- Italiano

- English

- Español

- Français

The Daily Fix – PMI’s and growth in focus in the session ahead

Much of the focus for equity traders fell in the US after-hours session, where we’ve seen earnings drop from Visa, Texas Instruments, Alphabet, and trader favourite Tesla.

Tesla has caught the attention of traders, with shares -6.4% in after-hours trade. A punchy move, although, guided by options pricing which implied a -/+7.8% move on the day of reporting, some had been expecting an even more pronounced move and perhaps that eventuates when US cash equity opens in the session ahead. A big miss to Q2 EPS and free cash flow was a factor, but guidance on production and volume growth fell short, and gross margins (ex-regulatory) fell to 14.6% (from 16.4% in Q1). Technically, the price has been consolidating in a $265 to $235 range, and given the moves after hours, the lower levels of this range are in play, and we question if the share price finds the same support we saw on 12 July.

Alphabet initially rallied c2% on earnings, with Q2 earnings coming in above expectations, and search and operating margins nicely above expectations. Shareholders saw a business in good shape, but as the analyst call got underway, sellers have pushed the stock lower, and we now sit -1.6% in the after-hours, which makes for an interesting cash trade ahead.

S&P500 and NAS100 futures are largely unchanged after the earnings numbers, with very little change (in after-hours trade) in the mega market cap companies that hold the big weighting on the respective indices. While we saw a strong performance in the Russell 2k, the flat close in the S&P500 and NAS100 results in our opening calls for Asia indices looking a little soggy, with flat unwinds expected in the ASX200, NKY225 and HK50.

S&P500 sector leads

Looking at the sectors, by way of leads for Asia, we see S&P500 materials and financials outperforming, so it makes some sense that the ASX200 will outperform the region on open, and why we see small gains coming in the ASX200, which has the big index weights in these two sectors. BHP, by way of a loose guide, should open 0.2% higher (given the ADR pricing).

Looking at the tape in the ASX200 yesterday, we peaked at 7993 after 2 hours of trade, and subsequently saw a slow grind lower, with energy and materials names out of favour. Today, while energy faces headwinds, we should see a better bid in materials names. However, sentiment towards China is hardly inspiring, either in the flows we’re seeing in China/HK equity or copper and iron ore futures, which can’t find a friend and where elevated inventory levels suggest rallies will likely be sold here. Crude also looks weak, and we see US crude -1% lower from where the ASX200 energy equity names closed yesterday, and that needs to be priced in on open.

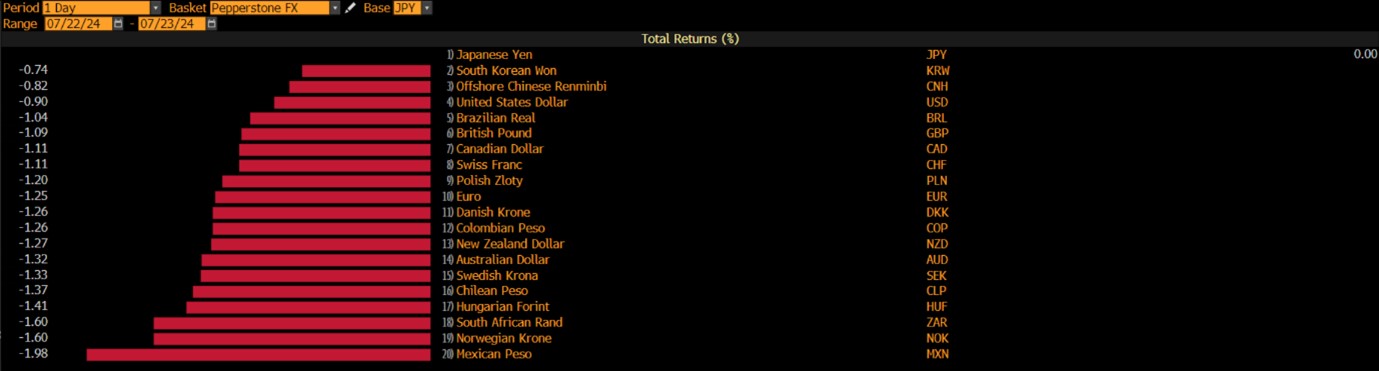

FX moves vs the JPY on the day

While US Treasuries have seen limited net change on the day, we’ve seen some life in FX markets, and notably JPY shorts have been crushed as JPY-funded carry trades covered hard. Notably, we’ve seen a solid rally in the JPY vs the high-yielding Latam plays, with MXNJPY -2%, while NOKJPY gets the additional downside kicker of a lower Brent crude price.

EURUSD, GBPUSD and AUDUSD have all seen solid client flow, notably with EURUSD breaking Monday’s low of 1.0873, and while this has little to do with carry (as was the case in the JPY pairs), I would be watching to see if the USD rally gets legs from here, and we see EURUSD push towards 1.0800, with AUDUSD eyeing the former range lows of 0.6600.

USDCAD also gets a focus, with the highest closing levels since 16 April and in the session ahead the Bank of Canada release its policy outcome (apologies I had this a day early in yesterday’s report). We see the CAD rates market has a 25bp cut as their firm base case, so we’d likely need to see a 25bp cut and an outlook that signals more cuts are to come to get this pair pumping further higher. We also get PMIs in Australia, Japan, Europe, the UK, and the US, so these data points could move the dial, with improvement expected across the board, and notably in services. I think Europe could be most sensitive to the outcome of PMIs, so watch EUR exposures over the figures.

Bitcoin has also seen upbeat client flow with price rolling over from 68k and hitting a low of 65,450 – a decent flush out of weak longs, so we’ll assess to see if we see follow-through selling ahead or whether traders use this point to reengage on the long side.

On the US earnings side, notable names that fall on client’s radars are IBM, and Newmont who report after markets.

Good luck to all,

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.