- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Stocks have been battered by coronavirus headwinds over the past two weeks as markets fear an economic standstill with millions of people around the world in quarantine. Oil prices were already sliding as travellers stayed home - and that was before Russia stunned the world with a refusal to cut supply and keep pieces buoyant. Oil producers were propelled into a free-for-all race to global market share, and WTI crude briefly fell below $30 a barrel.

Low energy prices not only cause deflationary pressures, but numerous major companies are tied to higher, stable oil prices. Stocks plummeted dangerously close to bear market territory in Monday’s trading as traders grappled with Russia’s jaw-dropping decision.

What is a bear market?

A bear market occurs when equities or an overall index fall 20% or more from its recent highs for a sustained period, usually two months or more. Bear markets occur during times of uncertainty and market pessimism.

The last US bear market occurred in the 2008 Global Financial Crisis (GFC). Between October 2007 and July 2008, the Dow Jones fell 20% and found itself in bear market territory. Yes, that’s almost nine months compared to this year’s shock which has reached the verge of bear market territory in just three weeks.

A contraction is similarly defined as a drop of 10% but the key difference is that it’s short-lived compared to a bear market. Markets hit a sharp contraction late February when virus fears reached Europe and the United States. Stocks have since fallen further. A continued decline into late April and below the 20% threshold would be confirmation of a bear market and the end of the record bull market.

The current bull market began in March 2009 when stocks lifted from their GFC lows.

Short selling CFDs offers a way to make money in a bear market, particularly for those who want to facilitate a hedge against a falling stock or wider portfolio.

Can a bear market be avoided?

Markets rallied off the bear market cliff’s edge in the asian session Tuesday, but can this be sustained or are stocks doomed to go lower?

US rates markets are pricing a 75bp rate cut for next week’s FOMC meeting, up from Friday’s expectations of a 50bp cut. The Federal Reserve won’t want to spook markets by not meeting expectations, so will likely give markets what they want and deliver a triple cut next Wednesday. It’s also expected they will address their discussions around the Fed purchasing corporate bonds and debt - a radical development that would require a law change. This could cause a relief rally considering the oversold nature of equities at the moment.

So the Fed could provide temporary relief next week, but chairman Jerome Powell acknowledged in last week’s emergency meeting that drastic rate cuts can only do so much to help a downturn. People can’t spend if they’re in quarantine, but slashing rates to near-zero could help with a recovery once the virus is contained.

US President Donald Trump has floated the prospect of payroll tax cuts to provide relief to reeling markets and crucially free up cash to encourage spending.

Oil remains a threat. A further decline in crude prices will fuel fear about energy giants’ cash flows and their vulnerability to high debt levels, putting pressure on credit markets.

The EU Stoxx index has fallen to an all-time low, calling EU banks into concern. Also worrying is a potential blow-out in EU credit-default swaps and the cost of insuring against mass credit defaults. We’re watching the European Central Bank (ECB) meeting this Thursday when ECB President Christine Lagarde will address the coronavirus fallout and the bank’s plans to prevent a deep eurozone recession. ECB rates are already negative, giving the bank limited monetary policy firepower to fight the downturn than many of its global counterparts.

Markets are in panic mode and pricing a full recession, represented by US Treasuries falling below 1% across the curve yesterday.

Here are 3 major stock indices and the levels where they enter a bear market. A close below the 20% threshold puts the index into bear territory. One is already there.

