CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The cause of the recent move

The cause of the vol spike seems clear, but we have to revisit the ebb and flow of the market structure on Wednesday. Here, we can see that the market dynamic centred on signs of better data in the US, and enough to confine the Federal Reserve to a 25bp cut. It’s a US-China trade truce that had seemingly filtered into the background — sufficient that investors were happy to pay up for the historically higher earnings supported by the lack of alternatives, low “real” (inflation-adjusted) bond yields, and subdued implied volatility.

Fast-forward a couple of days, and we’re hit with the toxic combination of Trump’s 10% tariffs on US$300bil of consumer-focused goods, China’s subsequent rebuttal with the halting of purchases of US agricultural products, and the symbolic gesture of China being labelled a “currency manipulator.” This series of events absolutely wasn’t in the script; we’ve been treated to a genuine shock to the system that needed to be discounted rapidly. The spike in implied volatility saw volatility-targeting funds dumping risk, and we’ve had a solid shake-out.

The politics of tariffs

The market has clearly formed a view that this saga has far more to play out, with a number of investment houses saying we won’t see a deal between Xi and Trump until after the 2020 US presidential election. Trump wants to lean on the Fed to support his hawkish plans to use trade as a policy initiative designed to galvanise his base and elevate his election chances. However, the Fed currently sees a US economy lacking a need for aggressive stimulus at this juncture. The issue of independence has also become so great that we saw the unprecedented step of the all four prior Fed chairs putting an op-ed piece out to the world (titled “America needs an independent Fed” in the Wall Street Journal).

Just take St Louis Fed President James Bullard as an example, who’s become a reasonable proxy of the Fed collective, with such comments as, “Trade has been tit-for-tat since the spring, or even earlier than that,” and “I’ve already taken into account that trade uncertainty is high and going to remain high.”

China, on the other hand, will be hoping the US economy weakens sufficiently that the Democrat candidates can leverage off any economic fragility as a policy miscalculation. With hope, they can forge a far more compelling deal with a less hawkish government — although the near-term risk is that China may have to withstand Trump lifting the 10% tariff to 25% or higher, which will no doubt be offset, somewhat ironically, by a weaker yuan. Trump knows the politics involved but also understands that he needs the Fed as his offset should the economy deteriorate.

Lower rates will have limited effect on economics

That’s all well and good. But if the clarity for US businesses under this tariff regime is so poor, it's hard to see any spike in demand for credit even if the Fed is making capital far cheaper. It’s a dangerous game played by Trump, and the markets know it.

We had some relief yesterday. As mentioned yesterday, when the PBoC refrained from lifting the midpoint of the USDCNY through its daily “fix” anywhere near as high as the models suggested, the market rallied. While a 30bil RMB bill sale stabilised and helped breathe some life into the CNH on the perception that liquidity would be sucked from the system, the PBoC has been out reassuring corporates that the yuan won’t keep falling. But they haven’t seen that today, with the bank fixing the USDCNY 313 points higher at 6.9996. This was just above the consensus view of 6.9977, which is close enough. But USDCNH buyers are now making their case, and this is again proving central to moves across markets in Asia.

If USDCNH’s going higher, risk assets’ going lower, and traders’ unwinding carry structures in earnest are the case, it explains why the EUR — the ultimate funding currency (for the carry trade) — has been working so well. S&P 500 futures are now -0.7%, and we watch to see if we get a retest of the 200-day MA in S&P 500 and NASDAQ futures. That’s where the buying kicked in yesterday. A break here, and things can turn ugly again.

Asia agrees that we aren’t out of the woods here. Despite the S&P 500 closing 1.3% higher and ASX 200 going up 0.4%, Japan, Hong Kong and China, however, are trading lower. The China A50 index (CN50) found a strong bid off horizontal support yesterday. And if traders were happy to defend into 12,329, a closing break on the next attempt will be taken poorly.

