CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

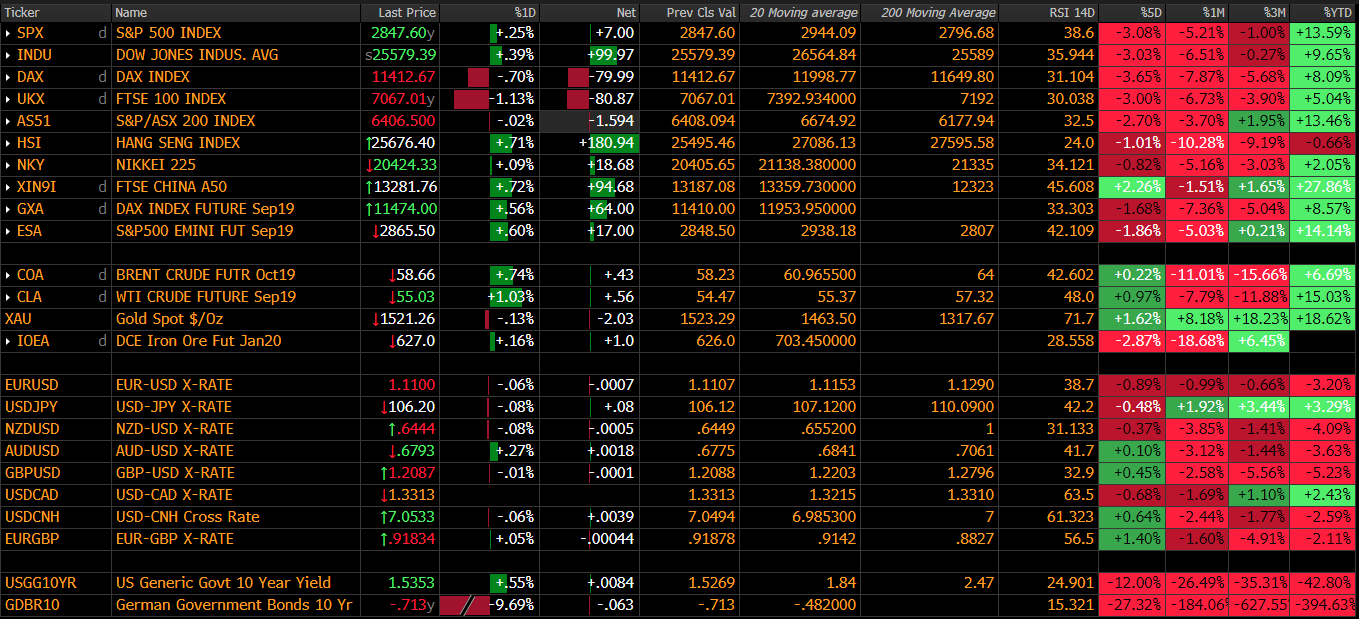

As I review in the Event Risk Playbook, the market will trade in anticipation of Friday’s Jackson Hole Symposium, as well as what’ll be and what won’t be said, and who will say it. This will be the only thing that matters. The title of the symposium — and what’s in effect a massive central banker shindig — is “challenges to monetary policy.” Consider that one of the reasons we’ve seen buyers of gold, global bonds and JPY is that the world is questioning the central bank put. But also because many just don’t believe that monetary policy can save us if this downturn gets momentum.

I’m inclined to agree; therefore, the emphasis of the symposium falls not only on the level of confidence bankers can instal in the belief they’ve the firepower to curb any economic fallout, but also on how much of a role fiscal policy needs to play in the period ahead.

The question of who represents the Fed is critical. After New York Fed President John Williams’s communication mishaps a couple of weeks ago, the market will be hoping to hear from the main man on the Fed — Vice Chair Richard Clarida. While he may be more dovish than other voting members, the market will listen to him above all others.

Aside from the Fed, we should hear from key representatves from the European Central Bank, Bank of Japan, and other developed- and emerging-market central banks. With trade tensions, flatter curves and a belief that policy isn’t working or isn’t going to work, this event is going to be a possible game-changer.

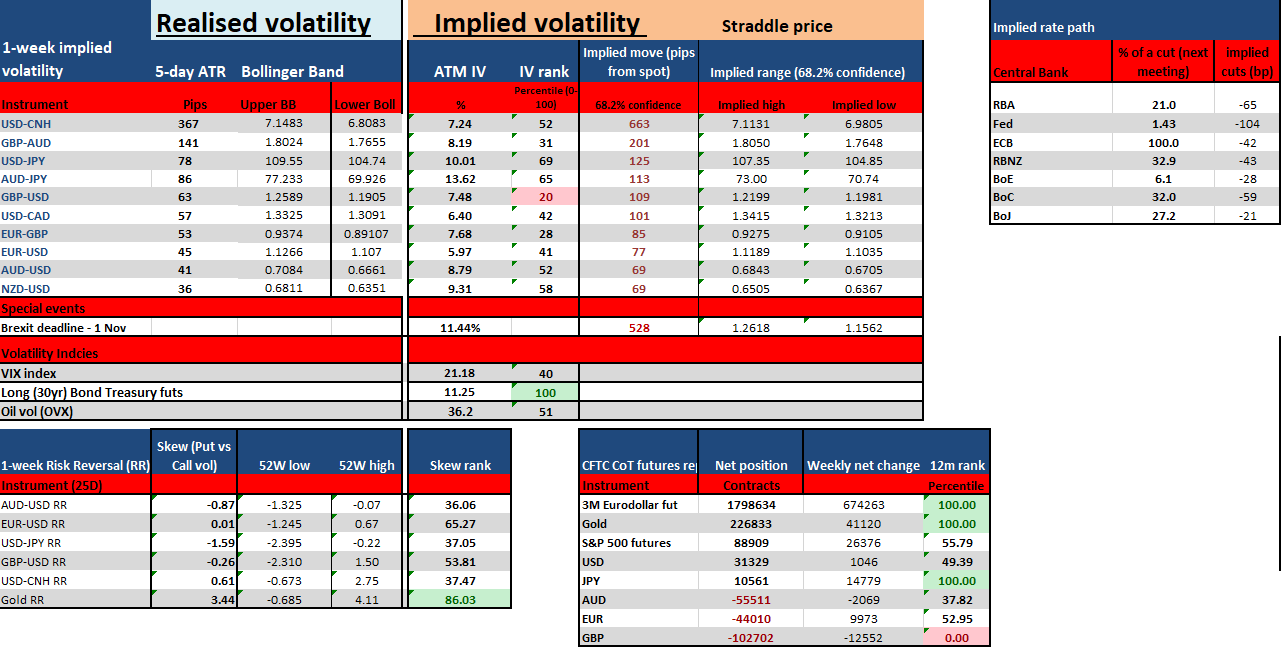

If we look at my weekly implied volatility (IV) report, the IV covers FX options that expire Friday (New York cut), so it doesn’t account for the Monday open. If the Fed stays behind the curve and continues to lack any urgency to get in front of the curve, Monday’s open (on 26 Aug 2019) could be pretty ugly. I’ll update this spreadsheet Monday to account for the event risk.

If you have a spare hour (I know, who does these days?), check out my recent webinar on using volatility as a framework to manage risk. It breaks down this spreadsheet, as well as how you can apply or understand risk reversals and the weekly Commitment of Traders report, and have a deeper perspective on implied and realised volatility.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.