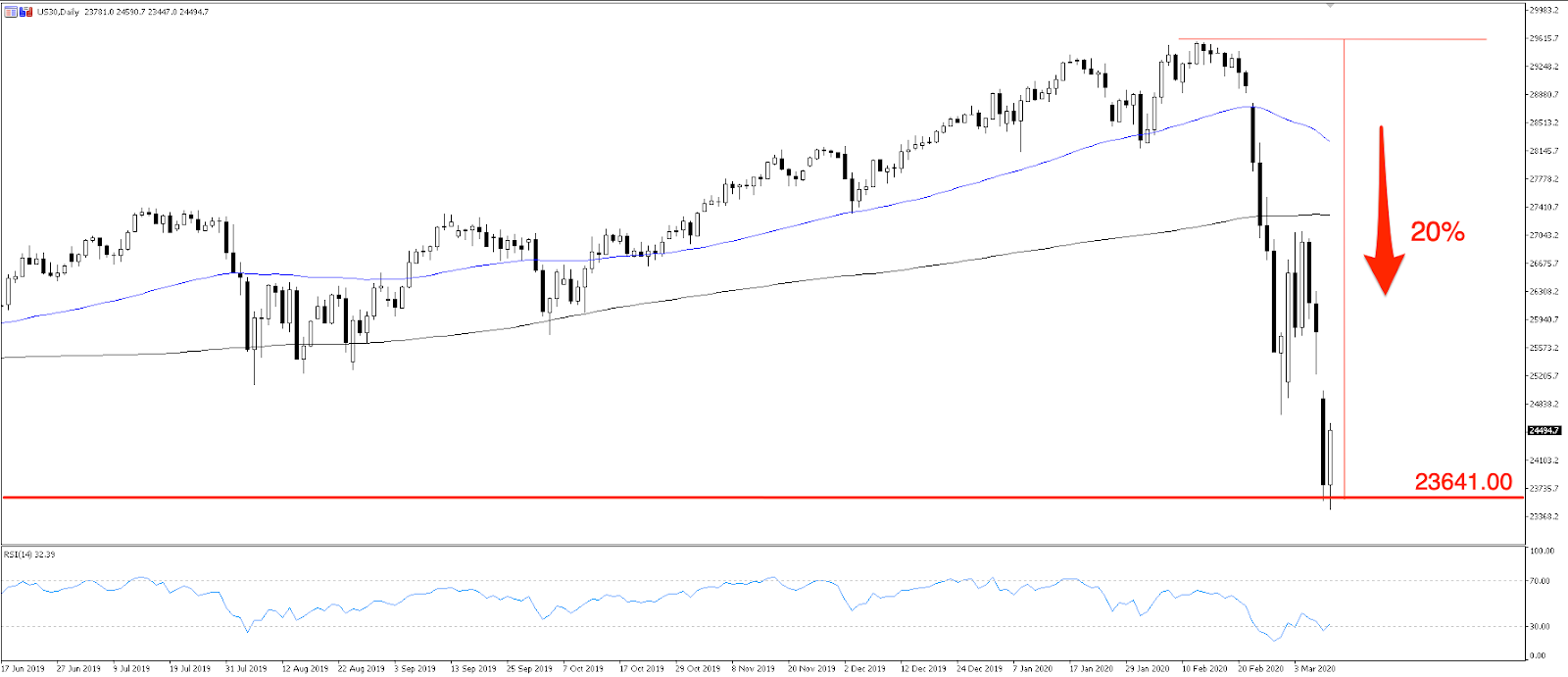

Dow Jones Industrial (US30)

US30 futures traded into bear market territory in early asian trading Monday before bouncing back on easing risk aversion.

US30 bear market level: 23641.00.