Big moves in FX markets

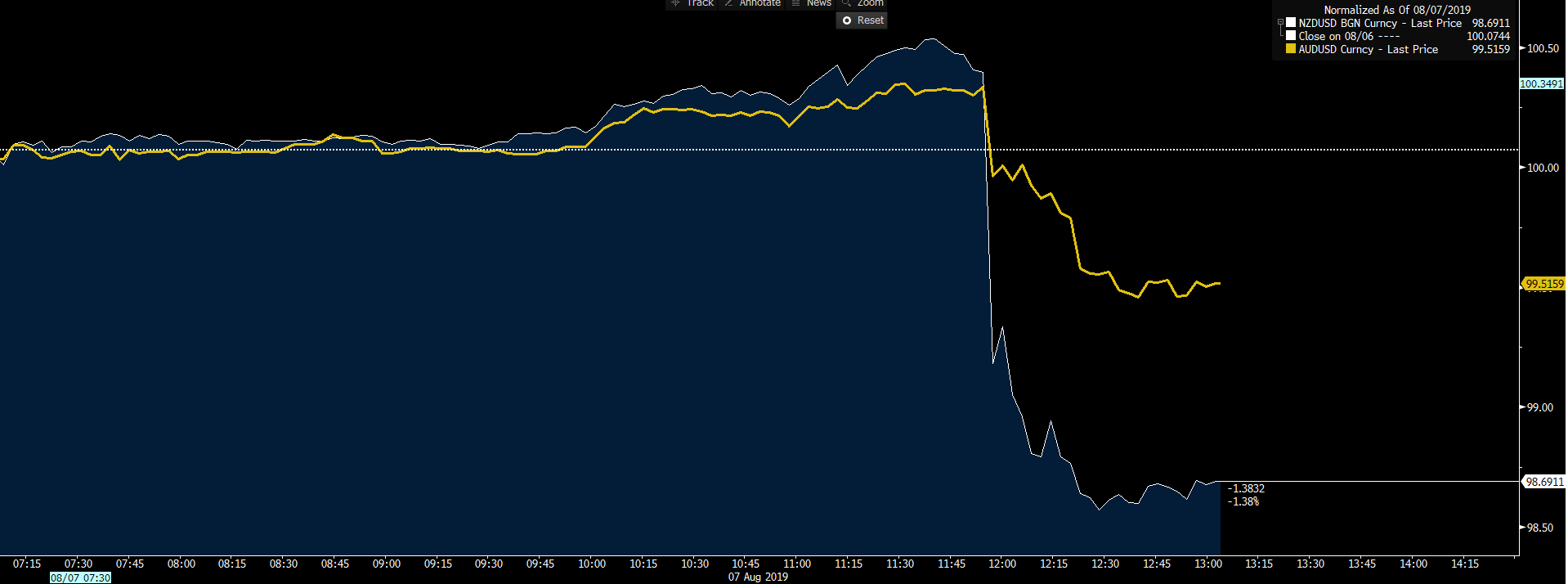

In FX, it’s been a huge day for the NZD, with the Reserve Bank of New Zealand cutting 50bp and showing, once again: If you want to get ahead of the curve, then the RBNZ does this better than most and isn’t one to mess around. One questions if this is a message that if they’re genuinely worried and, if so, we should be, too. The moves in NZD have resonated in the AUD, and AUDUSD has traded below the December flash-crash low. All rallies are to be sold here, it seems.

"White: NZDUSD. Yellow: AUDUSD."

USDJPY saw a huge turnaround yesterday. But traders are flipping back to short exposures today, and we’re seeing the pair through 106.00. The pair is taking its direction from US Treasury futures, where we can see yields 3bp lower across the curve on the day driven by some incredible buying in Kiwi bonds. It’s real Treasury yields that interest most here, as US Treasury 10-year “real” (i.e., inflation-adjusted) yields are now just six basis points from turning negative. We see the twos vs tens Treasury curve testing 10bp, where a break of 10bp and we talk inversion here. That’s certainly not telling me the world is fine, and suggests the rally yesterday was a relief rally and nothing more.

We’ve seen gold futures traded above US$1,500 today, although we watch for spot gold to move to the figure, too. If real rates are turning negative, then gold is only going one way. Oil is flat on the day. But flip to the four-hour chart, if this kicks lower I’m jumping on board.

"White: gold futures. Yellow: spot gold."

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.