- Italiano

- English

- Español

- Français

Analisi

US2000 – A breakout in small caps on the cards?

As US large-cap indices look to Nvidia’s earnings (Wed after-market), one questions if we were to see downside and vol in the NAS100 and US500, we look to see if some of that capital rotates into US small caps – the US2000 being a good proxy here. Looking at the sector composition (of the US2000) we see 18.7% of the index weight is skewed towards industrials and 15.2% towards financial stocks, suggesting a higher sensitivity to longer-duration US Treasury’s. A rally, therefore, in the US10yr Treasury would assist the upside case. Traders also get pockets of leverage to the A.I theme through Super Micro Computer (weighting of 0.52%), which has been incredibly volatile of late. MicroStrategy commands the second greatest weight given their market cap of $11.87b, so there is also an element of high beta driving the index. The setup on the higher time frames needs work but is on the radar – where after the strong 27% rally from Oct to Dec, price retraced to the 38.2% fibo, found a base and is retesting the run high of 2073. Set alerts for a bullish break, where a daily close above here would argue for a solid continuation rally.

JPN225 – 34 years later

The Japanese equity market sits 1.2% away from the all-time high recorded on 29 Dec 1989, some 409 months ago. Granted, the composition of the JP equity market looks radically different from late 1989 but there is little doubt a break above 38,957 (the ATH in the JPN2225 cash index) will get attention from the media and from our equity index traders. While we can point to other equity markets at or near ATHs, the JPN225 is by far the strongest performer in 2024 (15% YTD), and even when priced in USDs the YTD returns dwarf those in all other DM markets. If it kicks then we should see new highs soon enough with 40k coming into the mix. Buy strong, sell the weak.

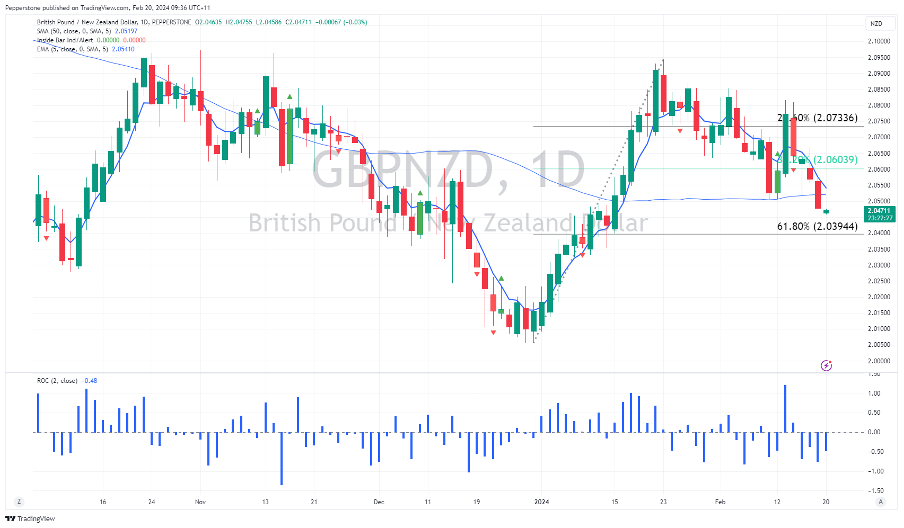

GBPNZD – the bird takes flight

There are some interesting set-ups and flows currently seen in the FX cross rates (daily). Notably, I like being long on CADCHF, adding through the 200-day MA, as well as short EURNOK and long AUDCHF. The strength in the NZD has also stood out, largely assisted by a belief in pockets of the economist community that the RBNZ could pull a surprise 25bp hike in next week’s central bank meeting. The NZ swaps market ascribes a 13% probability of a 25bp hike, and while I don’t think they will hike myself; one can argue that the 13% implied is too low, suggesting the NZD can rally further into the meeting. The one factor concerning me on NZD longs is that the broad market (real money, hedge fund/leveraged and retail) has amassed a sizeable long NZD position, which tactically makes sense given the relative hawkish pricing in Kiwi rates. GBPNZD hits the radar given the lower low on the daily and I like this lower from here given the ST trend and would close on a daily close above the 5-day EMA.

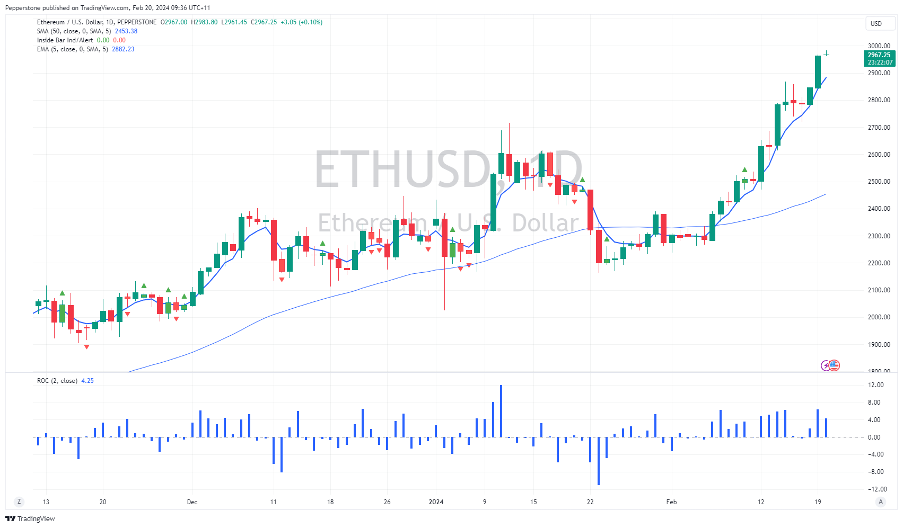

ETHUSD – pretty fly for a tradfi

We’re seeing some heat flow back into our suite of cryptos, where notably GLMRUSD is on a tear and seeing some strong upside momentum – happy to be long here, cutting back below 0.4300. LINKUSD also comes on the radar, where I like longs on a break of 20.40. Ethereum gets good attention and getting big attention from momentum players in the crypto scene as that is also on a tear and 3000 is soon to be tested – it’s a hot market so limit orders to capture the swing into 2950/45 may be the play. Long ETH/short BTC is a lower beta play here for those who want to reduce directional exposure and focus on lower beta strategies.

Cocoa – go hard on the softs

Softs/Ags are a little more exotic as a trading instrument than say gold, equity indices and FX, but for those who cut their craft trading trends and momentum, soft commodities/Ags can be some of the best vehicles around for capturing outliers within the distribution – when they kick the move can run for a prolonged duration and traders can sit in a position and trail stops when the market allows. As it stands, we’re seeing some strong one-way moves in wheat, corn, soymeal, soybeans, cotton, and cattle, although the trend is mature. Cocoa rallied 45% through Jan to 19 Feb high but is reversing and could be due for further reversion towards the 20-day MA.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.