- Italiano

- English

- Español

- Français

Analisi

The Daily Fix: There is an unease in markets, but will COVID19 derail the risk rally?

Former national security adviser John Bolton released his new book, in which he claims Trump asked the Chinese for help in his re-election campaign. This seemingly caused some wobbles in markets, as clearly there is going to be some real dirt produced as we head far closer to November and it’s going to get pretty grimy.

However, it feels like the world is starting to watch China more intently again after the breakout in the Xinfadi food market, with schools being closed and 1200 flights cancelled. This is also true in the US, with Texas reporting a record 11% level of hospitalisations and new cases in Florida reaching a record. Certainly, if we look at the daily case count across the suite of Republican states there is a worrying trend, where a number of recent surveys show people reluctant to wear masks, which is less the case in the blue states, which show a falling trend in the case count.

Trump has an incredible balancing act

Trump has made it clear that he is strongly against a second lockdown, and is hell-bent on opening the economies as he needs an economic snapback to use as a pitch for his re-election campaign. US recessions that play out two years before an election are very seldom won by the incumbent, and we can see plenty of case studies to back this case, with Hoover, Ford, Carter, and Bush senior examples. Trump knows he must balance a stronger economy with increased hospitalisation rates. If the voter base get a stronger feel that Trump has no plan to look after their welfare, and is myopically focused on getting the economy firing solely for political gain then he could lose moderates, and that may backfire, so he needs to find the right balance.

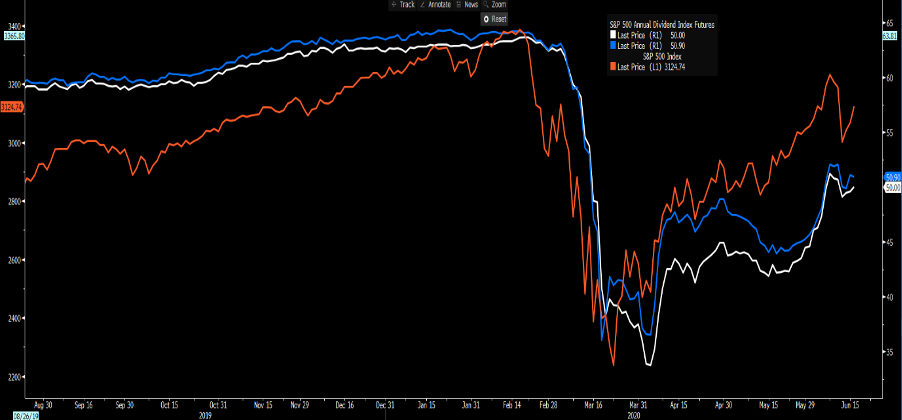

As I argue in my morning (video) rant, the market had been seeing COVID-19 as old news. Where the focus put squarely on what the Fed and global central banks more broadly have been doing with policy and effecting broad money supply. Economics are improving and beating expectations, and this is playing into the idea that companies may start looking at future cash flow improvements and review its dividend policy. As we see here, US dividend futures are on the rise, and whilst I question the liquidity in these instruments, we can see expectations of dividends for 2021 (blue) and 2022 (white) are rising and offering backbone to the S&P 500 (orange).

