- Italiano

- English

- Español

- Français

Analisi

The Daily Fix: The tone of the outlook promoting better sellers

Powell’s comments that the outlook was “highly uncertain” in his pre-written statement are hardly inspiring, especially after Dr Fauci’s comments in the prior session that the pandemic could worsen if states open too soon - with many in the market seeing the risk of a second wave as a major risk for markets.

The fact that we have such elevated concentration risk, with valuation at the highest levels in decades and you absolutely need new and inspiring news flow to fuel the beast – it is a factor hedge fund guru Jonathon Tepper touched on in US trade, detailing that valuation are the highest since 1999, which just served to say that if you’re buying now, you’re buying at (near) the highest multiples ever – I guess that worries discretionary traders far more than it does systematic, who don’t care for valuation or economics.

Powell again pushed the focus onto the fiscal response, noting the Fed has “spending powers, not lending powers… Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery.” If the Fed desires more fiscal, it probably isn’t great then that Republicans rejected a monster $3t stimulus plan by the Dems, a factor Trump described as “dead on arrival”.

Negative rates are a policy tool, but the journey to get there would be awful

Of course, it was all about Powell’s Q&A session, which Powell saying "All participants - that's not a sentence you get to say often" were not in favour of looking at negative rates. Although he did not explicitly rule them out. The wash-up? In rates we’ve seen small selling, indicating very modest pricing out of negative rates, while US 1Y1Y OIS (swaps pricing in one years’ time) pushed up 2bp to -1.5bp. There has been no real move in the US Treasury market to talk of, with UST 2s unchanged at 16bp, while we saw small buying in US 10s and 30s.

The fact is, and as I touch on in yesterday's deep dive on the subject, negative rates are certainly in the tool kit. But to get there we will have to see some very dark times ahead, that would see the Fed deploy a range of other policy tools and if they do not work then they’ll look at negative rates. Perhaps at that stage though the conversation would have even moved on sufficiently to whether the Fed should have the powers to spend, not just lend (and provide liquidity) – real MMT. That would get the gold bulls excited, but it comes with incredible consequences.

Another theme that has been widely talked about is trade relations. Locally that is a big talking point, given Australia’s leverage to China. However, the markets are most intently eyeing the US-China relationship, with talk Trump is eyeing US investment in Chinese markets. China has seemingly hit back overnight, with Hu Xijin, editor of the Global Times, putting out this tweet. Not a great look for risk.

Equity leads for Asia

Equities have taken the brunt on the move, with the S&P500 closing -1.8% and following through from yesterday's bearish outside day. A break below the 4 May swing would incite higher vol, with the VIX index pushing a further 2.2 vols higher into 35% - only outdone by implied volatility in EU Stoxx gaining 5.7 vols to 33%.

The NAS100 has broken the march uptrend and we’ve seen a stochastic momentum cross, although the US30 looks the weaker vehicle. This is true of small caps, where the Russell 2000 closed -3.3%.

The risk aversion was not lost in FX markets either, with the USD finding buyers on a broad basis although the moves have not been too extended. As we've seen, the NZD wore the brunt of the selling, with moves into 0.5980 – you have to admire the RBNZ, when they go they roll hard leaving little to the unknown. The MXN has caught a bid, although USDMXN intra-day is messy, as it is if you go out the timeframes and look at price action on the daily.

I am out of EURAUD and the defence of the 200-day MA and April low has been in fitting with the change in tone in the S&P 500 and sentiment more broadly. Will take another look here, but I want price to show me more vulnerability. We have Aussie jobs on the docket today (11:30 AEST), with calls for 575k jobs lost (range -1m to -125k), with the unemployment rate expected to push up to 8.2% - AUDUSD overnight vol sits at 16.33%, which will likely move higher in the coming hours, and offers an implied move (higher or lower) of 51p on the day. The market is saying it is a risk, but not a tier-one risk.

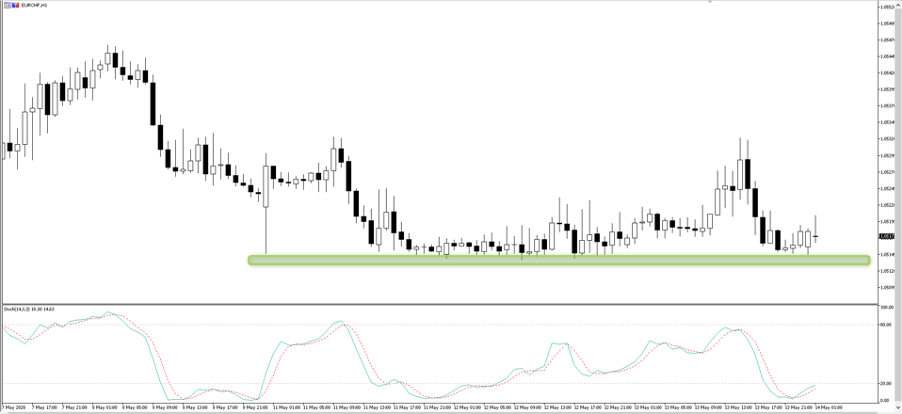

EURCHF - is 1.05 the new1.20?

EURCHF looks interesting, and as a few pointed out the defence of 1.05 is there for all to see. Is 1.05 the new 1.20? Obviously, Jan 2015 is still too fresh in the mind and if the DAX or S&P500 does roll over, EURCHF is only going one-way.

We can look at the explosion of Swiss National Bank sight deposits – these are seen as a proxy of SNB CHF intervention, as the SNB print CHF, and offered to local banks in return for EURs - this is marked as a deposit (liability) on the SNBs balance sheet. So, as we see below these sight deposits are exploding. Now, a break of 1.0515/00 isn’t going to see a re-run of 2015, but it might cause a 50-100 pip move. Be aware.

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.