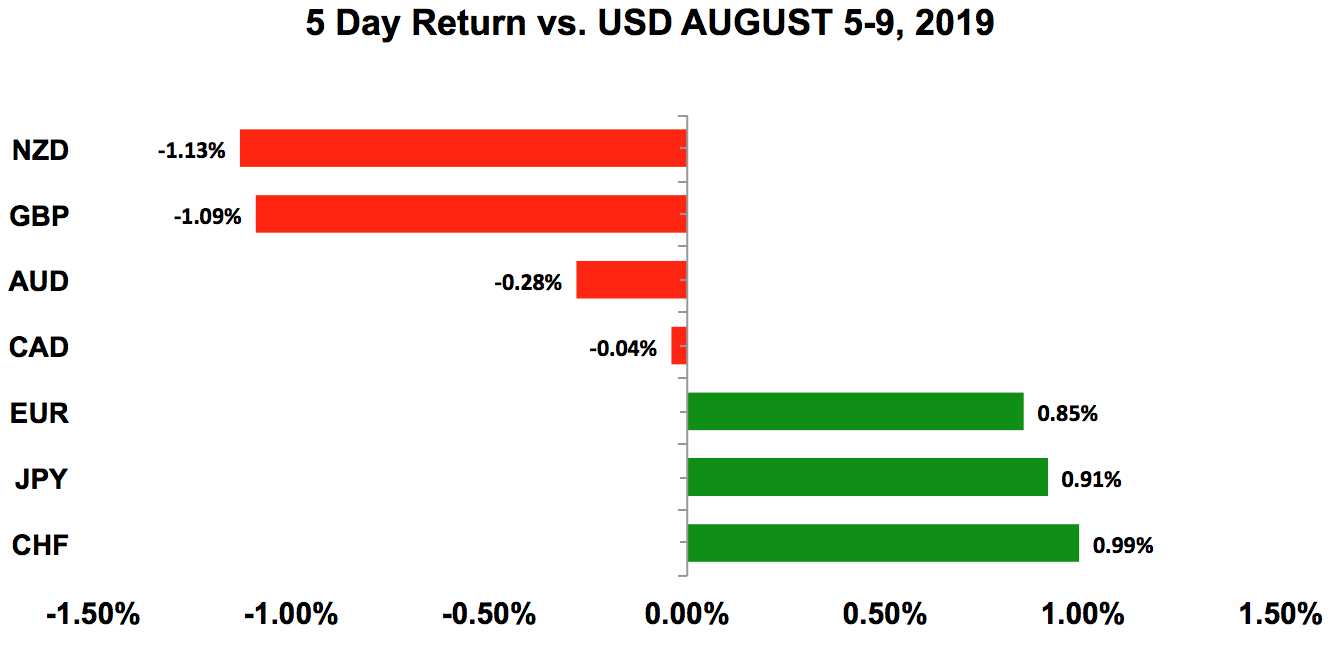

Although some currencies underperformed the greenback, the two overarching themes in the market are US dollar weakness and risk aversion. Next week’s US inflation and consumer spending reports won’t matter much if Trump continues to pressure the Federal Reserve, China and, by default, the financial markets. News bombs and headlines are the only things that matter, especially in a light trading month like this one. The trends emerged over the past month are driven by strong political motivations that won’t change easily. Investors should brace for further losses, as sellers come in on relief rallies to sell USDJPY, AUDUSD, and other high-beta currencies.

It should be no surprise that the yen was last week’s best-performing currency, because it’s the single biggest beneficiary of risk aversion. The Swiss franc isn’t far behind. The worst performer was the New Zealand dollar, which suffered greatly from the Reserve Bank’s surprise 50bp interest rate cut. Aside from US retail sales and CPI, UK inflation, employment and retail sales data are potentially big movers — in addition to Australia’s labour market numbers and Germany’s second-quarter GDP report.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- ISM non-manufacturing index 53.7 vs 55.5 expected

- Jobless claims 209K vs 215K expected

- PPI final demand 0.2% vs 0.2% expected

- PPI ex food and energy -0.15 vs 0.1% expected

Data preview

- Consumer price index: drop in oil and gas prices signal lower CPI

- Empire State and Philadelphia Fed survey: potential downside surprise given trade tensions

- Retail sales: rise in Redbook retail sales and wages signal uptick is positive for spending

- Housing starts and building permits: prospect of lower interest rates supports housing

- University of Michigan Sentiment Index: Confidence should be dented by trade tensions and equity weakness.

Key levels

- Support 104.50

- Resistance 107.00

Can US dollar fall another 5% to 10%?

It’s been a very busy week for President Trump. On Sunday he announced fresh tariffs on China. On Tuesday he ordered the Treasury to label China a “currency manipulator.” On Thursday he blasted the government’s strong dollar policy. On Friday he said the US isn’t going to do business with Huawei, and called on the Fed to lower interest rates by a full percentage point. Although it was later clarified that he meant he’d be banning the Federal Government, not US businesses, from doing business with Huawei, the damage was done. It’s clear that President Trump has no plans to make a deal with China this far from the 2020 election. He’s on a rampage to show his constituents that he’s fulfilling the promises that he’s made in 2016 and in doing so he’s hurting the markets and the US dollar.

