- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Daily Fix: Labelling China an FX manipulator raises the tension levels

It’s the rate of change in asset pricing, which is just so important here. We know the disdain central banks have for fast-moving markets. And what we see across global equity indices, FX and bond markets suggests rising risks of calming rhetoric and promises of better liquidity dynamics in the near term. In China, the markets have been on heightened alert around the daily CNY (yuan) fixing, which takes place daily at 11:15 AEST, and where the People’s Bank of China “fixes” the USDCNY midpoint of relative to consensus estimates. Traders sense this is symbolic, where a fix higher than estimates sends a message to the White House.

A focus on the CNY “fix”

Importantly, the PBoC fixed the USDCNY midpoint at 6.9683 (+458p) today. While that’s higher, it was far lower than the consensus estimates of 6.9871. In a psychological way, the market saw this as a quasi-olive branch from Beijing — or at least it didn't inflame the issue further.

We’ve also seen the PBoC detail that they’re to sell 30bil yuan in short-term money market bills. By issuing this debt, it should have the effect of reducing liquidity, which has had a positive effect on the CNH, and we’ve seen better sellers in USDCNH.

"Yellow: USDCNH (inverted). White: S\u0026P 500 futures."

The mere fact that USDCNH has fallen has seen brought-out buyers off the opening low in Chinese equities, as we can clearly see in the China CN50 chart — an index that weights the top 50 mainland Chinese companies traded as a futures index on the Singapore futures exchange. In turn, we’ve seen S&P 500 futures follow suit, sitting 1.2% off the earlier low while still at -0.8% in Asia trade. The ASX 200 has found stability, although a 2.5% sell-off in this market holds few positives.

"China A50 index"

The impact of tariffs on China's economy

Economists are running the numbers and impact of Trump’s unexpected additional 10% tariff will likely have on the Chinese economy. Most estimate the new tax will reduce China's exports by around 2.5% to 2.7%, and act as a headwind by some 50bp to growth, with an unwelcomed negative impact on employment. Perhaps I’m too simplistic, but if Trump were to slap Australia or Europe with this tax, one’d expect the AUD or EUR to be smashed. So, USDCNH gained 2% and we subsequently heard the US Treasury department label China a “manipulator.” It all seems just a bit too convenient.

If we go back to 2015 and look at the guidelines the US set for labelling a country a “manipulator,” it’s hard to categorically say China fall into that camp, although the script can change at any stage and the goalposts pushed any which way Mnuchin and Trump decide.

Is China really an FX manipulator?

