- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Friday’s US ISM manufacturing report showed a big deterioration in the new orders and employment sub-components (both moved into contraction) and while inventories rose to 56.0, the feeling is this isn’t a sign of supply chains easing (equity positive), but a sign that demand is falling and inventories build consequently.

The Atlanta Fed Q2 GDP nowcast model has US Q2 growth running at -2.1%, so after a contraction of 1.6% in Q1, the prospect of a technical recession is now pretty high, although given the labour market is in rude health, many won’t have felt protracted economic pain. That may, unfortunately, come further out the year and the fact we have 77bp of cuts priced in US rates for 2023 suggests the market sees this as a growing probability. I guess when we see jobless claims show a deteriorating trend the Fed will take notice, but until then inflation is still its central target, and they know it is right where they want it.

The concern the market has is that the Fed failed to reign in its balance sheet when price pressures were building, and rates were put up too late – so they failed to understand inflation, thinking it was ‘transitory’ for far too long. Now the fear is they will be too slow in easing off from hikes, as consumer confidence burns and PMIs head towards contraction, with the forward-looking elements already there. QT is a massive known unknown and all the modelling from PHDs will struggle at predicting behavioural issues – the fact is liquidity is the core driver of risk and it is falling away.

The rates market showed us inflation was never going to be transitory but high, entrenched and sticky – it seems the pricing of aggressive hikes proved correct, and they are now telling us they will need to cut. The question is when will bad news (by way of data releases) be seen as good news for markets? It cannot be too far off, but it means we now put more weight on growth data points and somewhat less on the inflation reads. This is key for our risk management and knowing what data points will move markets.

Bonds are working well in a slower growth environment; the JPY is flying as the BoJ’s dovish stance looks validated and the AUD and copper are trending strongly lower.

Life is never boring in markets, but like many, I sense the 21 September FOMC meeting could see a major turn from the Fed. One where they will pivot to a more accommodative stance, and this could be the trigger for a bullish turn in risk into year-end – a view the rates market is guiding to and one that is becoming consensus.

It’s hard to be bullish risk when economies are slowing so rapidly, but the market is going through change and the only thing that matters is price and reacting to moves and changes in volatility.

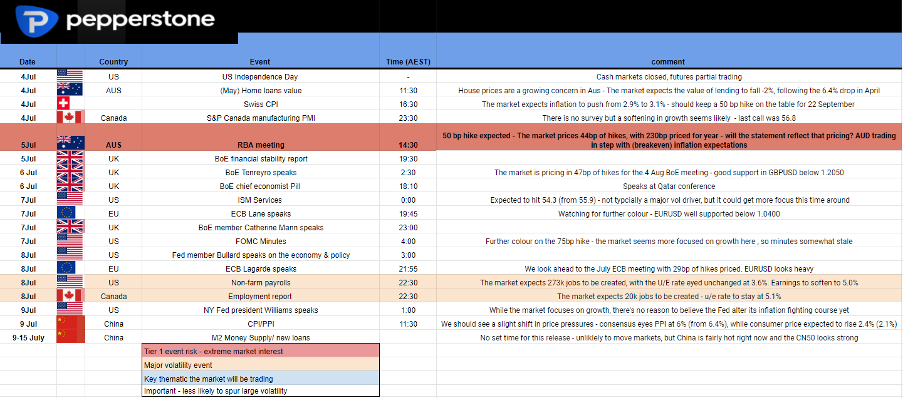

The week ahead calendar and playbook – what matters in the week ahead

(Source: Pepperstone - Past performance is not indicative of future performance.)