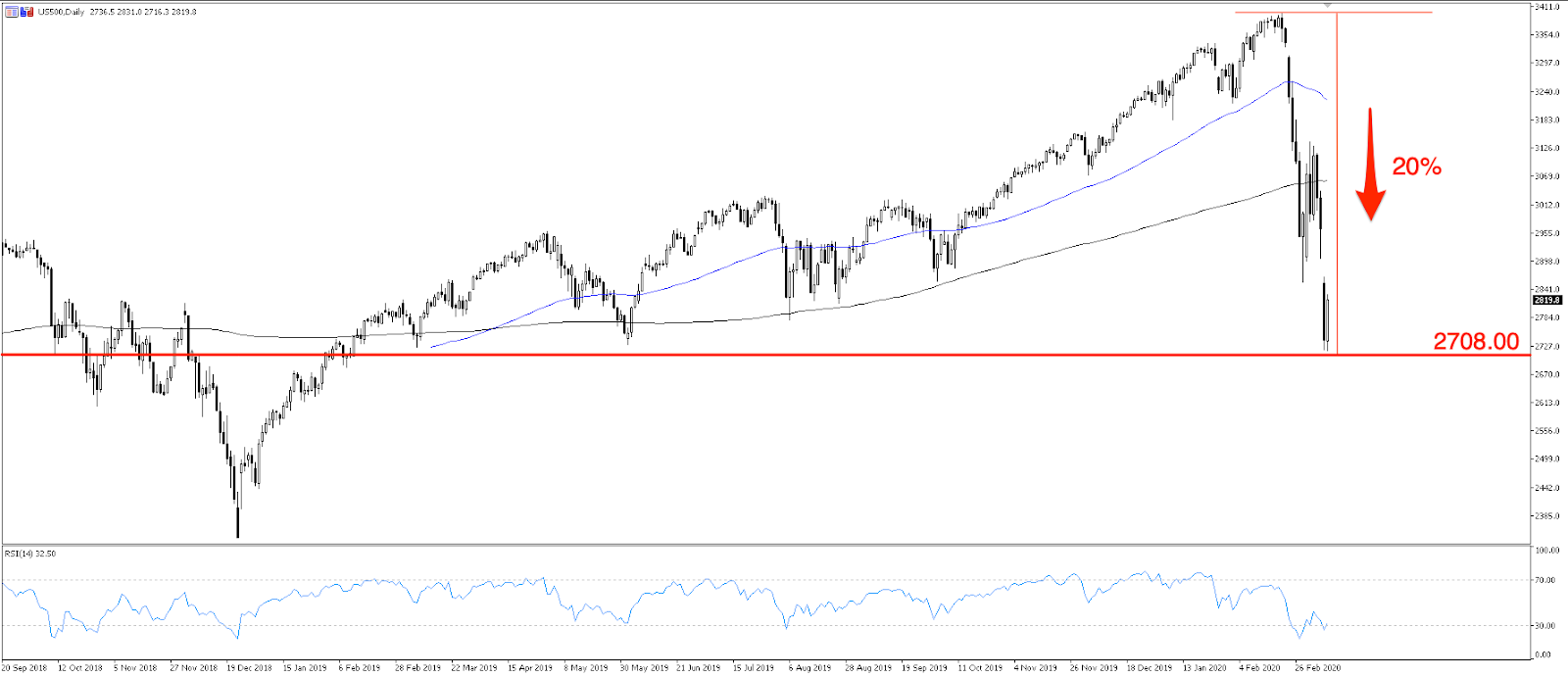

S&P 500 (US500)

The US500 hasn’t quite yet tested bear market territory but has come dangerously close.

Bear market level: 2708.00

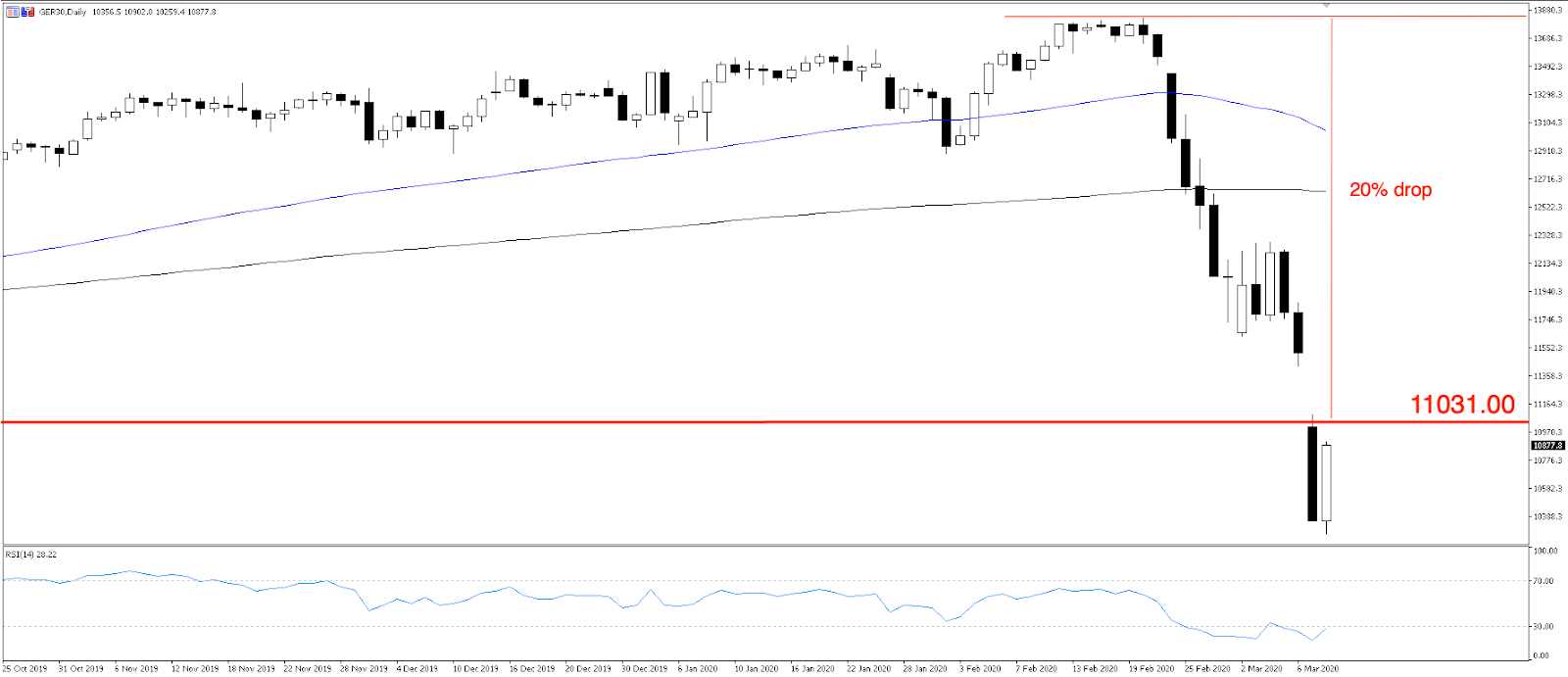

The DAX (GER30)

The benchmark German index tends to rise and fall faster than its US counterpart, and is already in bear territory. If the index sustainably trades at low levels over the next few weeks, it’ll be bear market confirmation. EU banks and the ECB’s response are crucial to the GER30’s fate here.

Bear market level: 11031.00

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.