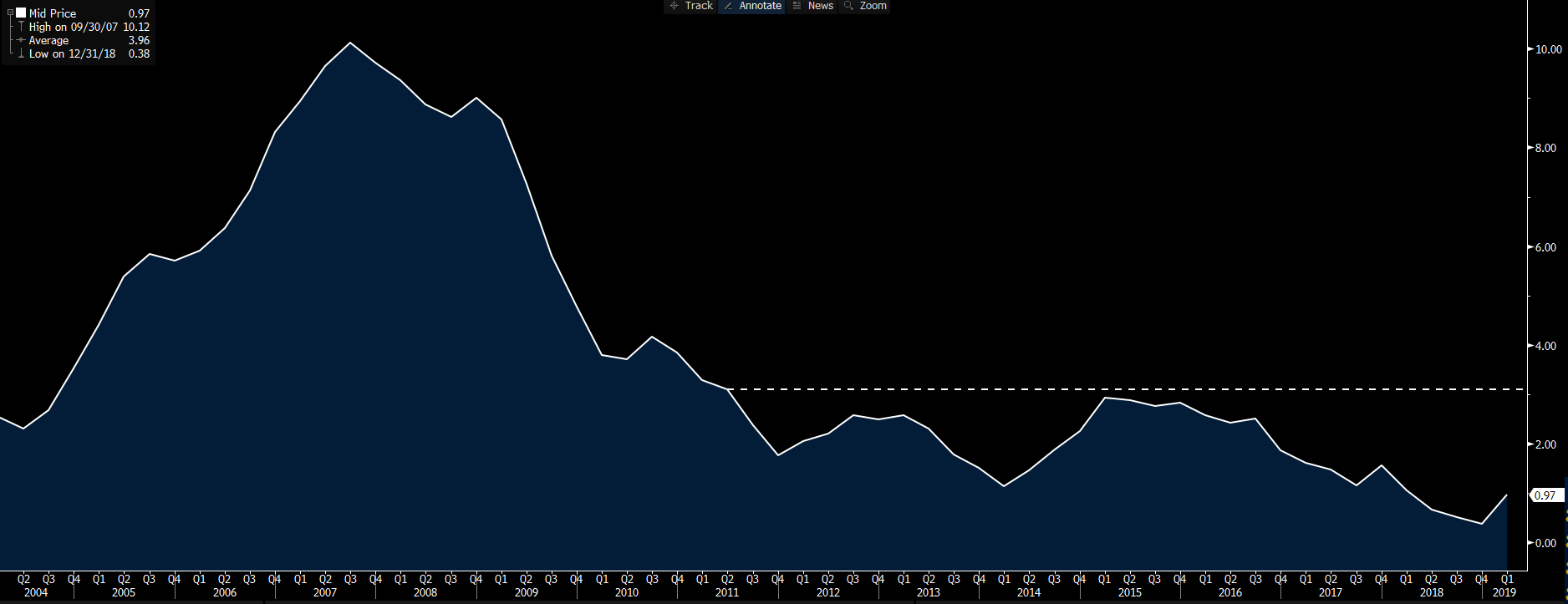

The first criterion (of three) was for China to run a trade surplus of over US$20bil with the US. On current numbers, it’s clear that’s a huge fail for China here. The second is whether China has a current account surplus of over 3% of GDP. As we see on the Bloomberg chart below, China’s current account has been under this threshold since Q3 of 2011. The third and more contentious part is whether the Chinese have purchased foreign exchange of at least 2% of GDP of a 12-month period. If we look at the trend in the CNY over the last year or so, if anything, the PBoC would have been buying their currency. We see that China’s foreign exchange reserves have been stable for many months now.

"Source: Bloomberg"

Does this raise the threat of intervention?

The first question everyone is asking: What’ll be the repercussions on China of being labelled a “manipulator”? Most end up drawing the conclusion that the call modestly raises the probability of FX intervention from the US Treasury department. Intervention was already a hot topic in the markets anyhow given Trump and his team have spoken out about their concern around the USD’s strength. However, it raises the point of what intervention could look like, what sort of size of USD flow we could feasibly see, and how much of a collaborative effort would there be between the Treasury Department and the Federal Reserve.

It seems logical that if we’re going to see USD intervention, then we’d initially see the Treasury Department conduct a verbal exercise, scaring USD longs into reducing exposures. We aren’t there yet. If we ever truly thought the US would intervene, then USDCNH would be below seven in no time at all. USDJPY would be trading below the December flash crash of 104.70, and gold would arguably be north of US$1,500.

So, that’s a theme to watch. But we have to think that if US President Donald Trump wants to use trade tariffs to get lower rates, then he’s pulling the right levers. Fed fund futures are pricing a 39% chance of a 50bp cut in September, although pre-China CNY “fix” stood closer to 50%, and there are nearly four cuts priced over the coming 12 months. If Trump wants a weaker USD, he’s now shaping the narrative to intervene to weaken the USD in the period ahead. If he wants to lower oil, he can work the supply/demand dynamic. It’s obviously a very dangerous economic game, as the changes in globalisation are having a lasting effect on the business landscape, and will impact hard data at some stage.

But to understand the circuit-breaker, we have to consider what Trump is wanting to achieve from these actions. At this stage, while we could have seen a more punchy response from the PBoC on the CNY, Washington and Beijing are moving further apart — not closer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.