CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Nvidia Holds Tight Range as Market Awaits a Breakout or Pullback

News impacting Nvidia is never far away, with investors now having to consider reports that 15% of revenues sourced from China will be paid to the US government. This comes alongside claims that Chinese authorities are actively advising domestic buyers to avoid purchases of the H20 chip.

That said, this has not materially impacted the share price. On the daily timeframe, we see price consolidating in a $184 to $179.30 range for the past six sessions. This consolidation could, of course, extend in duration – and typically, the longer it continues, the more explosive the eventual move is likely to be, whether higher or lower.

After rallying 111% since April, the question is whether this is merely a pause before another push higher into Q2 earnings (due 27 August), where the options market implies a ±6.6% move on the day, with potential upside taking the AI powerhouse towards $200 and its market cap closer to $5 trillion – or whether this is a topping pattern, a distribution phase, that could lead to a modest drawdown and higher index volatility.

One factor driving US tech, internet, and AI stocks above all others is that investors are drawn to companies with strong revenue growth. Granted, they are also attracted to businesses with high margins, elevated return on equity, and active equity buyback programmes – but the number one drawcard remains topline growth.

After rallying 111% since April, the question is whether this is merely a pause before another push higher into Q2 earnings (due 27 August), where the options market implies a ±6.6% move on the day, with potential upside taking the AI powerhouse towards $200 and its market cap closer to $5 trillion – or whether this is a topping pattern, a distribution phase, that could lead to a modest drawdown and higher index volatility.

Investors Want Revenue Growth

One factor driving US tech, internet, and AI stocks above all others is that investors are drawn to companies with strong revenue growth. Granted, they are also attracted to businesses with high margins, elevated return on equity, and active equity buyback programmes – but the number one drawcard remains topline growth.

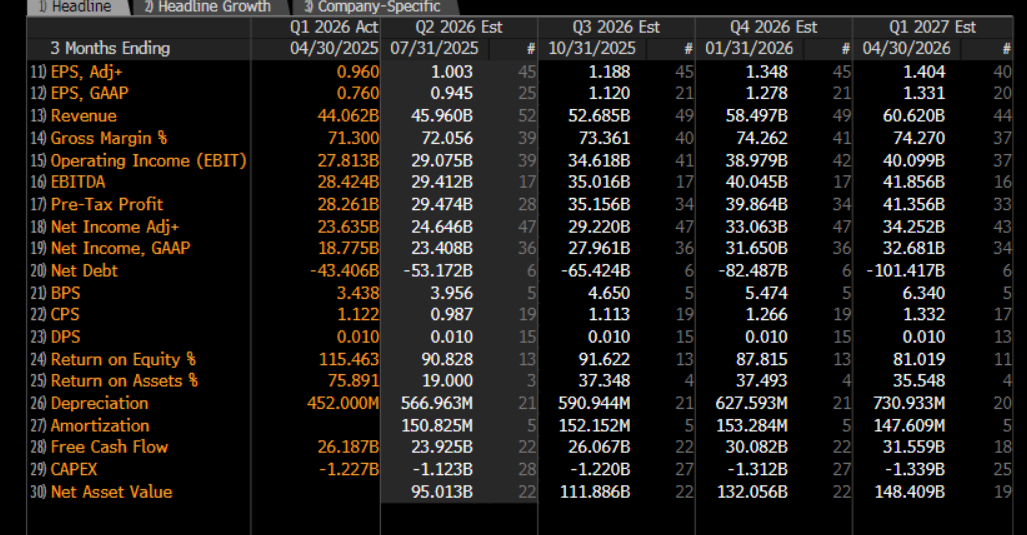

Nvidia certainly delivers here, with the Street modelling Q2 sales of $45.96 billion (+53% y/y) and projecting $53.69 billion for Q3. Gross margins are also expected to improve through the reporting quarter and into CY2026.

There are, of course, risks in being overly exposed to Nvidia, but the business is in robust shape. As such, pullbacks should be contained, and the debate is more about when the share price hits $200. The influence of passive flows and options hedging activity (by market makers) on the share price is also a significant factor, often fuelling strong price trends.

For now, traders will continue to monitor the defined range, ready to react aggressively to any developments in price action and the broader technical set-up.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.