- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

June 2024 BoE Review: The ‘Old Lady’ Holds Steady

As had been fully expected, and discounted in advance by financial markets, the Bank of England’s Monetary Policy Committee maintained Bank Rate at 5.25% at the conclusion of the June policy meeting. This, of course, marks the seventh consecutive meeting at which the MPC have maintained Bank Rate at its post-GFC high, since the terminal level was reached last August.

Once again, however, the MPC was split in terms of the appropriate policy action. As with the prior meeting last month, both external member Dhingra, and Deputy Governor Ramsden, dissenting in favour of an immediate 25bp cut. The remainder of the Committee, however, voted for Bank Rate to remain unchanged, resulting in a second straight 7-2 vote split among MPC members. It was, however, noteworthy that the MPC flagged how the decision not to cut rates was “finely balanced” for some policymakers, heightening the chances of a cut next time around.

Away from the vote split, it was the policy statement that captured the most attention, given that no fresh economic forecasts were released.

In a similar manner to the vote split, though, the policy statement also brought little by way of surprises, and was a near carbon copy of that issued after the May meeting. Once more, the MPC reiterated the need for policy to “remain restrictive for sufficiently long” in order to return inflation to target, while also repeating a focus on monitoring signs of inflation persistence, and keeping “under review” how long Bank Rate should remain at its current level.

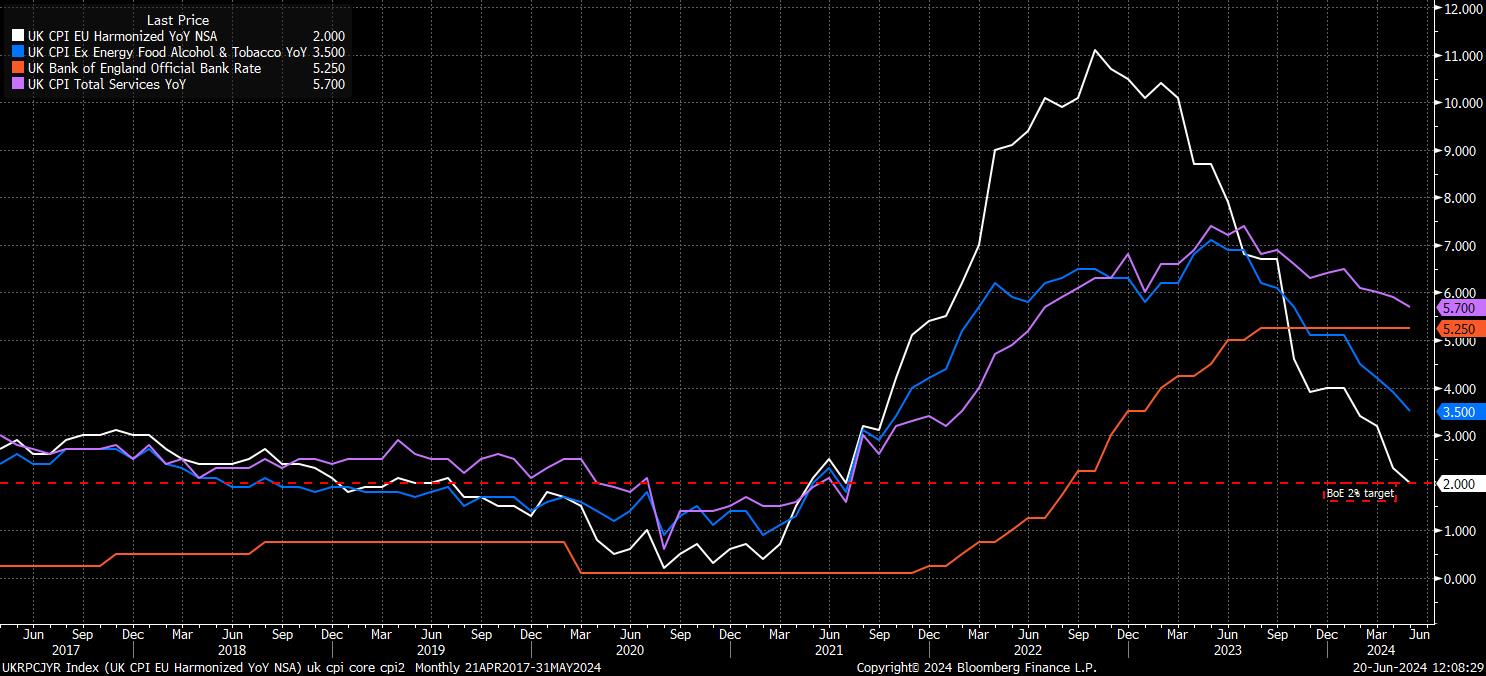

Some may, naturally, be a little surprised at the lack of significant changes to the MPC’s statement, despite data yesterday having showed headline CPI falling to the 2% target for the first time since mid-2021. While this is, of course, a positive development, it was driven largely by a continued decline in energy prices, as opposed to the alleviation of underlying inflationary pressures. In fact, the very same data likely gave policymakers some cause for consternation, with services CPI running at 5.7% YoY, not only incompatible with a sustainable return to the 2% target, but also considerably north of the BoE’s own 5.3% forecast.

This is, though, just one of three primary reasons for the ‘Old Lady’ to have stood pat on policy this time around. Developments in the labour market, where earnings growth continues to run close to 6% YoY, also likely dissuaded policymakers from any immediate steps to normalise policy, particularly with the impacts of April’s minimum wage hike, and associated pay rises among other lower-paid workers, still yet to be seen.

Perhaps most obviously, though, is the fact that the June MPC meeting came in the middle of the general election campaign, precisely 2 weeks before polling day. While this does not, technically, prevent the supposedly politically independent MPC from making any policy shifts, the decision not to make any public comments during the campaign limited the Bank’s opportunity to guide market pricing, and thus made holding steady by far the easiest option.

Market pricing shifted marginally in a dovish direction after the BoE decision, and statement, presumably due to the decision being ‘finely balanced’ for some on the Committee. The GBP OIS curve now prices almost 50bp of cuts by the end of the year, while seeing a 95% chance that the first cut is delivered by September, up from 44bp, and a 78% chance, respectively, pre-decision.

UK assets also experienced a dovish reaction, albeit a modest one, to the BoE statement. Cable softened, dipping beneath the 1.27 handle, to a day low, while gilts railed across the curve, led by 5s, which fell around 4bp to trade beneath 3.9% on a yield basis. UK stocks, meanwhile, found some love after the ‘dovish hold’, with the front FTSE future trading around 0.5% firmer, to fresh day highs.

_2024-06-20_12-11-27.jpg)

On the whole, the June MPC decision changes little in the grand scheme of things.

Clearly, the next move in Bank Rate is still set to be a cut, most likely at the August MPC meeting, in conjunction with the publication of the next Monetary Policy Report, so long as there are no nasty surprises in the June inflation figures released next month. Nevertheless, said August meeting is unlikely to be a unanimous decision, with the MPC’s hawks likely still concerned about the potential for inflation to remain persistent. This concern should also see the pace of policy normalisation remain relatively gradual, with just one further 25bp cut, probably in November, likely before the end of the year.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.