I CFD sono strumenti complessi e comportano un alto rischio di perdere denaro rapidamente a causa della leva finanziaria. Il 75.1% dei conti degli investitori al dettaglio perdono denaro quando scambiano CFD con questo fornitore. Dovresti considerare se hai capito come funzionano i CFD e se puoi permetterti di correre l'alto rischio di perdere il tuo denaro.

- Italiano

- English

- Español

- Français

How To Start Trading Forex: A Basic Guide For Beginners

What is forex trading?

Forex trading, also known as foreign exchange or FX trading, is speculating on the conversion rate of one currency into another. In essence, you’re forecasting how much one currency will increase or decrease in value as compared to another one.

For example, if you feel bearish towards the US dollar and think it is on a downward trajectory, then you might predict that its price will go down against another major currency like the euro. If your guess is correct then you’ll make a profit. If you’re incorrect, then you’ll incur a loss.

Sounds basic, right? Not necessarily. The forex market is totally unique – and it requires its own set of skills to master trading on it.

How is forex different from other markets?

Forex is the most liquid market in the world by far. With gigantic trading volumes of more than $7 trillion1 being traded on hundreds of different currencies every single day, it’s no wonder forex is considered the pinnacle of financial markets.

The forex market is decentralised, which means buyers and sellers trade directly without a central, regulated exchange. Compared to other financial markets, the forex market also has no real set trading hours, due to its global nature and the fact that it stretches across various time zones.

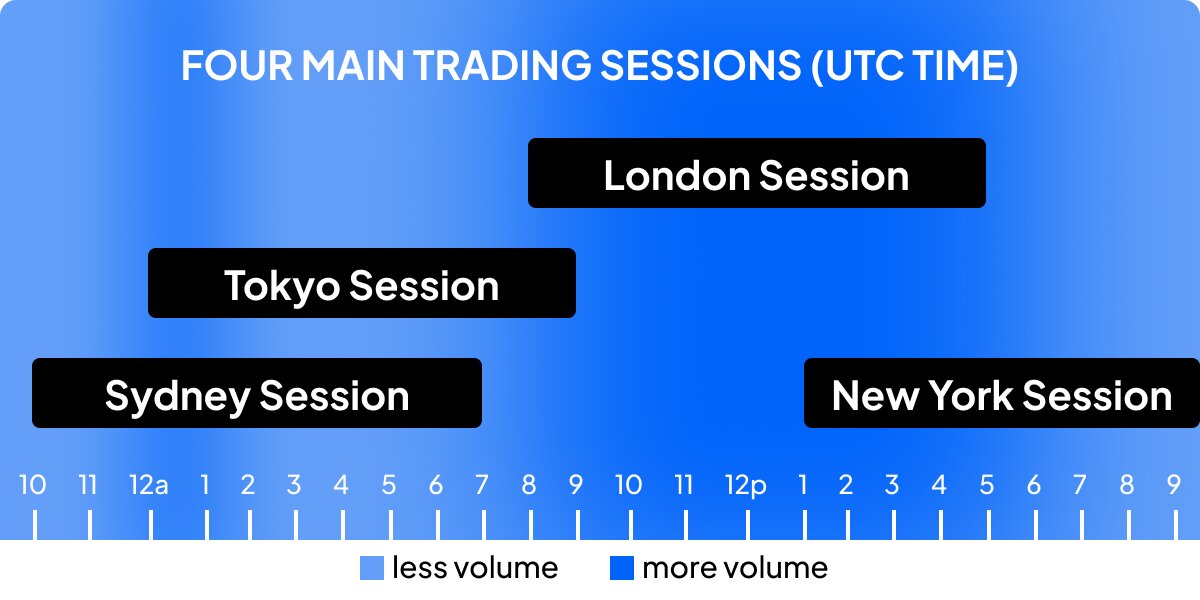

There are, however, four main trading sessions for Forex:

- Sydney session

- Tokyo session

- London session

- New York session

What moves the forex markets?

When speculating on the price movement of the forex market, it’s vital to understand what moves the foreign exchange market. These are some of the things that can move the forex market:

- Market sentiment

- Breaking news and Geopolitical events

- Central banks’ monetary policy decisions

- Macroeconomic events

Start forex trading for new traders in 4 steps

- How does forex trading work?