Could the greenback and USDJPY, in particular, fall another 5% or 10% as a result of Trump’s actions? Certainly. But risk aversion is also driving investors into the greenback. So, while USDJPY could hit 100 before the end of the year, the decline in the trade-weighted dollar index could be more modest. Even though DXY took a big hit this month, it’s up 1.5% for the year. The sharp sell-off in the dollar last week was felt against the euro, Japanese yen and Swiss Franc. But sterling, as well as the Australian, Canadian and New Zealand dollars performed worse than the greenback, as Trump’s action towards China hits these countries harder. If his fury shifts to Europe, the single currency won’t be immune to the risk aversion.

Meanwhile, it’s important to take stock of the implications of Trump’s latest moves. The tariffs have the most significant effect because it has a direct impact on US businesses and the Chinese economy. Stocks and earnings will suffer as the slowdown in global growth worsens. However, Trump’s talk of wanting a weaker dollar and the Treasury’s “currency manipulator” label has more symbolic than economic consequences. It mandates the Treasury to “take action to initiate negotiations” and work with the International Monetary Fund to remedy the problem. If no agreement is reached, the US can impose further penalties and restrict US government business with China. If he so desired, Trump would have hit China with more tariffs with or without the “currency manipulator” label. Currency intervention is also a bad idea, because it drives up prices, creates more volatility in the markets, and makes the Fed’s job more difficult. If Trump’s primary goal is to pressure the Fed to cut interest rates further, he’s accomplished that by escalating the trade war with China. Stocks collapsed, the slowdown in global growth will deepen, and Fed Chair Jerome Powell will have no choice but to lower interest rates again this year. At the same time, intervention is ineffective if it isn’t coordinated with the central bank. If the Fed sterilises the intervention, the impact could be limited. And if stocks crash, investors will flock to the safety of US dollar anyway. So, while the prospect of more US protectionism, risk aversion, and easing will drive USDJPY lower, the greenback’s direction against other major currencies will depend on how aggressively those central banks match the Fed’s rate cuts.

AUD, NZD, CAD

Data review

Australia

- Reserve Bank of Australia leaves rates unchanged and expresses no specific concerns about US-China tensions.

- PMI services 43.9 vs 52.2 previous

- Melbourne inflation index 0.3% vs 0% previous

- Trade balance AUD 8,036mil vs AUD 6,000mil expected

- PMI construction 39.1 vs 43 previous

New Zealand

- Reserve Bank of New Zealand surprises with 50bp rate cut.

- Q2 unemployment rate 3.9% vs 4.3% expected

- Q2 employment change 0.8% vs 0.3% expected

- Average hourly earnings 1.1% vs 0.5% expected

Canada

- IVEY PMI 54.2 vs 52.4 previous

- New housing price index -0.1% vs 0% expected

- Housing starts 222K vs 202K expected

- Building permits -3.7% vs 1% expected

- Employment change -24.2K vs 15K expected

- Unemployment rate 5.7% vs 5.5% expected

Data preview

Australia

- Employment report: potential downside surprise given softer labour market conditions reported by service and construction sectors

New Zealand

- NZ PMI Manufacturing: likely to be weaker given RBNZ’s bold easing move

Canada

- No major data

Key levels

- Support AUD .6650; NZD .6350; CAD 1.3150

- Resistance AUD .6900; NZD .6600; CAD 1.3350

AUD: more losses ahead

While the New Zealand dollar was the worst-performing currency last week, the Australian dollar hit a 10-year low against the greenback. Considering that the Reserve Bank of Australia left interest rates unchanged and largely shrugged off US-China trade tensions, the AUD should be trading much higher. But the weakness in the currency reflects the market’s belief that the RBA will need to lower interest rates by another 25bp to 50bp. The central bank seems to agree, as RBA Governor Philip Lowe suggested that their forecasts account for market expectations. Yet, they expect the economy to return to trend growth next year, and feel that Chinese stimulus will support Australia’s export sector. The RBA is aware of the risks, and will cut rates if the labour market or inflationary conditions worsen. With that in mind, it’s difficult to see the central bank’s arguments for keeping rates steady. Service and manufacturing activity slowed significantly in July. There’s also a very good chance that this week’s labour market numbers will fall short of expectations. We believe that the RBA has no choice to ease. They’ve admitted that if all central banks go to zero, they’ll need to mull it, too. Before reaching zero rates, however, additional easing by the Fed, ECB and RBNZ should push the RBA to take rates below 1%, especially if the global economy is contracting and markets are crashing. As such, more losses are likely for the Aussie dollar, particularly against the US dollar and Japanese yen.

