CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Although, earnings will start to get greater attention for those trading the ASX200, where a handful of names start the ball rolling on 1H earnings season.

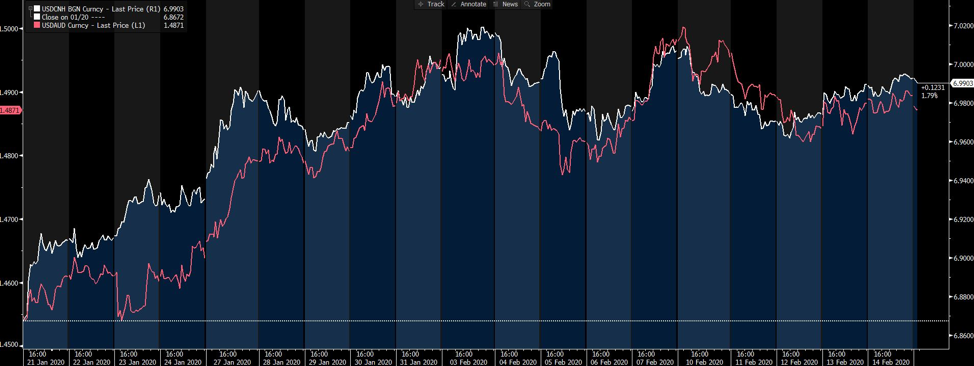

Interbank FX markets have opened on a sanguine footing, with no meaty weekend news to spark life into G10 FX. Although, we’re seeing small buyers of AUD, which is following the move from USDCNH, with traders reviewing their coronavirus hedges after Wang Xinhuan, head of the Wuhan Leishenshan hospital, detailed on state TV that a turning point has been reached. Keep USDCNH on the radar, as an upside break of 7.0122, should it play out, would be the trigger for AUDUSD to retest 67c, with the AUD once again moving inversely to USDCNH.

Red – USDAUD, white – USDCNH

Source: Bloomberg

The roll down into weaker economics, stemming from China’s growth prospects and supply chains, is yet to fully play out in the data, although liquidity and central bank offsets are still supportive for risk. One suspects that as long as implied vol stays subdued, credit spreads don’t blow out too aggressively, and equities remain bought on pullbacks, then carry will remain a standout thematic in FX and we stay bullish on the MXN as a primary vehicle here.

Data on the docket today

Through trade today though we see Japanese Q4 GDP, which is expected to contract 3.8% (annualised, seasonally adjusted), while industrial production will be seen later in the day. Singapore January exports (consensus eyeing electronic exports -10.5% YoY, non-oil exports -3.2%) are due, with Thailand’s Q4 GDP (2%) and Indonesia (Jan) trade data (imports -4.9%, exports +1.4%) also in play. All economies closely linked to China, even if it’s the February data is where we should see the brunt of the impact from the world's actions to limit the spread of the virus.

Whether these data points influence market sentiment is yet to be seen, but it feels a tall order to believe any of these cause a sudden jolt to markets. Weak numbers could plant a seed, especially ahead of this week’s Korean trade data and European and German PMI data, all of which could show deterioration. I guess this scenario leads to higher prospects of stimulus though, both at a monetary and fiscal level and could reinforce the idea that for now, the US is the best place to park your capital. It’s also not hard to see why we saw a massive $23.6b of inflows into fixed income and ETF funds last week (the most since 2001), and why after pushing up to 38bp we now see the US 3m vs 10yr Treasury curve threatening to become inverted again, with the rates market now pricing 41bp of cuts over the coming 12 months. A break of 1.50% in US 10s would be telling.

Gold making moves

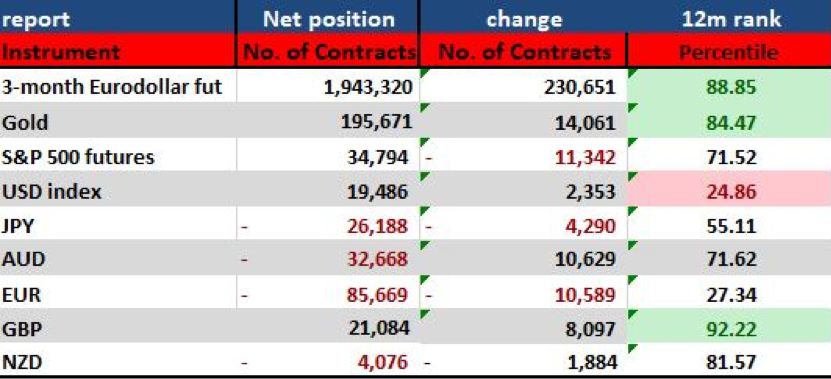

Gold looks interesting here, with price (in USDs) pushing into the top Bollinger band as well as the highs esculents of the $1590 to $1550 range. We see real and nominal bonds yields once again in EUR terms (XAUEUR) has been well traded, with EURUSD sold into any strength and we’ve seen price make a lower low for nine straight days. With the weekly Commitment of Traders report showing EUR net shorts hitting 85,669 contracts and into the 27th percentile (of the 12-month range), there is no doubt EUR is on the radar for counter-trend traders who see the EUR as grossly oversold. I see EURUSD 1-month implied put vols trading at a 0.29 vols difference to calls – the most since September.

Weekly CoT report

We’re seeing small buyers of EURs on open this morning, but until price can forge a daily close above the 5 or 7-day EMA then EURUSD heads lower and EUR-denominated gold longs will work.

Nevada caucus due on Saturday

US politics and the November election are not causing any real need to hedge, especially given the markets belief that the Republicans have this in the bag. We watch for this weekend's Nevada caucus, as this is a solid representation of Super Tuesday (3 March), so it will be interesting to see how well Sanders performs here and if there is any subsequent reaction in gold should he take this home, which is what the polls are suggesting.

What would be the trigger for a EUR rally though? I guess it would have to come from risk aversion, promoting a part unwind of carry positions or any belief that this Fridays EU PMI’s could come in above expectations. We shall see but our EUR flow has perked up on the long side and retail traders are looking for a slight snapback of sorts.

We have eyes on the crude open too, after WTI crude closed 1.2% on Friday and holds a 52-handle. The correlation with the CAD has picked up too, so should oil build on last week's move then CAD should outperform.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.