- Currency pairs for beginners

- Understanding pips and forex lots

- Step-by-Step Fx trading

1. How does forex trading work?

Forex trading takes place in pairs (for example the US dollar vs the euro) and involves the buying or selling of one currency as priced according to another. The market price will show how much of one currency is needed to buy another.

There are two currencies that will influence your trade:

- Base currency (left of the currency pair)

- Quote currency (right of the currency pair)

As a forex trader you’ll estimate the value of the quote currency as compared with the base currency. For example, if the base currency is the US dollar and the quote currency is the euro, you’ll speculate on how much of the euro is equal to one unit of the dollar.

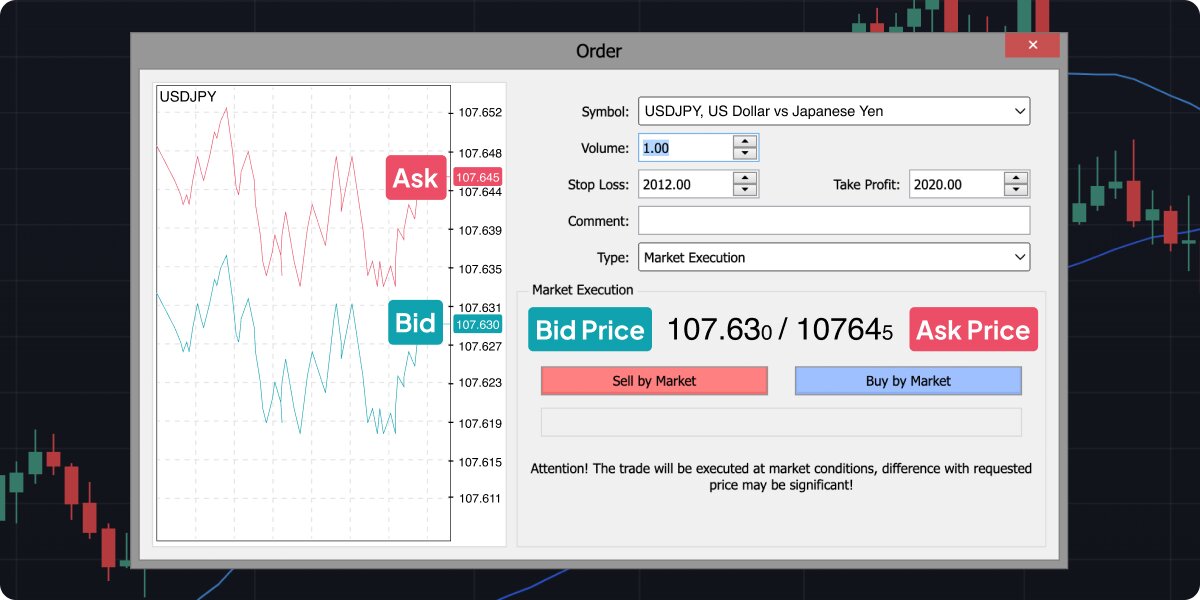

Trading example: forex CFD

In this example, we’ll use forex CFDs as the chosen financial instrument. You decide to trade a popular currency pair, USD/JPY. You’ll ‘buy’ or go long on the Japanese Yen if you believe it will increase against the US dollar, and you could make a profit if you are correct. If instead you believe the Yen price will fall, then you’ll go short. If you are incorrect about the direction, you could make a loss.

Trading example: forex CFD

In this example, we’ll use forex CFDs as the chosen financial instrument. You decide to trade a popular currency pair, USD/JPY. You’ll ‘buy’ or go long on the Japanese Yen if you believe it will increase against the US dollar, and you could make a profit if you are correct. If instead you believe the Yen price will fall, then you’ll go short. If you are incorrect about the diLearn how to trade forex

2. Currency pairs for beginners

You may have heard traders mention currency pairs like ‘the cable’, ‘the fibre’ or ‘the ninja’ but had no idea what they were talking about. Because Forex is traded in pairs, they are constructed of two currencies that are traded against each other; for example with ‘the cable’ it is the British pound vs the US dollar. Each pair has its own symbol (a unique three-letter ‘ISO’ code) to help you quickly identify it as part of a pair.[KS1]

Codes of the most popular currencies:rection, you could make a loss.

