- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The transactions take place between crude producers, trading firms, refiners, airlines and fuel wholesalers, and usually play out at the point of loading – subsequently being delivered through pipelines or tankers.

The deals are usually one-off transactions between the two parties, so clearly this environment is not one that is conducive of speculation – which is the solution offered by derivatives.

Understand crude futures

Crude futures are important, as they are the core component and variable used to price a CFD crude spot price.

Crude futures (and options) markets offer corporations and market participants insight to assess the markets implied price at a future date. Many will use this structure as a guide to make key business decisions, such as how much crude they are producing. They also offer an efficient vehicle should they wish to hedge future production.

Crude futures also offer traders an instrument to express a trading view on the price of crude over a specific timeframe.

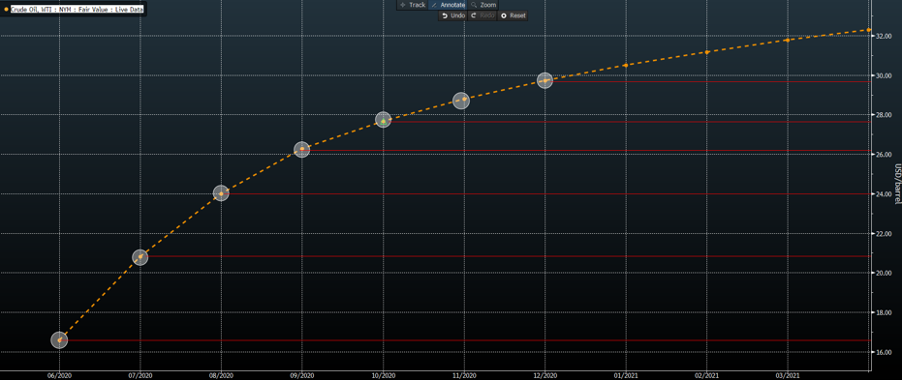

In normal market conditions, as we head further along the forward futures ‘curve’, we will typically see each futures (monthly) contract increasing in price or trading at an ever-increasing premium. This is because of factors such as interest (or carrying) and storage costs. This results in positive slopping forward futures curve – this market condition is known as ‘contango’.

Example - We can see the increasing premium in the table below, with the June futures trading at $16.48, July at $20.73 and August at $23.88 and so on.

We can look at the pricing table another way and portray it to map each futures contract as a ‘curve’. We can more readily see the steepness and the ongoing premium priced into future contracts.

In a contango market, over time we see the futures price converge to the spot price, with the carrying costs gradually coming out of the futures prices.

Futures rollover

An important consideration is that each futures contract has an explicit expiry date. This expiry or expiration date is the last day that a trader can buy and sell that futures contract (June futures for example) before it expires and the next month becomes the ‘front-month’ or active contract.

It can often be a period of uncertainty, where illiquidity and other factors can cause erratic or disorderly moves.

On the day of expiration, the futures trader can either roll their position, by covering the open position and then re-establishing that same position in the next month (or any) futures contract. Most traders, however, will roll their positions well before the expiry day.

In some cases, there may be a sizeable price differential between the contract that is expiring and the next month futures contract. This is not necessarily a huge concern for futures traders as they will just paying spread to close their existing position and again to re-establish the position in the next (or any) futures contract. They will be required to pay a higher initial margin for the new position because the price is higher.

While on first blush it sounds like it could be a costly process, if the trader is long the June WTI crude at $20, and wants to roll to the July futures, which is trading at $30, the traders account will be not be impacted by the $10 difference. This can, however, be a strong consideration for ETF’s that track the crude price.

The other option is to allow the position to expire and go to settlement. In this scenario, if a trader holds a short position, they may be required to deliver the physical crude. On the other hand, a trader who held a long position may be required to deliver the crude. In many cases, the trade will just be cash-settled but it depends on the terms.

The CFD way

CFD traders want a price to trade an instrument that is representative of a spot price, that being a today price that has been formulated to remove all future interest and associated costs. There is not one universally adopted methodology to create this price, and it is specific to the LP or market maker - so one broker's spot price will often differ from another’s.

Pepperstone takes a spot price from our Liquidity Provider (LP) who will work a price back from a specific futures contract to make a spot or cash price.

The fact that we hedge our exposure by buying or selling crude futures is also a key factor, where futures are clearly the most efficient vehicle to manage risk.

So, there is a fundamental difference between a CFD spot price that has been derived from the futures pricing and worked back to create a cash price. Relative to that of the underlying spot price, which is made up of boutique physical transactions.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.