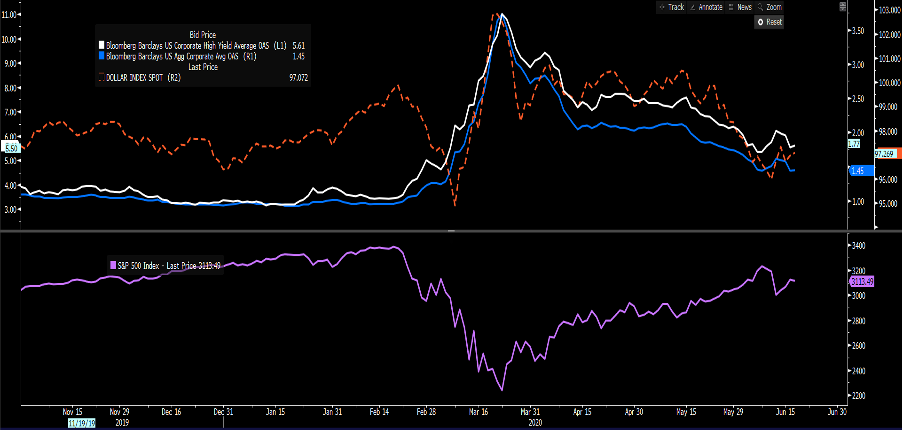

Credit spreads have also been at the heart of everything – as we see here, it’s all just one big trade. The Fed acts, credit spreads tighten making it ever cheaper for corporates to issue debt, the USD falls, and equities head higher.

- White- High yield credit index

- Blue – Investment grade credit index

- Orange – USD index (DXY)

- Purple – S&P 500

The question then is will COVID-19 wrestle back some market concern and promote greater volatility? I think we must consider economics most intently here. On one hand, with a low risk of a second lockdown then we’re likely to see the case count increase but whether this truly impacts the trajectory of the economic recovery is the point of debate – if consumer behaviour is unaffected despite a further rise in the case count then it may not turn into a vol event at all. Economics are key here.

With the Fed buying credit ETFs and select individual investment-grade credit instruments it seems unlikely that we’re going to see a material blow out in spreads, which, if this did play out, and this correlation stayed true, would see the USD rise and global equities lower.

One to watch. But, it does feel that there is enough in the COVID-19 headlines to limit traders from putting new money to work on current valuations and this suggests we chop around in the near-term and price action could get messy.

Keep an eye on GBP, EUR and AUD exposures

Also, on the radar, we have an eye on the BoE meeting today (9:00pm AEST/12:00pm BST) with a focus on increased QE and possible more clues on negative rates. Here is a preview we put together.

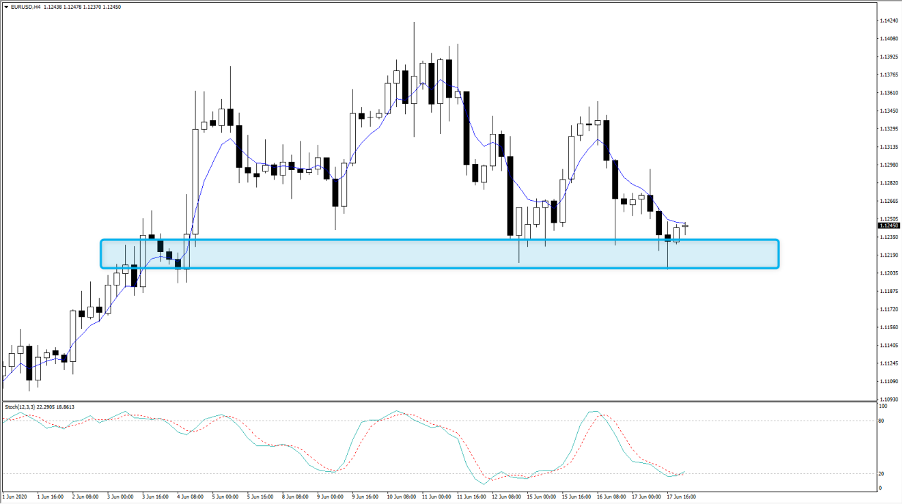

Also, we’re testing some decent levels in EURUSD – one to watch with the ECB due to publish its economic bulletin (18:00 AEST) and US jobless claims due (22:30 AEST). We should see solid support of the 1.1230/10 area, but if this gives way then it will incentives further covering of USD shorts.

In potential headwinds for the local economy the Aussie jobs data printed -227.7 with U/e increasing 0.7 pts to 7.1% (the consensus was for -78.8k and an U/e rate eyed at 6.9% (8.5% - 6.3%). Participation dropped to 62.9%, as did hours worked. A key data point when assessing trends in labour demand.

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.