- Português

- English

- Español

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- لغة عربية

Nvidia Q423 preview – This Needs To Be On Everyone's Risk Radar

How the Nvidia share price reacts immediately after its earnings results and CEO Jensen Huang’s guidance could have far-reaching implications - not just for those holding exposures in Nvidia equity CFDs - but for those with open positions in NAS100 and US500, and even risk NDFS de Pares de Moeda, such as AUD, NZD, and NOK.

Nvidia is a true market darling – it hits the sweet spot in A.I revolution, which may not be a completely new theme, but given the sheer rate of change in the evolution market participants still have very low conviction when it comes to forecasting future cash flows. This inability to price certainty only increases the volatility.

Looking at consensus expectations on sales, margins, and earnings may not prove to be overly worthwhile, given fundamentals mean little for what is essentially a pure momentum vehicle like Nvidia.

It’s the commentary and guidance and the tone of the outlook that inspires investors, notably around its long-term data centre sales. We can explicate how the business is likely tracking from recent earnings numbers from the likes of AMD, SMCI and TSMC, and given the strong trends we’ve seen of late can assume sales are growing at a solid clip.

Options structures price big moves on earnings

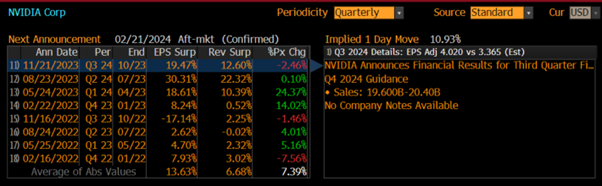

If we look at the options market, the implied or expected move for the day of reporting sits at an impressive -/+11%. That level of implied volatility could indeed be mispriced, but an -/+11% move for a company with a $1.83t market cap would be staggering.

When we consider that Nvidia has the fourth largest weight on both the S&P500 and NAS100, commanding a 4% and 5% weighting on each index respectively, an -/+11% move could have significant implications – especially if the move in Nvidia’s share price spreads into other A.I and mega-cap tech names, which it most probably would.

Should we see a move in US equity futures it would likely impact the USD and risk NDFS de Pares de Moeda, such as the AUD, NZD, or NOK.

Staying in the options space, we see that Nvidia’s 1-week call options (10% out-of-the-money) currently commands an implied volatility of 100.8%, a clear premium over 1-week put options (with strikes 10% out of the money) at 85%. This is rare, as put option implied vol is typically higher than calls, given the increased relative demand to use put options to hedge against equity drawdown.

We also see that 9 of the top 10 most traded options strikes recently (expiring on 23 Feb) are traders buying call options, which just adds to the view that equity traders are positioning portfolios for higher levels and remain incredibly bullish on their near-term prospects.

The bottom line – Nvidia’s share price is not being driven by fundamentals – valuation matters little – it is all order flows and momentum. What matters to traders here is that the market expects a huge move on the day of earnings, and this could send ripples through broader markets. This creates opportunity but it also is a risk for traders that needs to be managed – put Nvidia on the risk radar.

Related articles

O material fornecido aqui não foi preparado de acordo com os requisitos legais destinados a promover a independência da pesquisa de investimento e, como tal, é considerado uma comunicação de marketing. Embora não esteja sujeito a nenhuma proibição de negociação antes da divulgação da pesquisa de investimento, não buscaremos obter qualquer vantagem antes de fornecê-la aos nossos clientes. A Pepperstone não representa que o material fornecido aqui é preciso, atual ou completo e, portanto, não deve ser confiável como tal. As informações, quer sejam de terceiros ou não, não devem ser consideradas uma recomendação; ou uma oferta de compra ou venda; ou a solicitação de uma oferta para comprar ou vender qualquer título, produto financeiro ou instrumento; ou participar de uma estratégia de negociação específica. Não leva em consideração a situação financeira ou objetivos de investimento dos leitores. Aconselhamos aos leitores deste conteúdo que busquem seu próprio conselho. Sem a aprovação da Pepperstone, a reprodução ou redistribuição desta informação não é permitida.