The Reserve Bank of New Zealand, on the other hand, shocked the market through cutting interest rates by 50bps over the forecasted 25bps, sending NZDUSD plunging below 64 cents. Bucking the gradualist approach of other central banks, the RBNZ opted for a larger cut, and suggested further easing may be in store as the neutral interest rate has declined. In its statement, the RBNZ attributed the move to lower GDP growth, rising headwinds, along with easing demand for New Zealand’s goods and services. The move was especially surprising given the robustness of New Zealand’s labour data. Wages surged and unemployment rate hit an 11-year low. The RBNZ is clearly trying to be proactive in making sure that monetary policy is supportive of growth going forward. The central bank’s move puts enormous pressure on the RBA to act in September, with some analysts suggesting that the RBA may need to act just as aggressively with a 50bp cut. This easing chain reaction from central banks is, of course, driven by the fact that President Trump has completely upended the global trading order. The future direction of the commodities dollars will very much depend on headlines coming from DC and Beijing. For now, both sides appear to have dug into their positions. The longer the standoff lasts, the more damage it’ll do to global growth. That, in turn, could trigger a vicious cycle of global equity sell-off — followed by a further sell-off in AUD and NZD as investors assume an increasingly defensive risk-off posture.

Rate cuts could also be coming for Canada after last week’s employment report. The market was looking for job growth to return in July, but employment fell by -24.2K — the largest drop since August 2018. Full-time and part-time work declined, pushing the unemployment rate up to 5.7% from 5.5%. USDCAD shot higher immediately after the report, but it also turned sharply lower as selling of US dollar resumed. Given the current sentiment for US dollar, it may be smarter to wait to buy USDCAD until selling pressure eases.

EURO

Data review

- German PMI composite revised down to 50.9 from 51.4

- EZ PMI composite left unchanged at 51.5

- German factory orders 2.5% vs 0.5% expected

- German industrial production -1.5% vs 0.5% expected

- German trade balance 16.8bil vs 19.5bil expected

- Current account balance 20.6bil vs 21.7bil expected

Data preview

- German ZEW Survey: Investor sentiment will be dented by trade tensions.

- German and EZ Q2 GDP: Retail sales weakened significantly. Trade also softened.

- EZ trade balance: Weaker German and French trade balance signals lower EZ data.

Key levels

- Support

- Resistance

Understanding euro’s resilience

Unlike all of the other high-beta currencies, the euro didn’t succumb to risk aversion last week. In fact, when the Dow Jones Industrial Average plunged more than 700 points Monday, EURUSD was the only major currency pair to trade higher. Outside of the rise in German factory orders, data from the eurozone has been weak. Industrial production, as well as trade and current account balances deteriorated, painting a picture of weakness for the manufacturing sector. The political situation in Italy also blew up, driving Italian bond yields sharply higher Friday. The conflict between the two parties making up the coalition government hit a boiling point, with Italy’s deputy prime minister Matteo Salvini calling for snap elections. It isn’t clear how far this will go, because his voice alone won’t be enough to hold a no-confidence vote on the prime minister. But the course has been set, and the two parties will have to decide if this is the next step for Italy’s government. Between the deterioration in regional data, intensification of the trade war, market volatility and Italy’s political troubles, the European Central Bank has every reason to ease next month. Like the RBNZ, they could opt for a bold move. Even with this risk, though, the euro is steady because interest rates are negative in Germany and, as a funding currency, the euro benefits from risk aversion in the same way as the Japanese yen and Swiss franc.

BRITISH POUND

Data review

- PMI Services 51.4 vs 50.3 expected

- PMI composite 50.7 vs 49.8 expected

- Halifax House Prices -0.2% vs 0.3% expected

- Q2 GDP -0.2% vs 0% expected

- Q2 GDP 1.2% vs 1.4% expected

- Industrial production -0.1% vs -0.2% expected

- Manufacturing production -0.2% vs -0.3% expected

- Trade balance -7bil vs -11.8bil expected

Data previews

- UK employment report: potential downside surprise, as manufacturing, services and construction sectors report weaker hiring

- CPI: inflationary pressures likely to be lower, as manufacturing and service sectors report lower price growth

- Retail sales: spending growth likely to be weaker as prices fall and spending rises modestly, according to the British Retail Consortium

Key levels

- Support 1.1100

- Resistance 1.1250

Sterling hits two-year lows on Brexit troubles and risk aversion

Sterling is trading at a two-year low despite mixed economic data. Unlike other central banks, the Bank of England isn’t actively entertaining the idea of easing. And, according to the PMIs that ticked up in July, steady policy is justified for the time being. Yet, GBP has fallen because it’s a high-beta currency sensitive to risk aversion. As each day passes, the chance of no-deal Brexit increases. There’s been very little progress with the Johnson Government insisting on renegotiating the backstop with Brussels even though this is a nonstarter for the European Union. British Prime Minister Boris Johnson has made it clear that if the backstop insurance clause isn’t taken out, the UK will leave the EU with no deal on Oct 31. This persistence prompts calls for a no-confidence vote to stop a no-deal Brexit. This is troublesome, too, because if a no-confidence vote is held before Oct 31, it’ll trigger a general election immediately after. And the rules of purdah prevent the government from changing course on a no-deal Brexit during an election campaign. No matter how you look at it, the UK political situation is messy with no clear path ahead. Sterling could be poised for further losses.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.