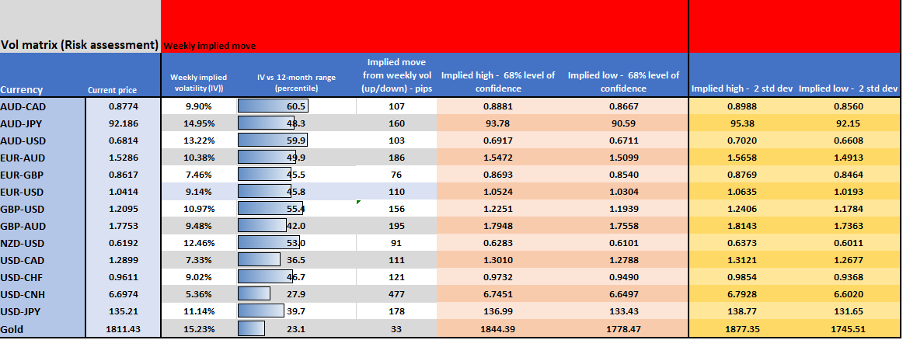

Weekly implied volatility matrix – here we look at the implied volatility and expected trading range in G10 FX and Gold.

I find this good for understanding how the market sees risk in the week ahead and for mean reversion.

(Source: Pepperstone - Past performance is not indicative of future performance.)

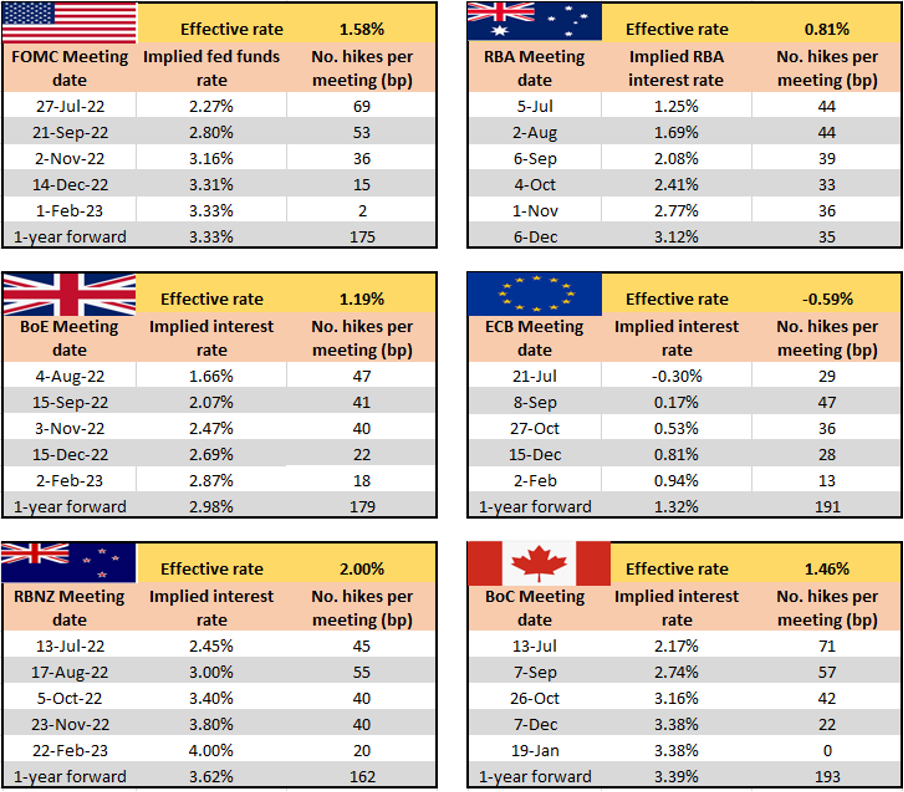

Interest rate matrix – we look at the markets pricing for each meeting and the step up (in basis points) per future meeting. For example, we see 44bp of hikes priced for the upcoming RBA meeting and a further 44bp for August. We now see 69bp of hikes in the July FOMC, so we can round that to 75bp.

(Source: Pepperstone - Past performance is not indicative of future performance.)

Happy 4 July to those who celebrate, it will be quitter than usual although FX and futures will be trading. As always keep an open mind and be prepared to react to change when trading the possibilities.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.