- Italiano

- English

- Español

- Français

Analisi

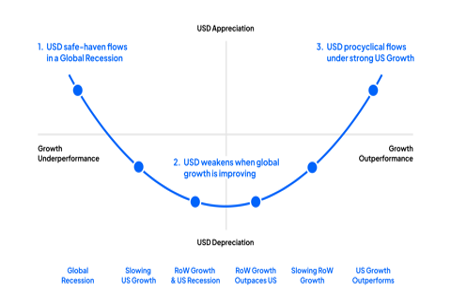

The USD ‘smile’ theory

To understand the fundamentals at hand we can revert to the USD smile concept. Essentially, this portrays a model where the USD outperforms in times of ‘risk off’ (equity drawdown/higher volatility), and/or when global economic data slows, and the US economy looks 'exceptional'.

In the past 24 hours, one could argue that both the left and right sides of the smile have been working concurrently. On the right side of the smile theory, poor China Caixin Services PMI data (at 51.8 vs. 53.5 expected) and EU country services PMI promoted USD inflows. The argument on the left side is somewhat weaker given the VIX index has barely moved, but Chinese/HK equity did see heavy selling, with some $4.6b of outflows through the Northbound Shanghai-HK ‘Connect’. China will play a key influence on sentiment again today.

USDJPY

Just one of the many USD pairs that have broken out. We see clients increasing short exposures now, looking for a short-term mean reverting play. USDJPY shorts have been helped by comments this morning from Japan’s top currency chief Masato Kanda, who has detailed that he is seeing “speculative moves in forex” and “won’t rule out any options if FX moves continue”. The comments are a warning that intervention is on the radar, but at this juncture is unlikely to cause a lasting drawdown in USDJPY, where the bulls will be holding for 150 and channel resistance. Happy to hold a long bias until price closes below the 5-day EMA.

AUDUSD

We saw a lot of confusion in the headlines as to the weakness in AUDUSD yesterday. The RBA meeting had very little to do with it, and the AUD has just been a proxy of Chinese markets. A higher USDCNH and weaker HK50 saw AUD lower, and a simple overlap will highlight this. Weaker China Caixin services PMI data was behind this, so as we look ahead at China trade data (tomorrow – no set time), international funds continue to use the AUD as a liquid and cost-effective vehicle for trading the yuan. After a big move lower on the session yesterday, we are seeing modest follow-through selling in AUDUSD today – not influenced by Aus Q2 GDP, but USDCNH pushing higher.

Favour this pair further lower, although if China property stocks do reverse higher here, I’d reverse as a day trade and follow the tape.

XAUUSD

Price has reversed into the 61.8 fibo of the July-Aug decline at $1948, with the stronger USD clearly impacting. With the rise in both US nominal and real rates, we’ve seen that the opportunity cost of holding a yield-less asset impact investor psyche. Both the 50- and 200-day MA are acting as a magnate of late, which suggests mean reversion strategies may be worth deploying, however, a break of $1917 could see $1900 and even $1884 come into play.

The gold bulls will either be long XAUAUD (over XAUUSD) or will want to see a turn lower in USDCNH, while ‘hoping’ for a print in today’s US ISM services index (00:00 AEST) below 50.0 (consensus 52.5), although hope is not really a strategy in trading. They would also be keen to see better-than-feared China trade data (due tomorrow – no set time) as this would cause USDCNH to find sellers and negatively impact the USD on a broad basis.

Apple

As we look ahead to next week’s Apple ‘Wonderlust’ product launch on 12 Sept, with the iPhone 15 due to be unveiled, we see price closing the gap to $190.69. How price reacts into this level and from here matters for the US500 and NAS100 given Apple’s weight and influence – gaps are there to be filled, but a rejection could see increased equity vol and increase the prospect of a 3-5% drawdown. A push higher and a close above $190.69 will radically increase the prospect of new ATHs in the NAS100.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.

_(1).jpg?height=420)

.jpg?height=420)