- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Considering Parliament returns from its current break on 3 September, this leaves an incredibly short period for those who oppose a no-deal Brexit (i.e., the Remainers) to make some big moves before Parliament is suspended on 12 September. GBP volatility could therefore be elevated through the period of 3 - 12 September given the prevailing uncertainty. Clearly, GBP will also be moved by headlines.

Ultimately, the Remainers have three options to pursue from 3 September:

- Try and pass legislation through the House of Commons, which will involve extending Article 50 in the hope of a new deal with the European Union

- Hold a no-confidence vote in the Johnson Government either in the 3 - 12 September window or after the EU summit (17 - 18 October)

- Accelerate the Scottish legal challenge, with Scottish judges ordering Johnson to revoke A50 on the grounds that suspending Parliament is unlawful

A deal to be found? 25% (based on my gut instinct model)

If a legal challenge arises and amplifies the risk of extending Article 50, with increased discussion on the withdrawal agreement at the EU summit, one’d then imagine the GBP having a rally above 1.2300. We’ve already seen a softening in the language and a more constructive dialogue that played out in recent meetings between French President Emmanuel Macron, German Chancellor Angela Merkel, and Johnson — a contributing factor to GBPUSD rallying 1% last week. Still, the timeline is tight, and actually finding a solution that passes a fragmented Parliament is still the concern.

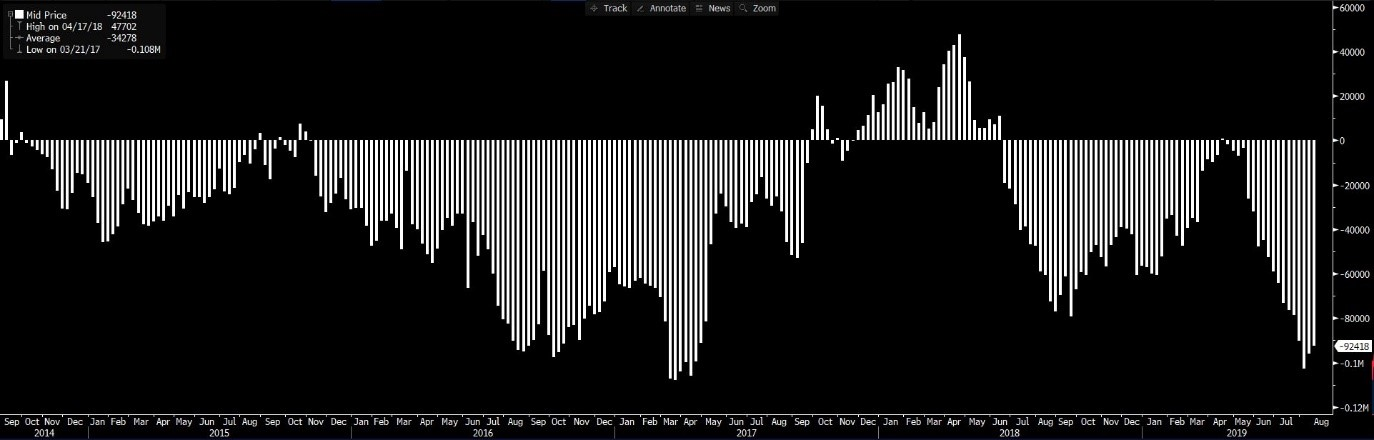

As we can see from the Commitment of Traders report (GBP futures non-commercial holdings), the market is still holding a decent short exposure.