| FX | Currency Code |

| Euro | EUR |

| US dollar | USD |

| Pound sterling | GBP |

| Canadian dollar | CAD |

| Mexican peso | MXN |

| Australian dollar | AUD |

| Japanese Yen | JPY |

| New Zealand dollar | NZD |

| Chinese renminbi | CNH |

| Swiss franc CHF | CHF |

| Turkish lira | TRY |

| Swedish krona | SEK |

| Hong Kong dollar | HKD |

| South Korean won | KRW |

| South African rand | ZAR |

The different types of pairs are also categorised as follows:

- Major: one of the currency pairs will be the US dollar paired with another major currency (example - Australian dollar vs US dollar)

- Minor: neither of the pairs include the US dollar, but are still comprised of other better-known foreign currencies (example: euro vs pound sterling)

- Crosses: one pair is a well-know of major foreign currency and the other is less known (example: euro vs New Zealand dollar)

- Exotics: at least one of the currencies is from an emerging market (example: Pound sterling vs Turkish lira)

3. Understanding pips and forex lots

There are two important units of measurement beginner forex traders need to grasp: pips and lots. A 'pip' represents the smallest price movement that a specific currency pair can experience on the trading charts. It's like the tiniest step the exchange rate takes. For instance, you might hear someone say that a currency pair has 'risen by two pips' or 'fallen by three pips'. These pip movements indicate the incremental shifts in value for a currency pair.

It's important to note that while small, pips play a crucial role in assessing price changes and potential profits or losses. They serve as the building blocks for measuring market movement and are used to calculate gains or losses in a trade. So, when you're exploring the forex market, remember that even a seemingly minor pip movement can have a significant impact on your trading outcomes.

Forex lots, on the other hand, will measure the size of the position that the trader opens, so the unit of volume for that position. This determines the amount of money you’re speculating per pip.

Forex lots come in standardised amounts you can choose from. The different forex lots are:

- Standard lot (1 lot = speculating with 100,000 units of currency per pip)

- Mini lot (1 lot = speculating with 10,000 units of currency per pip)

- Micro lot (1 lot = speculating with 1,000 units of currency per pip)

- Nano lot (1 lot = speculating with 100 units of currency per pip)

Understanding these different lot sizes empowers you to tailor your trading approach to your risk tolerance, investment goals, and overall trading strategy. Whether you're aiming for substantial trades or prefer a more cautious approach, the various forex lot options provide you with the flexibility to make informed trading decisions.

4. Step-by step FX trading

- Do your research to understand how FX trading works

- Create a Pepperstone account and access one of the trading platforms we offer, i.e. MT4

- Choose a currency pair and asset

- Decide if you are going ‘long’ or ‘short’ according to what you think the market will do

- Set up stop loss orders and take profit orders according to your risk management strategy

- Open your first trade

- Monitor and eventually close your position

- Practise, Practise, Practise

Explore a risk-free Demo Account

Trading in general is high risk and you should always make sure that you don’t spend capital that you can’t part with. If you want to get to know the world of FX and see how a trading app works – but not risk any capital while you learn – you can always become familiar with the markets using a demo account.

CTA at bottom of this section: Open a Demo Account

FAQs:

Which forex trading platform is the best?

The best forex trading platform is the one that meets all your trading needs and has the tools that will work for you. At Pepperstone we have several trading platforms that you can explore. These are MT4, MT5, cTrader and TradingView.

Can I trade forex on MetaTrader 4?

Yes, you can. MT4, short for MetaTrader 4, was created specifically for forex traders and is very often associated with forex trading above all other markets.

What are the risks involved in trading forex?

Trading in general is always a risk, especially if you don’t know what you are doing. When you decide to trade forex you should always have a solid trading plan and put adequate safeguards, like stop losses, in place.

Is forex good for beginners?

Yes, forex can be good for beginners for several reasons if they understand from the start that this is a complex market that will require a lot of practice and profit is never guaranteed. Beginners can always start out with a Demo account to learn the platforms and the markets. Because of the global nature of all the markets, forex can be traded 24/5 and this gives new trades a lot of opportunities to trade forex.

Can I trade forex at night?

Yes, you can trade forex day or night. It’s a good idea to time your trading for when the time zones of the pair you want to trade are in session, or when most markets of the most major currency pairs are in session, as that’s when markets will have the most liquidity.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.

.jpg?height=420)