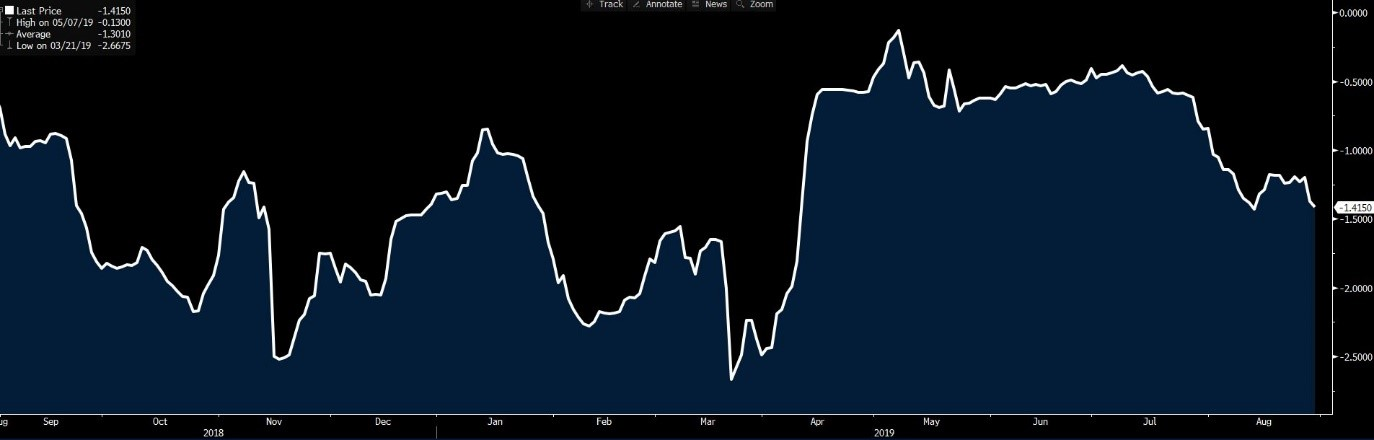

Two-month risk reversals show a market paying up for put vol over call vol, while liquidity in GBP pairs is somewhat lacking, which we see that in bid / ask spreads and poor liquidity could exacerbate moves.

One for the optimists. I think there’s a 25% chance of playing out — a low call however. But Johnson has limited interest in this outcome, and he’s driving the show.

A general election? 45%

Route two is looking very likely, if not inevitable, as in theory it’s the easiest avenue for Remainers to bring down the Government. With the Tories holding a narrow one-seat majority in the House, Boris will likely lose the vote with at least two rebels voting against the Government, and the Government will fail. In this scenario there’d be a 14-day period to find a caretaker government, like we saw in 1940. A national unity government would be required to manage the Brexit process.

The makeup of any temporary government is a huge question. The Remainers won’t want to be led by Johnson, but it’s hard to see any Tories wanting to work in a crossparty unity government led by Opposition Leader Jeremy Corbyn of the Labour Party. So, in the absence of a caretaker government being found within 14 days, it leads us to a snap general election framed as the “People versus Parliament.” I see this as a 40% probability, and is the current base case.

A general election would likely take place in November, or six weeks from when it’s called, and may require a short extension to A50 likely granted by the EU. This outcome would be naturally binary and a massive risk to traders, where GBP vols will be incredibly high on that date as it’ll be framed as “in or out,” or a new quasi-referendum on Brexit. It’s an event where I almost don’t see how the GBP does anything but fall. With a Johnson win, which seems likely if the polls are to be believed, the process of leaving the EU would accelerate (a GBP negative).

We may, of course, see a hung parliament. Alternatively, Corbyn gets up, and the odds of staying in the EU increase markedly. But we’ll be left with a hard-left politician running the country (a strong GBP negative). He may need a coalition partner, however, potentially in the form of Liberal Democrats.

No-deal Brexit? 30%

I won't cover option three. But consider if neither one nor two is enacted by 12 September, then the chance of a no-deal Brexit ramps up markedly, although it’s unclear if a no-confidence vote would be pulled in the 3 - 12 September window or post the EU summit.

With Johnson suspending Parliament from 12 September to 14 October, we resume proceedings 14 October with almost no time to get a deal in place for the Brexit deadline of 31 October. With such little time we could crash out almost by accident with no real plan in place to manage the fallout (look up for “Operation Yellowhammer” on Google). I see this currently at 30%. But if we don’t see outcome one or two play out before 12 September, then this outcome will become a base case, and GBPUSD will be less than 1.18 even if this outcome is partly priced given the steep falls in the GBP since Johnson became PM.

Ready to trade?

Switch to Pepperstone now and join our global community of over 620,000 traders. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.